Is Bank of Nova Scotia (TSX:BNS) Fairly Priced After Its 35% One‑Year Rally?

Bank of Nova Scotia (TSX:BNS) has quietly put together an impressive run, with the stock up about 35% over the past year as earnings and revenue growth outpace expectations.

See our latest analysis for Bank of Nova Scotia.

The recent 7.3% 1 month share price return and 14.4% 3 month share price return suggest momentum is building, while a 35.2% one year total shareholder return points to a longer term re rating story taking hold.

If this kind of steady rerating interests you, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

Given that Bank of Nova Scotia trades just above analyst targets but appears roughly 35% below intrinsic value estimates, is there still a mispricing to exploit here, or has the market already baked in the bank’s next leg of growth?

Most Popular Narrative: 1.3% Overvalued

With Bank of Nova Scotia closing at CA$100.40 against a narrative fair value of about CA$99.07, the story hinges on whether improving returns justify only a slim premium.

Fair Value Estimate has risen moderately from roughly CA$92.21 to about CA$99.07. This reflects a higher intrinsic value assessment for Bank of Nova Scotia shares.

Curious what is powering that higher fair value despite only modest upside from today’s price? The narrative leans on faster top line growth, fatter profit margins, and a future earnings multiple that quietly assumes a more profitable, more efficient bank than the one investors see today. Want to know how those assumptions stack up over the next few years, and what has to go right for them to hold? Read on to unpack the full playbook behind this valuation call.

Result: Fair Value of $99.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Latin American volatility and a potential Canadian housing downturn could quickly undermine credit quality, pressure margins, and derail the improving ROE story.

Find out about the key risks to this Bank of Nova Scotia narrative.

Another View: Market Ratios Still Look Stretched

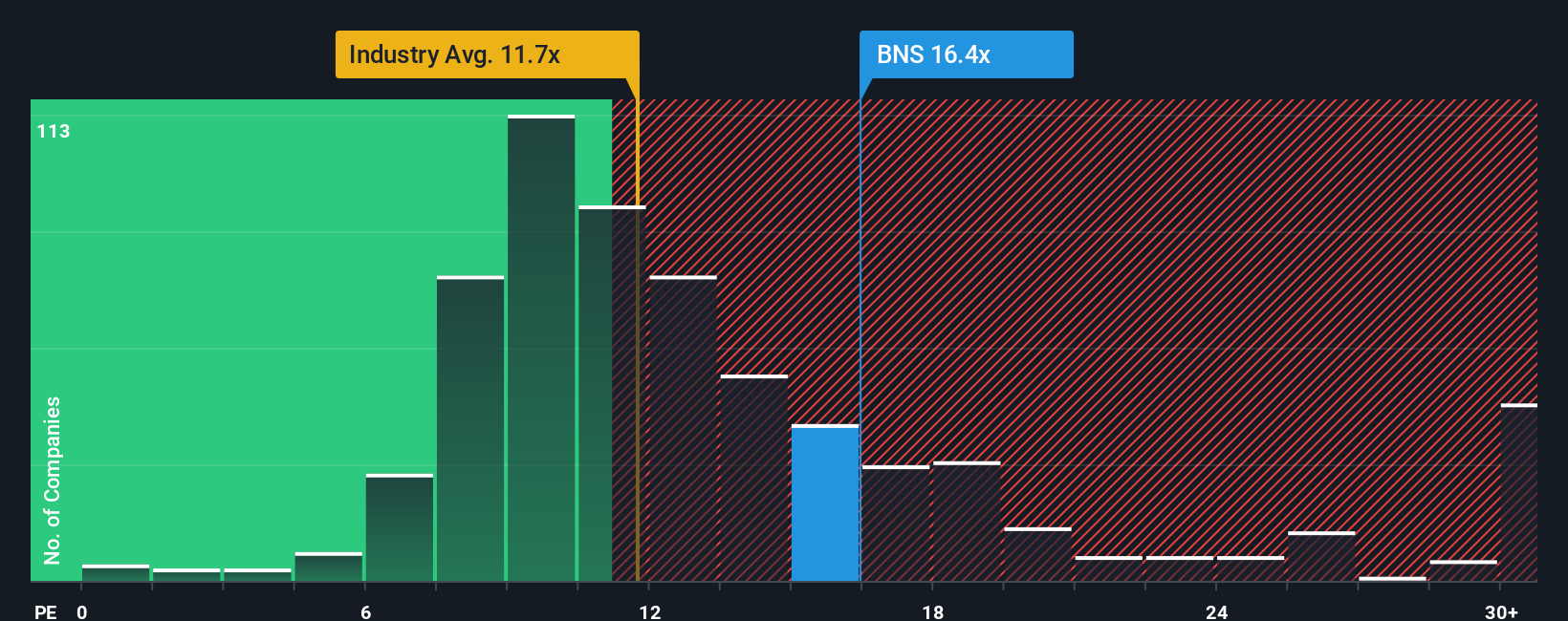

While the narrative fair value suggests only a small premium, the numbers tell a tougher story. Bank of Nova Scotia trades on a P/E of 17.1 times, richer than both peers at 14.6 times and its fair ratio of 15.5 times, which implies limited cushion if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

If you see the story differently or want to stress test your own assumptions, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Ready for more compelling opportunities?

Do not stop at a single bank when the market is full of potential. Sharpen your edge now by lining up your next three investment ideas.

- Capitalize on overlooked value by targeting these 904 undervalued stocks based on cash flows that the market has yet to fully recognize.

- Ride powerful thematic trends through these 25 AI penny stocks shaping how businesses operate and compete worldwide.

- Lock in potential income streams with these 12 dividend stocks with yields > 3% that pay attractive yields while aiming to preserve capital.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal