Discovering Opportunities: AirJoule Technologies Among 3 Promising Penny Stocks

As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, investors are keenly observing potential opportunities across various sectors. While large-cap stocks often dominate headlines, penny stocks—typically smaller or newer companies—continue to pique interest due to their potential for significant returns when backed by solid financials. Despite being considered a relic of past trading days, penny stocks still offer intriguing prospects for those willing to explore beyond the mainstream, with some demonstrating impressive balance sheet resilience and growth potential in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.05 | $450.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.82 | $632.91M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.93 | $152.12M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.25 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.37B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.51 | $586.77M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.53 | $369.07M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8977 | $6.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.20 | $100.14M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AirJoule Technologies (AIRJ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AirJoule Technologies Corporation focuses on atmospheric renewable energy and water harvesting technologies, with a market cap of approximately $178.40 million.

Operations: AirJoule Technologies has not reported any specific revenue segments.

Market Cap: $178.4M

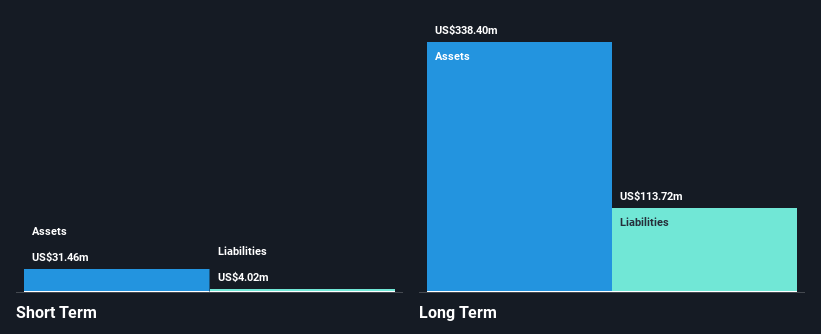

AirJoule Technologies, with a market cap of US$178.40 million, is pre-revenue and focuses on atmospheric renewable energy and water harvesting technologies. Despite having no debt, the company's short-term assets of US$27.9 million do not cover its long-term liabilities of US$84.4 million. The board and management are relatively new, with an average tenure of 1.8 years, indicating potential for fresh strategic perspectives but also a lack of experience. Recent collaborations include a significant deployment at Nexus Data Centers in Texas under a Water Purchase Agreement to leverage waste heat for water production, aligning with sustainability trends in data center operations.

- Click to explore a detailed breakdown of our findings in AirJoule Technologies' financial health report.

- Examine AirJoule Technologies' past performance report to understand how it has performed in prior years.

AC Immune (ACIU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AC Immune SA is a clinical-stage biopharmaceutical company focused on discovering, designing, and developing medicines and diagnostic products for neurodegenerative diseases related to protein misfolding, with a market cap of $276.05 million.

Operations: The company generates revenue from its segment of discovering and developing therapeutic and diagnostic products, amounting to CHF 4.37 million.

Market Cap: $276.05M

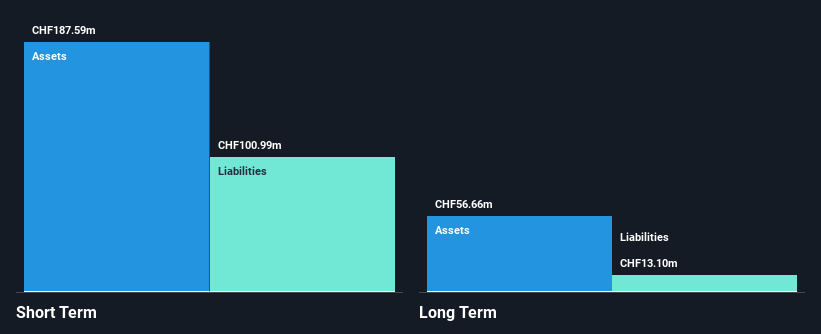

AC Immune, with a market cap of $276.05 million, is navigating the challenging landscape of neurodegenerative disease treatment as a pre-revenue company. Despite its unprofitability and recent revenue decline to CHF 0.939 million for Q3 2025, AC Immune maintains a debt-free status and has sufficient cash runway for over a year. The positive interim Phase 2 data on ACI-7104.056 for Parkinson’s Disease highlights potential progress in its pipeline. The recent appointment of Prof. Catherine Mummery as Chairwoman of the Clinical Advisory Board brings seasoned expertise to guide strategic development in this high-risk sector.

- Click here and access our complete financial health analysis report to understand the dynamics of AC Immune.

- Gain insights into AC Immune's outlook and expected performance with our report on the company's earnings estimates.

Erasca (ERAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erasca, Inc. is a clinical-stage precision oncology company dedicated to discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers, with a market cap of approximately $924.90 million.

Operations: Erasca, Inc. currently does not report any revenue segments.

Market Cap: $924.9M

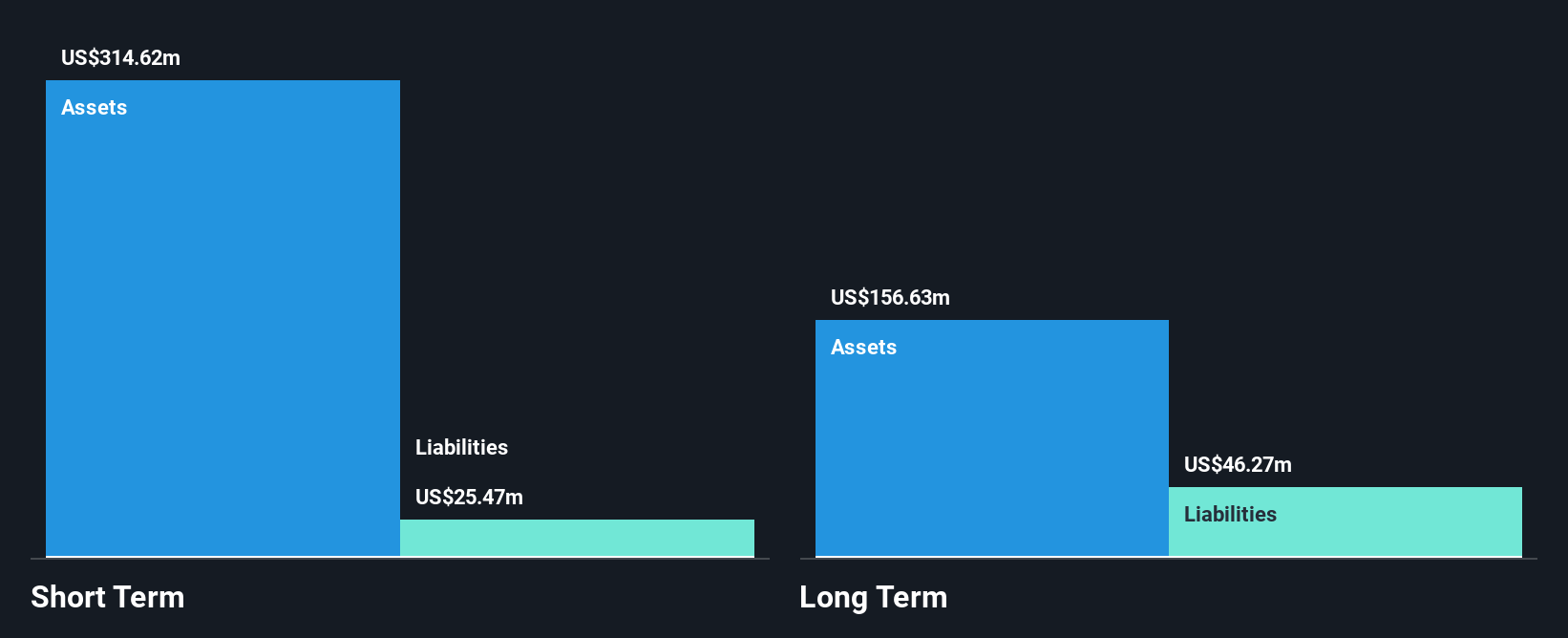

Erasca, Inc., with a market cap of approximately US$924.90 million, is a pre-revenue clinical-stage precision oncology company focused on RAS/MAPK pathway-driven cancers. The company recently secured U.S. patent protection for ERAS-0015, advancing its RAS-targeting franchise with both ERAS-0015 and ERAS-4001 in Phase 1 trials. Despite reporting a net loss of US$30.6 million for Q3 2025, Erasca remains debt-free and holds US$362 million in cash and equivalents, providing financial runway into late 2028. The experienced management team and board support the company's strategic progression amid high volatility in share price performance.

- Navigate through the intricacies of Erasca with our comprehensive balance sheet health report here.

- Assess Erasca's future earnings estimates with our detailed growth reports.

Where To Now?

- Get an in-depth perspective on all 343 US Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal