Did BAFS–Portico Integration Just Recast Fiserv's (FISV) Credit Union Lending Tech Narrative?

- In early December 2025, Business Alliance Financial Services (BAFS) announced its integration with Fiserv’s Portico® account processing system, giving Portico-using credit unions broader access to BAFS’ BLAST® commercial loan origination and accounting platform across the full lending lifecycle.

- This integration underscores how Fiserv’s core processing relationships can deepen its role in commercial lending technology for credit unions, potentially enhancing client stickiness and cross‑sell opportunities.

- Now we’ll examine how cautious analyst sentiment around Fiserv’s product momentum and sector headwinds could reshape this investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Fiserv Investment Narrative Recap

To own Fiserv, you need to believe its scale in payments and core processing can overcome slower growth, execution hiccups and sector skepticism. The BAFS Portico integration supports the core-processing and software cross sell story, but does not materially change the near term catalyst, which is rebuilding confidence after lowered 2025 and 2026 growth guidance. The biggest risk remains further execution delays and margin pressure if new platforms and initiatives fail to gain traction as planned.

Among recent announcements, the J.P. Morgan downgrade to Hold with a US$85 target stands out because it captures how cautious the Street has become about Fiserv’s ability to convert product investments into organic growth. Together with other neutral ratings, it frames integrations like BAFS as incremental positives that sit against a backdrop of lowered guidance and concerns about whether new offerings such as Clover and next generation platforms can drive the kind of adoption needed to re accelerate growth.

Yet investors should also weigh the risk that slower adoption of key next generation platforms could signal deeper competitiveness issues that...

Read the full narrative on Fiserv (it's free!)

Fiserv's narrative projects $24.7 billion revenue and $5.9 billion earnings by 2028.

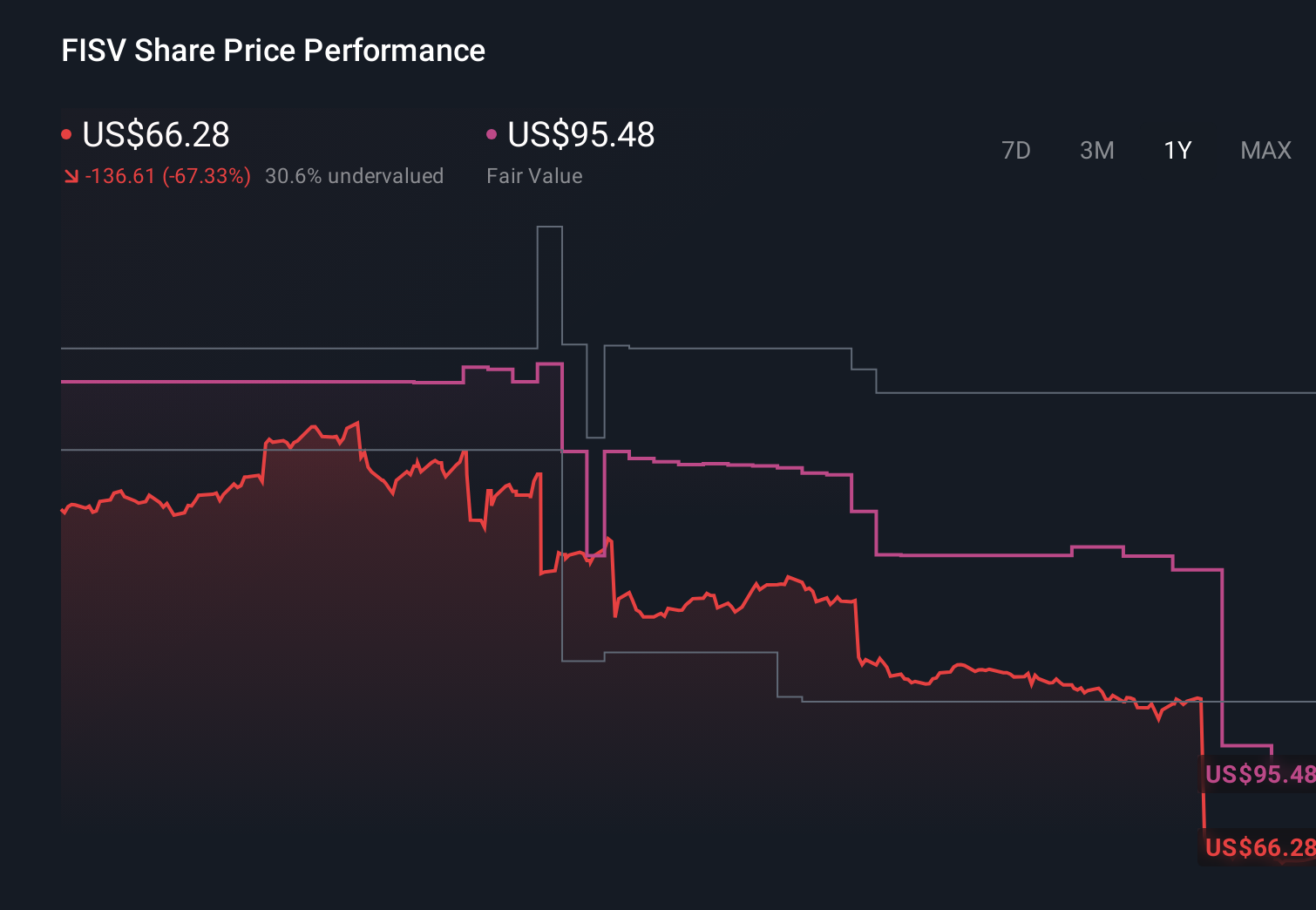

Uncover how Fiserv's forecasts yield a $95.48 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Eighteen members of the Simply Wall St Community estimate Fiserv’s fair value between US$95.05 and US$231.84, highlighting a wide spread of expectations. Against this, recent guidance cuts and analyst downgrades keep the focus firmly on execution risk and how it might influence the company’s ability to improve growth and profitability over time, encouraging you to compare several viewpoints before forming an opinion.

Explore 18 other fair value estimates on Fiserv - why the stock might be worth just $95.05!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

No Opportunity In Fiserv?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal