Fortescue (ASX:FMG) Valuation After 52‑Week High on Green Steel and Stronger Iron Ore Prices

Fortescue (ASX:FMG) is back on traders’ radars after punching up to a new 52 week high, helped by firmer iron ore prices and growing interest in its hydrogen based steelmaking partnership with Taiyuan.

See our latest analysis for Fortescue.

That move to A$22.98 caps a strong run, with a roughly 15% one month share price return and around 25% one year total shareholder return. This suggests momentum is building as investors re-rate Fortescue’s green iron and decarbonisation push.

If Fortescue’s latest surge has you rethinking the miners you follow, this could also be a great moment to explore fast growing stocks with high insider ownership for other fast moving ideas.

Yet with the share price now above the average analyst target despite flat revenue and weaker profit growth, the key question is whether Fortescue is still undervalued or if the market is already pricing in its green iron ambitions.

Most Popular Narrative Narrative: 23.9% Overvalued

Compared to the latest A$22.98 close, the most widely followed narrative points to a noticeably lower fair value estimate, highlighting a growing disconnect between price and fundamentals.

The trend of declining ore grades and rising extraction costs, combined with the need to develop more distant, lower-quality resources, will likely increase Fortescue's long-term cost base. This could erode its low-cost producer advantage, compressing net margins over time if high-priced iron ore markets are not sustained.

Curious how a miner facing shrinking margins can still command a premium valuation multiple and only modest long term revenue decline in the narrative? The answer lies in a delicate balance between profit compression assumptions and surprisingly resilient earnings power out to 2028. Want to see exactly how those future margins and earnings levels are stitched together into a higher implied multiple?

Result: Fair Value of $18.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger than expected cash flow from green projects, or sustained premium demand for higher grade ore, could cushion margins and upend this cautious narrative.

Find out about the key risks to this Fortescue narrative.

Another Angle on Value

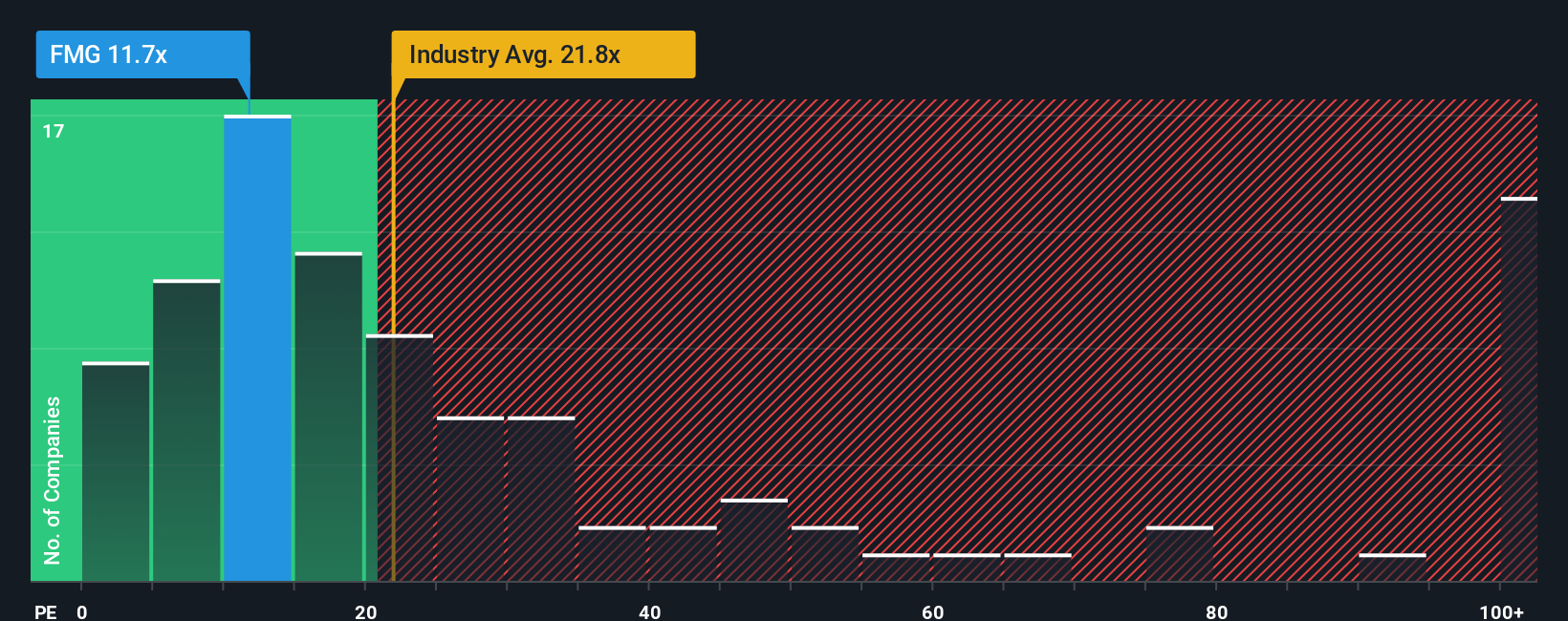

While the narrative model flags Fortescue as about 23.9% overvalued, our ratio based take tells a different story. At 14x earnings versus a fair ratio of 20.1x and an industry average near 21.9x, the current price could still leave upside if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortescue Narrative

If the conclusions here do not quite line up with your own view, dive into the numbers yourself and craft a personalised thesis in minutes, Do it your way.

A great starting point for your Fortescue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keep your edge sharp by acting now on fresh opportunities beyond Fortescue, or you will watch others move first on ideas you never even saw.

- Capture potential bargains early by scanning these 904 undervalued stocks based on cash flows, which combine solid cash flows with prices the market has not fully appreciated yet.

- Ride powerful innovation waves by targeting these 25 AI penny stocks, positioned at the heart of rapid advances in automation and intelligent software.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3%, which aim to reward shareholders with steady, meaningful payouts over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal