Why Rheinmetall (XTRA:RHM) Is Up 5.7% After Dutch Skyranger 30 Air-Defense Deal - And What's Next

- Rheinmetall recently secured a significant order from the Dutch Ministry of Defence to supply Skyranger 30 air-defense systems between late 2028 and 2029, reinforcing its role in European ground-based air protection.

- This contract underscores how Rheinmetall’s specialized air-defense technology is becoming increasingly embedded in NATO supply chains, potentially strengthening its long-term order visibility and bargaining power with governments.

- We’ll now examine how this Dutch Skyranger 30 contract could influence Rheinmetall’s investment narrative built around expanding European defense spending.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Rheinmetall Investment Narrative Recap

To own Rheinmetall, you need to believe that European defense spending remains structurally higher for longer and that the company can convert defense demand into profitable, well executed growth. The Dutch Skyranger 30 order supports medium term revenue visibility but does not materially change the near term picture, where the key catalyst is contract conversion into earnings and the main risk remains execution across a rapidly expanding and increasingly complex defense portfolio.

The most connected development is Rheinmetall’s reported interest in parts of KNDS, which sits squarely in its ambition to be a European land defense champion. If pursued and completed, such a move could reinforce its positioning in armored systems but would also magnify integration and execution risks at a time when capacity expansion and product breadth are already stretching management focus.

Yet investors should be aware of how quickly integration and expansion risks could start to affect...

Read the full narrative on Rheinmetall (it's free!)

Rheinmetall's narrative projects €26.4 billion revenue and €3.4 billion earnings by 2028.

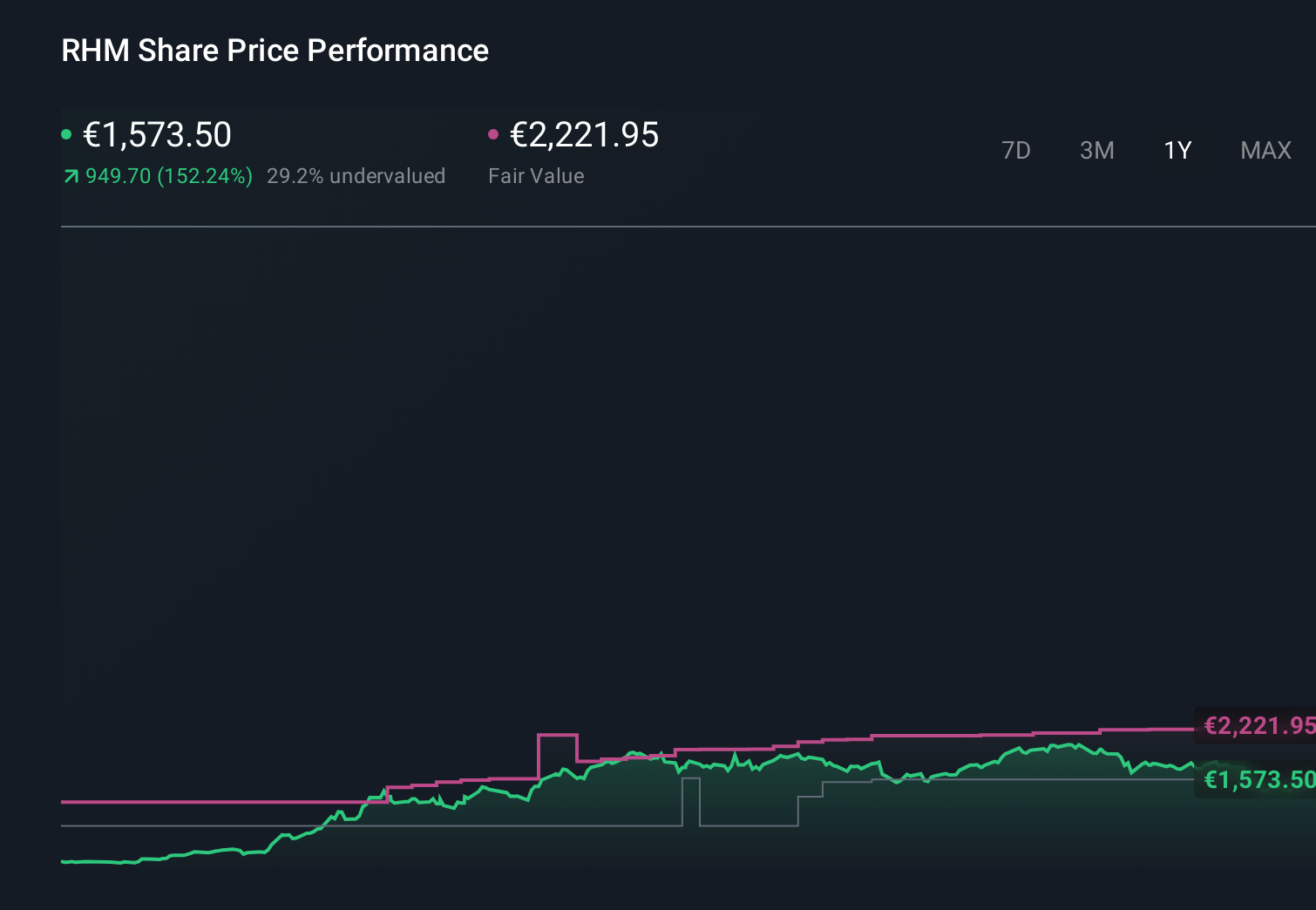

Uncover how Rheinmetall's forecasts yield a €2222 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Thirty one members of the Simply Wall St Community put Rheinmetall’s fair value anywhere between €1,722.91 and €7,569.50, highlighting very different expectations. Against that wide range, the Dutch Skyranger 30 deal and potential KNDS tie up both sharpen the question of how much execution risk you are willing to underwrite in return for exposure to expanded European defense spending.

Explore 31 other fair value estimates on Rheinmetall - why the stock might be worth just €1723!

Build Your Own Rheinmetall Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rheinmetall research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rheinmetall research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rheinmetall's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal