Top UK Dividend Stocks To Consider In December 2025

The United Kingdom market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. In such a fluctuating environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.08% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.43% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.48% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.79% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.89% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.20% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 8.32% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.10% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 5.91% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.68% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

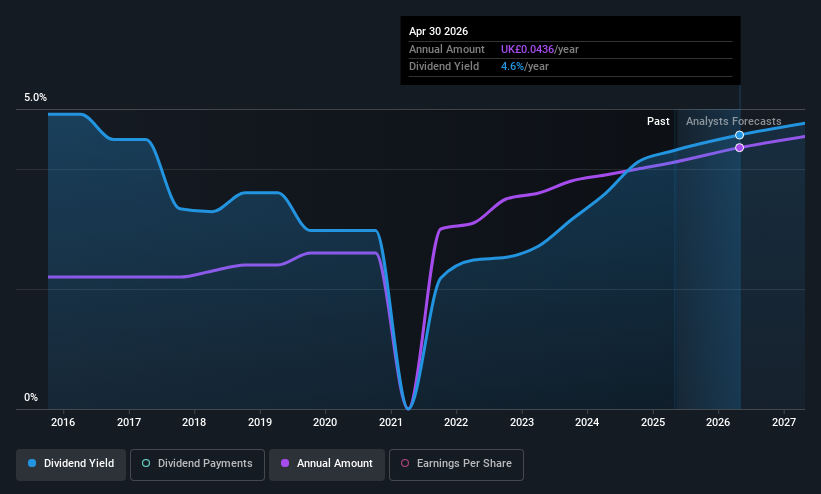

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Begbies Traynor Group plc offers business recovery, financial advisory, and property services consultancy in the United Kingdom, with a market cap of £177.02 million.

Operations: Begbies Traynor Group plc generates revenue through its business recovery, financial advisory, and property services consultancy divisions in the UK.

Dividend Yield: 4%

Begbies Traynor Group recently announced a 7% increase in its interim dividend, marking eight consecutive years of growth, underscoring its commitment to a progressive dividend policy. Despite a modest 4% yield, the dividends are well-covered by earnings and cash flows with payout ratios around 71%. The company's recent earnings report showed strong growth with net income rising significantly. This financial stability supports continued reliable dividend payments amidst ongoing strategic leadership changes.

- Click to explore a detailed breakdown of our findings in Begbies Traynor Group's dividend report.

- The valuation report we've compiled suggests that Begbies Traynor Group's current price could be quite moderate.

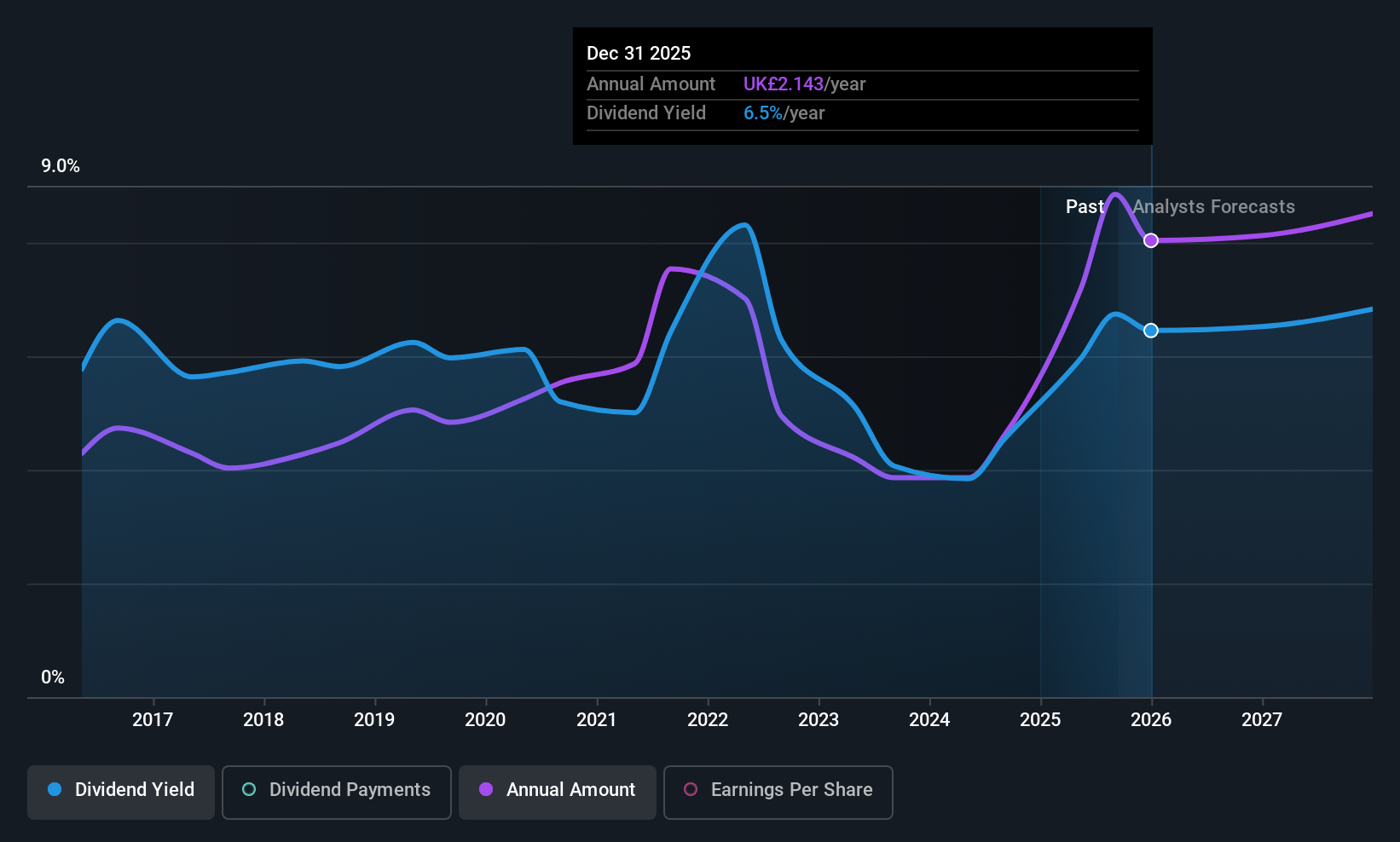

Admiral Group (LSE:ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Admiral Group plc is a financial services company offering insurance and personal lending products across the UK, France, Italy, Spain, and the US, with a market cap of £9.29 billion.

Operations: Admiral Group's revenue is primarily derived from its UK Insurance segment, which generated £4.33 billion, supplemented by Admiral Money contributing £20.10 million.

Dividend Yield: 7.7%

Admiral Group's dividend yield of 7.7% ranks in the top 25% of UK dividend payers, yet its sustainability is questionable due to inadequate coverage by cash flows, reflected in a high cash payout ratio of 248%. Despite past volatility and an unreliable dividend history over the last decade, recent earnings growth and a reasonable payout ratio suggest potential stability. The appointment of Carlos Selonke as an Independent Non-Executive Director may enhance operational resilience.

- Dive into the specifics of Admiral Group here with our thorough dividend report.

- Our valuation report unveils the possibility Admiral Group's shares may be trading at a discount.

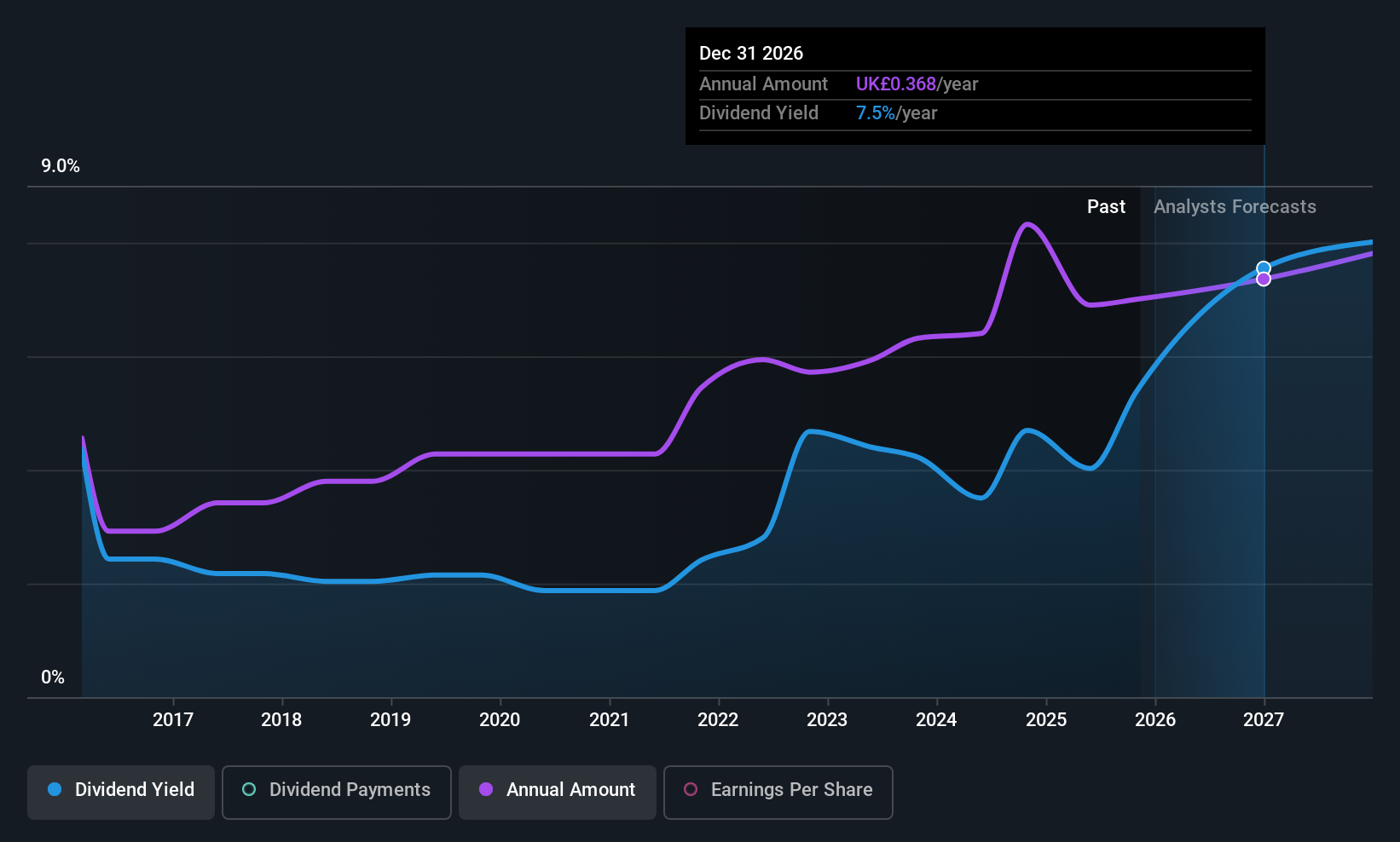

Hilton Food Group (LSE:HFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hilton Food Group plc, with a market cap of £444.58 million, operates in the food packing industry through its subsidiaries.

Operations: Hilton Food Group's revenue is derived from its operations across various regions, with £1.50 billion from APAC, £1.09 billion from Europe, and £1.59 billion from the UK & Ireland.

Dividend Yield: 7.1%

Hilton Food Group offers a notable dividend yield of 7.08%, placing it among the top UK payers, but sustainability concerns arise as payouts exceed free cash flows and earnings coverage is tight at an 80.3% payout ratio. The company's dividends have been historically volatile, with a lack of consistent growth over the past decade. Recent executive changes, with Mark Allen stepping in as Executive Chair, could influence future strategic direction and stability.

- Get an in-depth perspective on Hilton Food Group's performance by reading our dividend report here.

- The analysis detailed in our Hilton Food Group valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Dive into all 49 of the Top UK Dividend Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal