Global Value Opportunities With 3 Stocks Estimated Below Intrinsic Value

As global markets react to potential interest rate cuts and mixed economic signals, investors are carefully navigating an environment marked by modest gains in major indices and ongoing challenges in manufacturing and employment. In this context, identifying stocks that are estimated below their intrinsic value can offer strategic opportunities for those seeking to balance risk with the potential for growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tianqi Lithium (SZSE:002466) | CN¥51.64 | CN¥102.18 | 49.5% |

| Sanoma Oyj (HLSE:SANOMA) | €9.14 | €18.16 | 49.7% |

| KIYO LearningLtd (TSE:7353) | ¥700.00 | ¥1381.50 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5450.00 | ¥10875.98 | 49.9% |

| Jæren Sparebank (OB:JAREN) | NOK379.95 | NOK754.39 | 49.6% |

| H.U. Group Holdings (TSE:4544) | ¥3311.00 | ¥6592.59 | 49.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩448500.00 | ₩888483.25 | 49.5% |

| Exail Technologies (ENXTPA:EXA) | €86.30 | €171.25 | 49.6% |

| E-Globe (BIT:EGB) | €0.61 | €1.22 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.05 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥7.51 billion.

Operations: The company generates revenue through the development, design, manufacturing, and sales of cryogenic equipment within China.

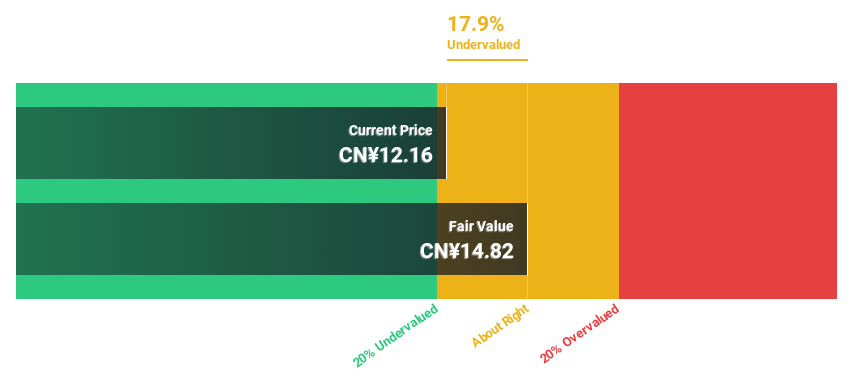

Estimated Discount To Fair Value: 36.1%

Hangzhou Zhongtai Cryogenic Technology is trading at CN¥21.17, significantly below its estimated fair value of CN¥33.12, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 10% to 2.4%, the company shows promising growth prospects with earnings expected to grow significantly over the next three years, outpacing the Chinese market average. Recent amendments to company bylaws indicate potential strategic shifts but have no direct impact on valuation metrics.

- Upon reviewing our latest growth report, Hangzhou Zhongtai Cryogenic Technology's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Hangzhou Zhongtai Cryogenic Technology with our comprehensive financial health report here.

Xi'an NovaStar Tech (SZSE:301589)

Overview: Xi'an NovaStar Tech Co., Ltd. designs and develops LED display control solutions both in China and internationally, with a market cap of CN¥13.94 billion.

Operations: The company generates revenue of CN¥3.32 billion from its video image display control industry segment.

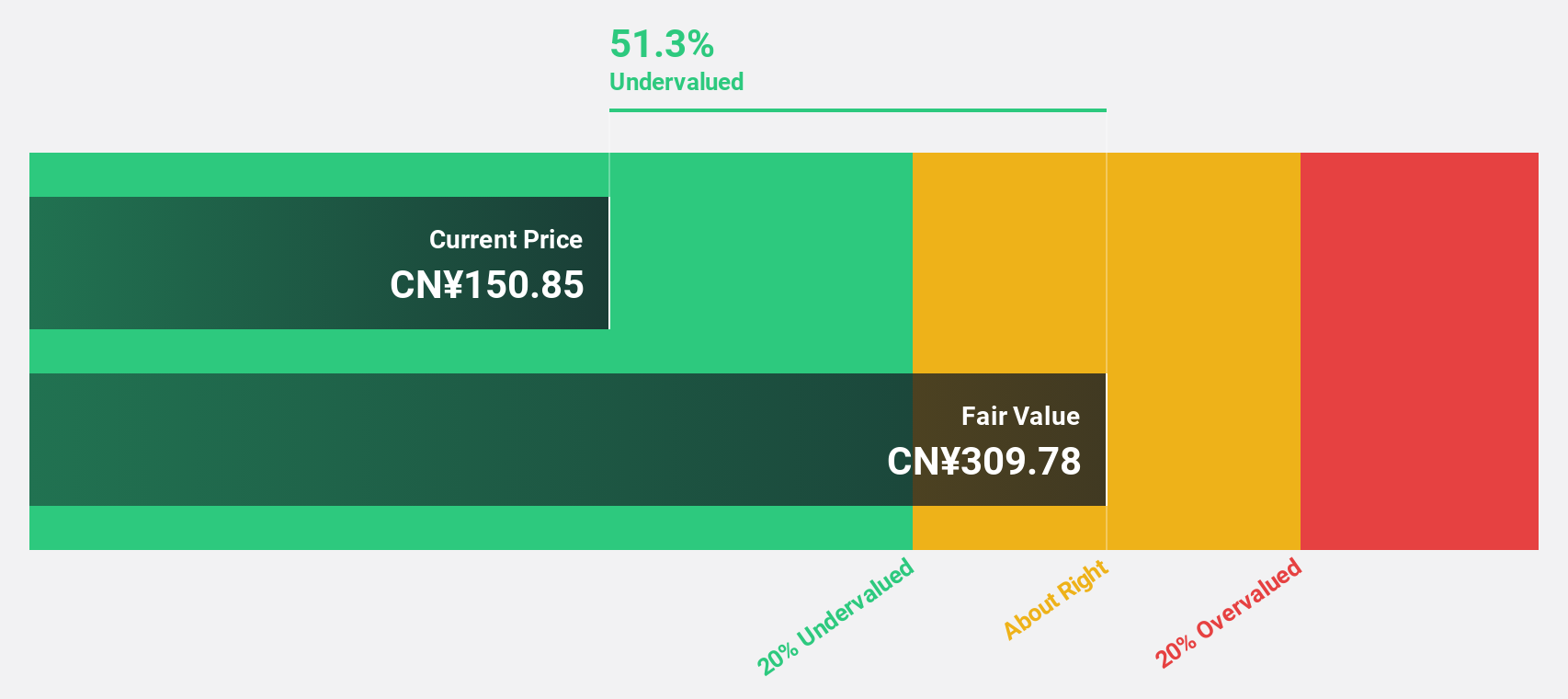

Estimated Discount To Fair Value: 47%

Xi'an NovaStar Tech, trading at CNY 160, is over 47% below its estimated fair value of CNY 301.77, indicating it is undervalued based on cash flows. Despite a slight year-over-year decline in net income to CNY 445.3 million for the first nine months of 2025, earnings are forecasted to grow significantly at an annual rate of over 29%, surpassing the Chinese market average. The recent share buyback completion underscores management's confidence in its valuation.

- Our growth report here indicates Xi'an NovaStar Tech may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Xi'an NovaStar Tech's balance sheet health report.

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. and its subsidiaries offer thermal solutions globally, with a market cap of NT$555.10 billion.

Operations: The company's revenue is primarily derived from its Overseas Operating Department, which contributes NT$129.35 billion, and its Integrated Management Division, which adds NT$93.88 billion.

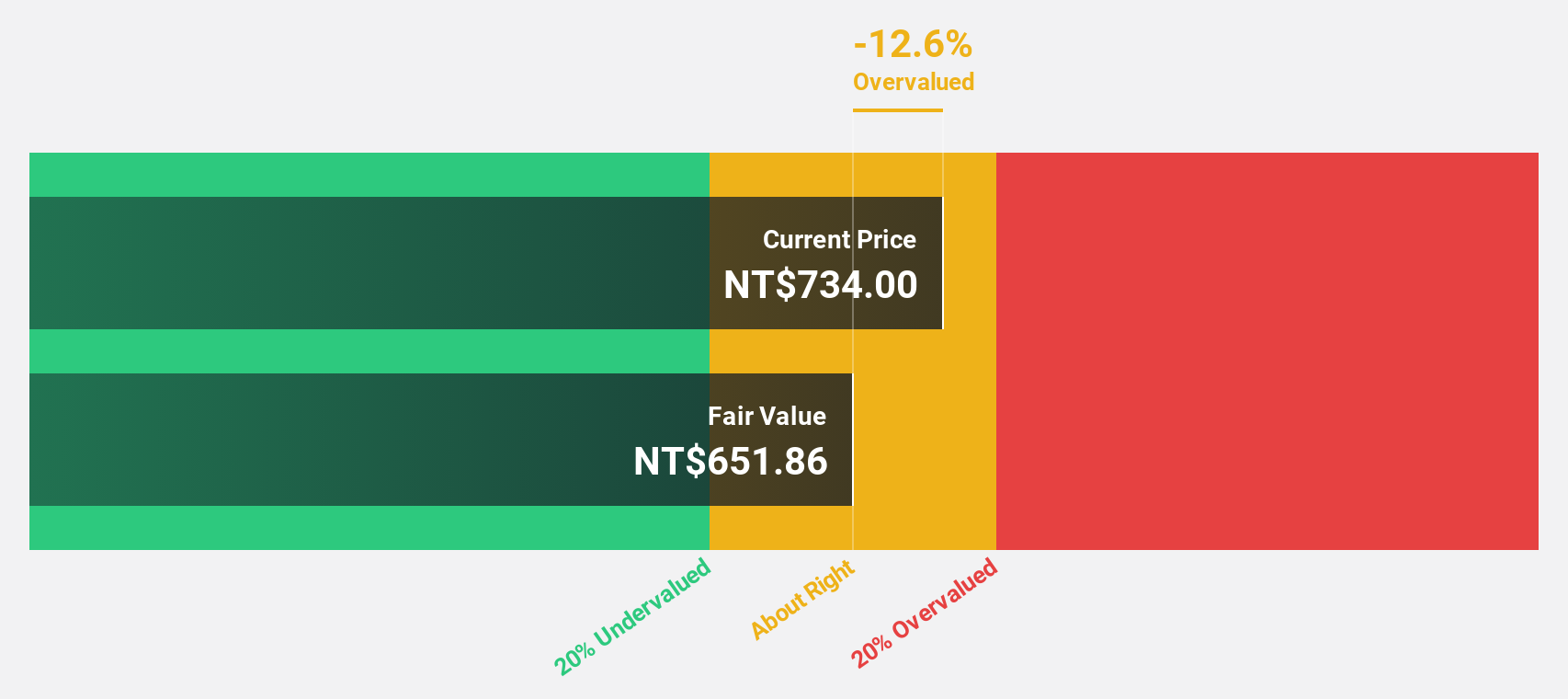

Estimated Discount To Fair Value: 28.2%

Asia Vital Components, trading at NT$1430, is significantly undervalued with a fair value estimate of NT$1991.43. Recent earnings results show robust growth, with third-quarter sales reaching NT$38.94 billion and net income at NT$5.34 billion, both nearly doubling from the previous year. Earnings are forecasted to grow by 33% annually over the next three years, outpacing the Taiwan market average and bolstered by strong revenue growth projections of 30.5% per year.

- According our earnings growth report, there's an indication that Asia Vital Components might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Asia Vital Components.

Seize The Opportunity

- Unlock more gems! Our Undervalued Global Stocks Based On Cash Flows screener has unearthed 497 more companies for you to explore.Click here to unveil our expertly curated list of 500 Undervalued Global Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal