Is Hims & Hers Health Still Attractive After Its 450% Surge and Telehealth Expansion?

- Wondering if Hims & Hers Health is still a smart buy after its big run, or if the easy money has already been made? You are not alone, and this article is going to unpack exactly what the current price is really baking in.

- Even after a recent pullback of around 5.1% over the last week and 4.6% over the past month, the stock is still up 47.7% year to date and a massive 450.4% over three years. This tells you the market has already rewritten its expectations in a big way.

- That surge in confidence has been fueled by growing attention on the company’s push into telehealth subscriptions, celebrity partnerships, and high profile category launches in areas like weight management and hair loss, all aimed at building a sticky, direct to consumer brand. At the same time, increased media focus on digital health regulation and competition from larger platforms has reminded investors that rapid growth comes with real execution risk.

- On our framework, Hims & Hers Health currently scores just 2 out of 6 on undervaluation checks, so the market is far from calling it a screaming bargain. However, the picture looks very different depending on whether you use multiples, cash flow models, or growth adjusted metrics. We will walk through those, then finish with a more intuitive way to think about valuation that goes beyond the numbers alone.

Hims & Hers Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hims & Hers Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and discounting those dollars back to today. In this case, the 2 Stage Free Cash Flow to Equity model starts with Hims & Hers Health’s last twelve month free cash flow of about $189.4 million and then layers on analyst forecasts and longer term growth assumptions.

Analysts currently project free cash flow rising to roughly $406.7 million by 2029, with Simply Wall St extrapolating the following years out to 2035 as growth gradually slows from higher early rates into more mature territory. All figures are in $ and remain well below the billion mark, so the story here is about compounding medium sized cash flows rather than mega cap scale.

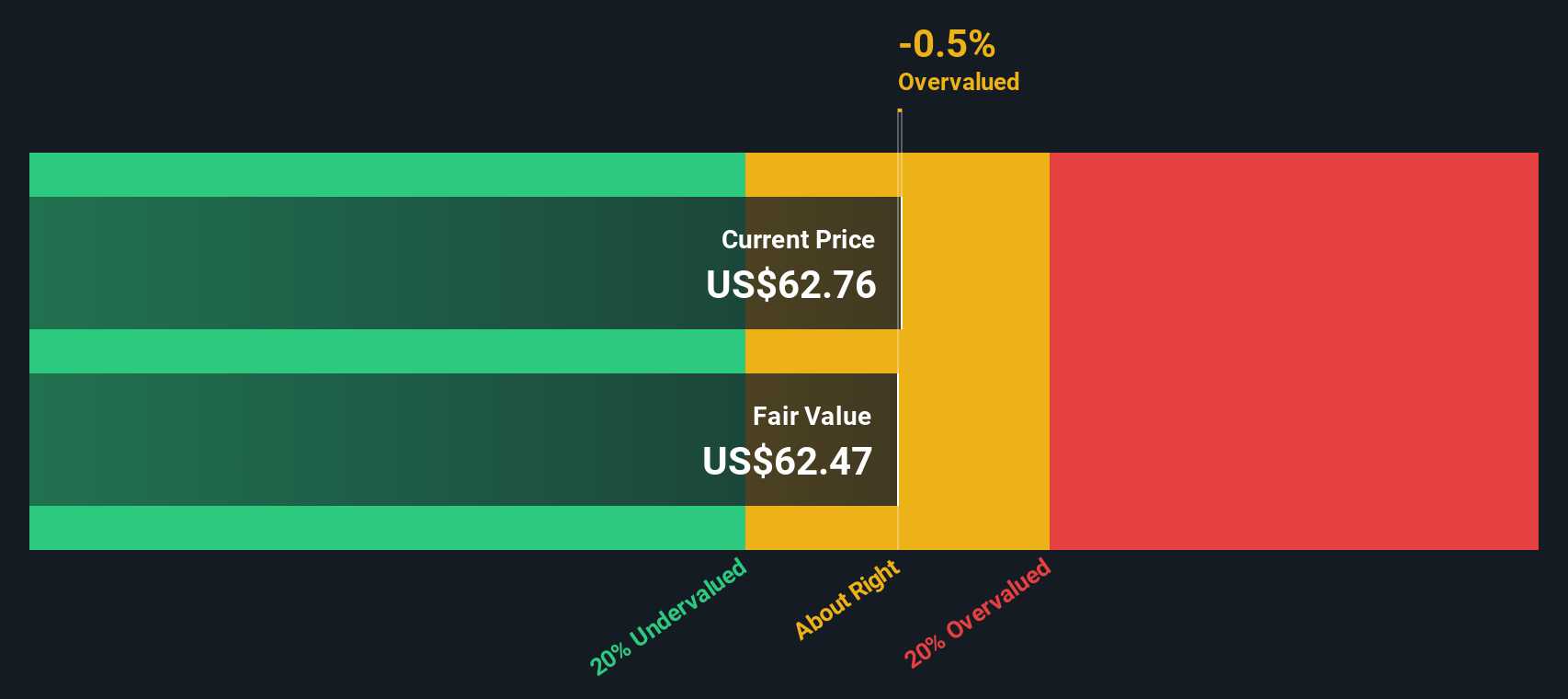

Rolling those projections together, the model arrives at an intrinsic value of about $58.00 per share, implying the stock is trading at a 35.8% discount to its estimated fair value and therefore screens as meaningfully undervalued on this framework.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hims & Hers Health is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Hims & Hers Health Price vs Earnings

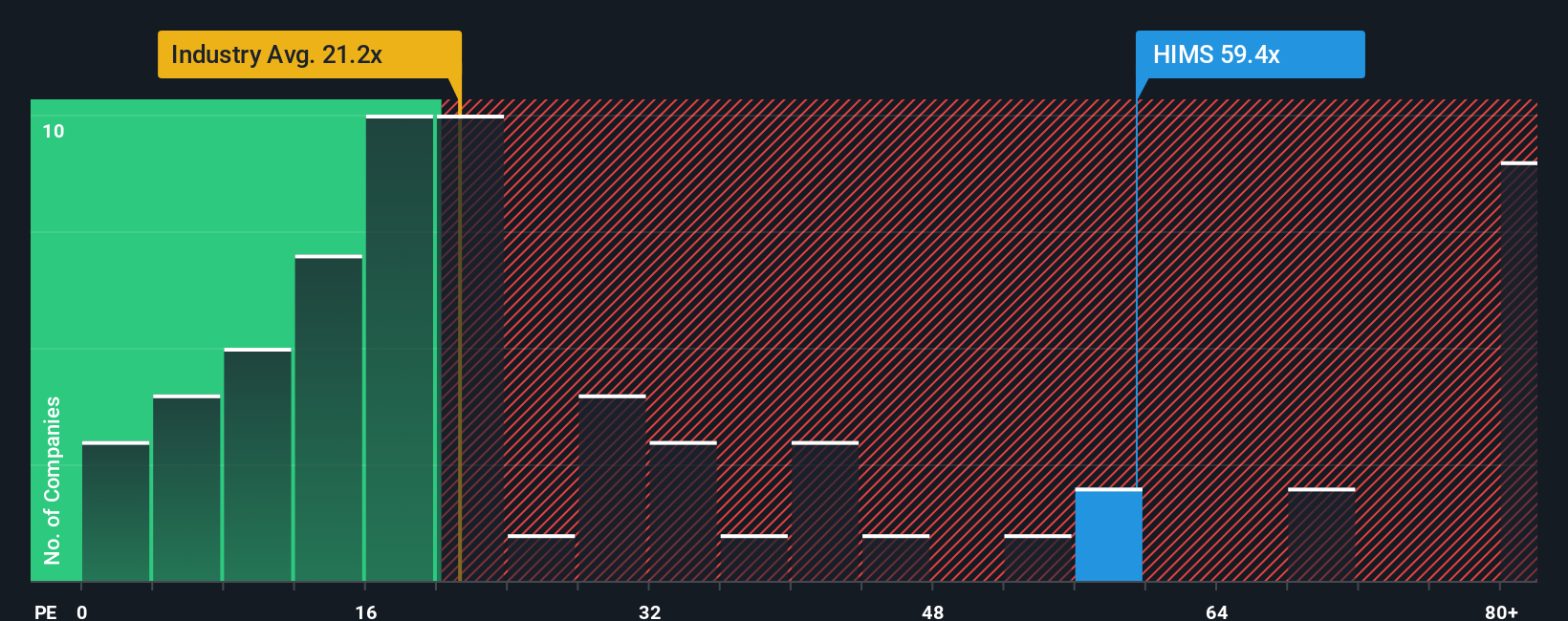

For companies that are already profitable, the price to earnings, or P E, ratio is a useful way to judge value because it links what investors pay directly to the profits the business is generating today. In general, faster growth and lower perceived risk justify a higher P E, while slower growth or higher uncertainty usually call for a more modest multiple.

Hims & Hers Health currently trades on a P E of about 63.31x, which is well above both the broader Healthcare industry average of roughly 23.72x and its peer group average of around 31.62x. At first glance, that kind of premium might look stretched. However, Simply Wall St’s proprietary Fair Ratio framework estimates a more appropriate P E of about 42.01x, based on the company’s earnings growth outlook, profitability profile, industry, market cap and risk factors.

This Fair Ratio approach is more tailored than simple peer or industry comparisons because it explicitly bakes in how quickly Hims & Hers is expected to grow and how risky that growth might be. Comparing the current 63.31x to the 42.01x Fair Ratio suggests the shares are pricing in more optimism than the fundamentals alone support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hims & Hers Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Hims & Hers Health’s story with a set of numbers like future revenue, margins and a fair value estimate, then see how that stacks up against the current share price.

On Simply Wall St’s Community page, Narratives let millions of investors turn their research into a structured forecast. This means you can quickly see how a particular storyline, for example Hims & Hers becoming the leading personalised health platform with a fair value near $114 per share, compares with a more cautious view that sees it as fairly valued closer to $44 per share based on slower growth and tighter margins.

Each Narrative links a clear thesis to a financial model and a fair value. It updates dynamically as new earnings, news and regulatory developments come in. This makes it easier to decide whether Hims & Hers Health looks like a buy, hold or sell for you by directly comparing its evolving Fair Value to today’s market Price.

Do you think there's more to the story for Hims & Hers Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal