Lacklustre Performance Is Driving Ithaca Energy plc's (LON:ITH) 30% Price Drop

Ithaca Energy plc (LON:ITH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 52% in the last year.

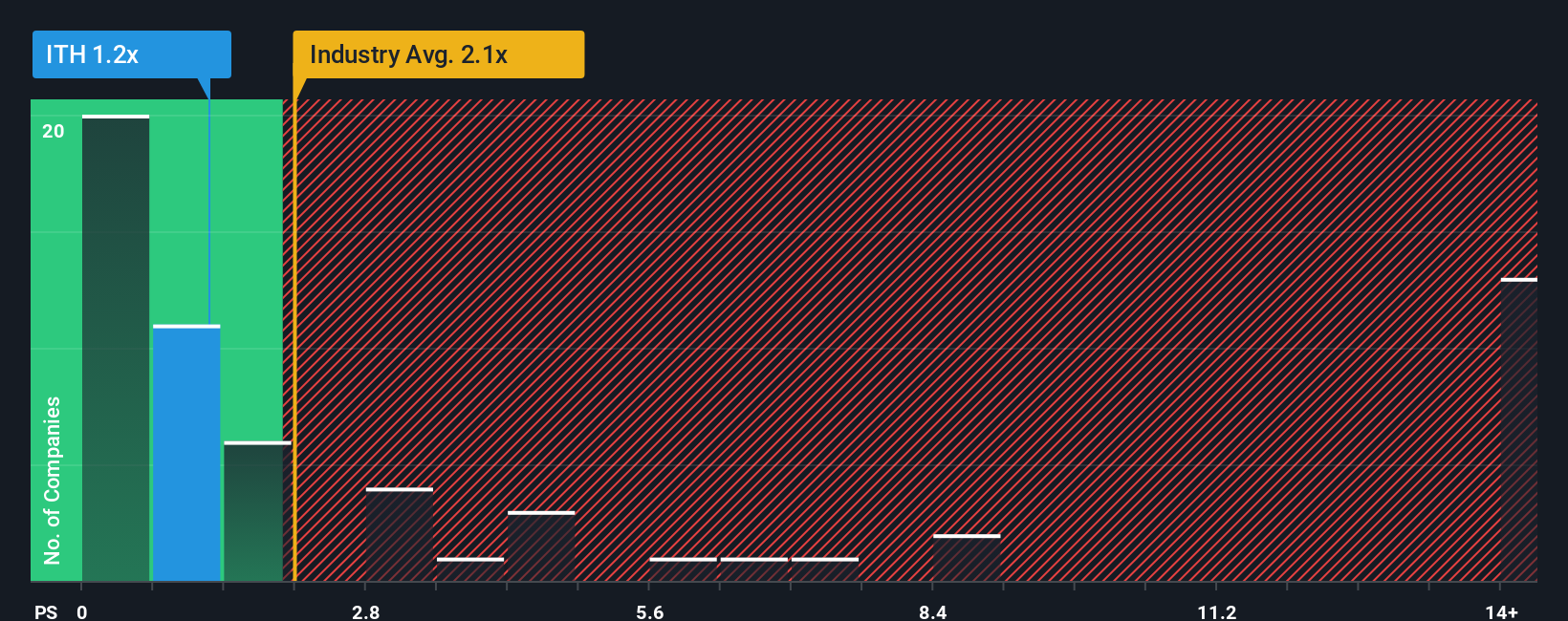

Following the heavy fall in price, Ithaca Energy may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Oil and Gas industry in the United Kingdom have P/S ratios greater than 2.1x and even P/S higher than 12x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Ithaca Energy

How Ithaca Energy Has Been Performing

Recent times have been pleasing for Ithaca Energy as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ithaca Energy.Is There Any Revenue Growth Forecasted For Ithaca Energy?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ithaca Energy's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 68% last year. Revenue has also lifted 17% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.0% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 7.9% per year growth forecast for the broader industry.

In light of this, it's understandable that Ithaca Energy's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Ithaca Energy's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Ithaca Energy's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Ithaca Energy, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal