Phillips 66 (PSX) Valuation Check After European Retail Sale and Growing Midstream Optimism

Phillips 66 (PSX) just closed the sale of a 65% stake in its Germany and Austria retail marketing business, a balance sheet friendly move that frees up capital for higher return, midstream driven growth.

See our latest analysis for Phillips 66.

That sale lands at a time when Phillips 66’s share price has been grinding higher, with a 90 day share price return of 9.67 percent feeding into a strong 25.36 percent year to date move and a 5 year total shareholder return of 159.6 percent. This suggests momentum is still on the front foot rather than fading.

If this kind of balance sheet reshaping has you thinking about what else might be setting up for a multi year run, it is worth exploring fast growing stocks with high insider ownership for other under the radar ideas.

Yet with the stock near highs, trading just below analyst targets but at a steep intrinsic discount, the real question is simple: Is Phillips 66 still attractive at this level, or is future growth already priced in?

Most Popular Narrative Narrative: 46.6% Undervalued

With the narrative fair value sitting far above Phillips 66’s recent close at $143.43, the setup points to a sizable long term valuation gap.

Phillips 66 (PSX) is often considered undervalued for several reasons. Investment analysis typically looks at various factors to determine if a company's stock might be undervalued and whether it has the potential to achieve higher profit margins.

Want to see why, according to mschoen25, modest revenue growth, fatter margins, and a richer future earnings multiple still justify such a lofty fair value? The narrative leans on a slower top line, upgraded profitability, and a valuation profile more often seen in fast growing sectors, not old economy refiners. Curious how those moving parts stack up to reach that target price? Read on to unpack the full storyline behind the numbers.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker refining margins or a prolonged energy downturn could derail profit expansion and keep Phillips 66 trading closer to cyclical rather than growth valuations.

Find out about the key risks to this Phillips 66 narrative.

Another View: Market Ratios Flash a Warning

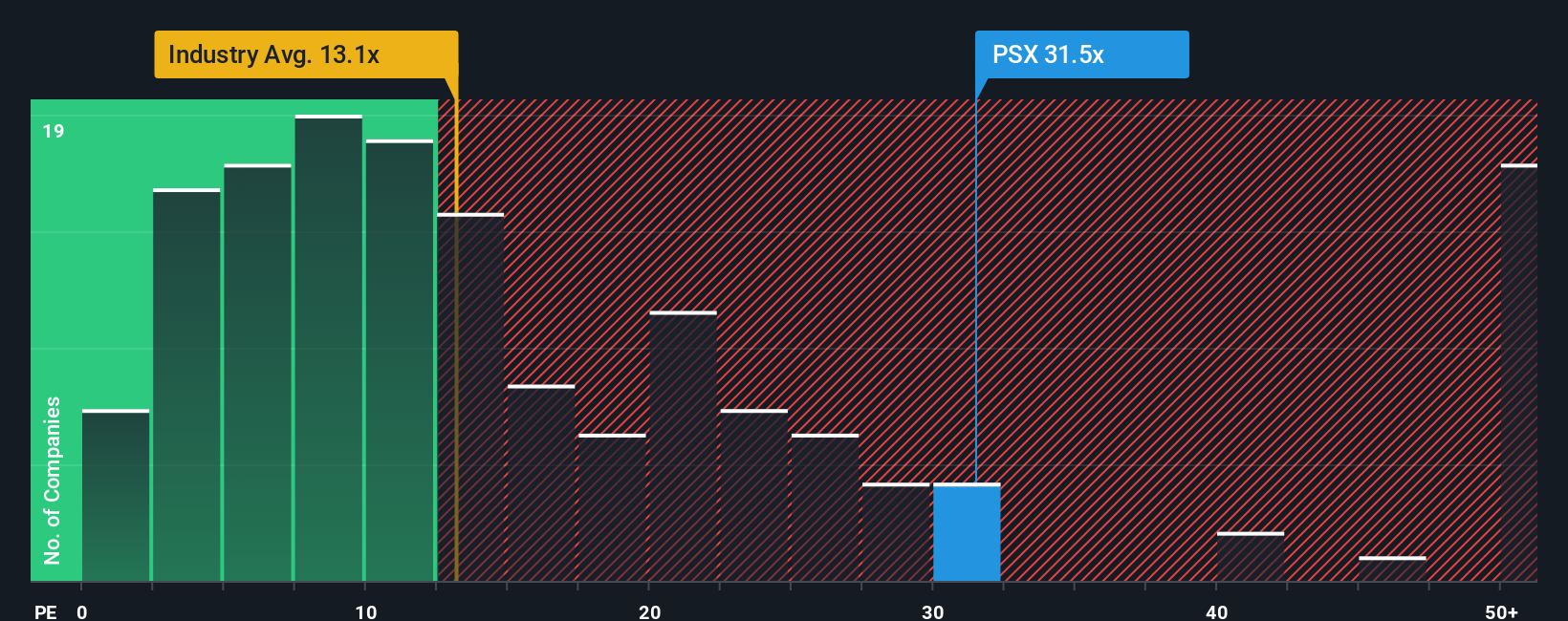

While the narrative fair value points to deep upside, the current earnings multiple tells a very different story. At 38.6 times earnings versus a fair ratio of 25.1 times, and well above peers at 25.8 times and the industry at 13.6 times, the stock screens as stretched and leaves less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized thesis in minutes: Do it your way.

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one opportunity. Sharpen your edge by hunting for fresh ideas across multiple themes using the Simply Wall St screener before everyone else catches on.

- Pinpoint income potential by targeting companies offering reliable payouts with these 12 dividend stocks with yields > 3% that stand out for yield and sustainability.

- Ride structural growth trends by zeroing in on innovators powering the future of medicine and diagnostics through these 30 healthcare AI stocks.

- Seize mispriced opportunities by scanning for stocks trading below their cash flow value using these 905 undervalued stocks based on cash flows before the broader market reacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal