Goldman Sachs (GS) valuation check as OneGS 3.0 AI strategy and dealmaking outlook lift investor optimism

Goldman Sachs Group (GS) has leaned hard into its OneGS 3.0 overhaul, using AI to simplify how the bank runs, while its recent financial services conference reinforced a constructive backdrop for deals and capital markets.

See our latest analysis for Goldman Sachs Group.

The stream of AI investments, fixed income issuance and expansion moves like the Innovator ETF deal has been met with strong enthusiasm, with Goldman Sachs delivering a robust year to date share price return and standout multi year total shareholder returns that signal building momentum rather than a late stage spike.

If this kind of momentum has you curious about what else is working, it is a good time to explore solid balance sheet and fundamentals stocks screener (None results) and see which other names combine resilience with growth potential.

With the stock already trading above most analyst targets after a powerful multi year run, the key question now is whether markets are simply catching up to fundamentals or already baking in the next leg of Goldman Sachs growth.

Most Popular Narrative: 10.6% Overvalued

With Goldman Sachs last closing at $887.96 against a narrative fair value of about $802.53, the storyline leans toward optimism being slightly ahead of price discipline.

Analysts expect earnings to reach $17.0 billion (and earnings per share of $53.95) by about September 2028, up from $14.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $19.7 billion.

Want to see what kind of revenue mix, margin lift, and shrinking share count are baked into this call? The underlying assumptions are anything but conservative.

Result: Fair Value of $802.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical uncertainty and rising regulatory capital demands could easily derail the optimistic earnings path analysts are modeling for Goldman.

Find out about the key risks to this Goldman Sachs Group narrative.

Another Angle on Valuation

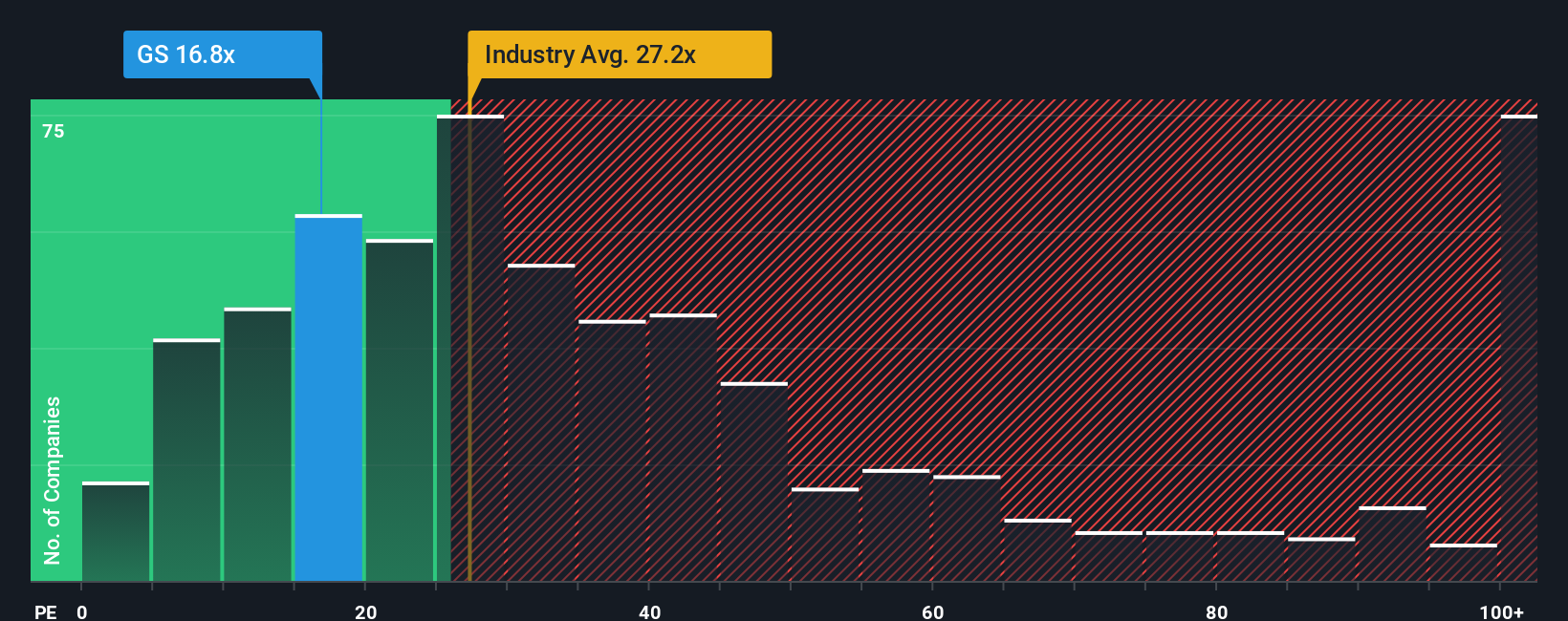

On raw earnings terms, Goldman Sachs looks far more reasonable. It trades on 17.6 times earnings versus about 25.4 times for the US Capital Markets industry and 30.1 times for close peers, while our fair ratio suggests the market could justify closer to 19.3 times.

That gap hints at a valuation cushion rather than froth. It also raises a harder question: are investors being too cautious on Goldman earnings durability, or is the recent share price surge already the reward for that discipline?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If this view does not quite match your own or you would rather dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Goldman Sachs Group.

Looking for your next investing move?

Do not stop at Goldman Sachs. Your next big winner could be hiding in plain sight, waiting in the Simply Wall Street Screener for investors who act early.

- Capture potential mispricing by using these 907 undervalued stocks based on cash flows to target companies where cash flow strength is not yet fully reflected in the share price.

- Ride powerful innovation trends by scanning these 26 AI penny stocks for businesses building real products and revenue around artificial intelligence.

- Lock in income potential by checking these 13 dividend stocks with yields > 3% for companies offering attractive yields that may support steady long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal