Omdia: AI is driving the semiconductor market to achieve unprecedented growth, AI technology investments drive revenue to record highs

The Zhitong Finance App learned that Omdia published an article stating that artificial intelligence (AI) -driven growth is reshaping the semiconductor industry pattern. AI is driving unprecedented growth in the semiconductor market, and investment in AI technology has driven revenue to record highs. Driven by AI technology, data center servers have become the main driver of semiconductor revenue, and demand for GPUs, logical ASSP/ASICs, DRAM (HBM), and power management chips has increased significantly. The AI boom is expected to drive the semiconductor industry to continue to grow for six years, and is expected to break the industry's traditional cyclical rules.

Data computing and advanced technology lead the transformation of the market

Driven by data center and AI-related applications, the data computing sector is expected to surpass 50% of total semiconductor revenue for the first time in 2026.

Advances in high-performance computing (HPC) technology, including chips moving from 7nm to 2nm processes, and specialized technologies such as silicon photons and cores will drive the growth of foundry revenue.

Memory chip spending is accelerating, focusing on the expansion of advanced DRAM and HBM production capacity to meet AI-driven needs.

Ecological evolution and emerging challenges

The automotive industry is transforming software-defined vehicles, and needs to build a new semiconductor ecosystem with advanced AI-enabled services, regional architectures, and strong cybersecurity capabilities.

Supply chain challenges, such as potential infrastructure bottlenecks, supply constraints, and geopolitical risks, can impact industry growth.

Emerging technologies such as QLCESD and edge AI are on the rise, but traditional solutions like HDD are still critical to large-scale storage requirements, highlighting the balance between innovation and existing infrastructure.

Breaking the semiconductor history cycle

Craig Stice, chief analyst at Omdia Semiconductors, said, “The semiconductor industry has historically shown cyclical characteristics. Revenue growth is usually driven by specific booming markets, but eventually these markets will gradually decline. Currently, AI is driving unprecedented industry growth, and the terminal market is investing billions of dollars in AI technology, driving semiconductor revenue to record highs. With no clear industry peak yet, will the AI-driven semiconductor cycle reshape the historical development trajectory?”

Is the AI boom resilient enough to break the semiconductor industry cycle?

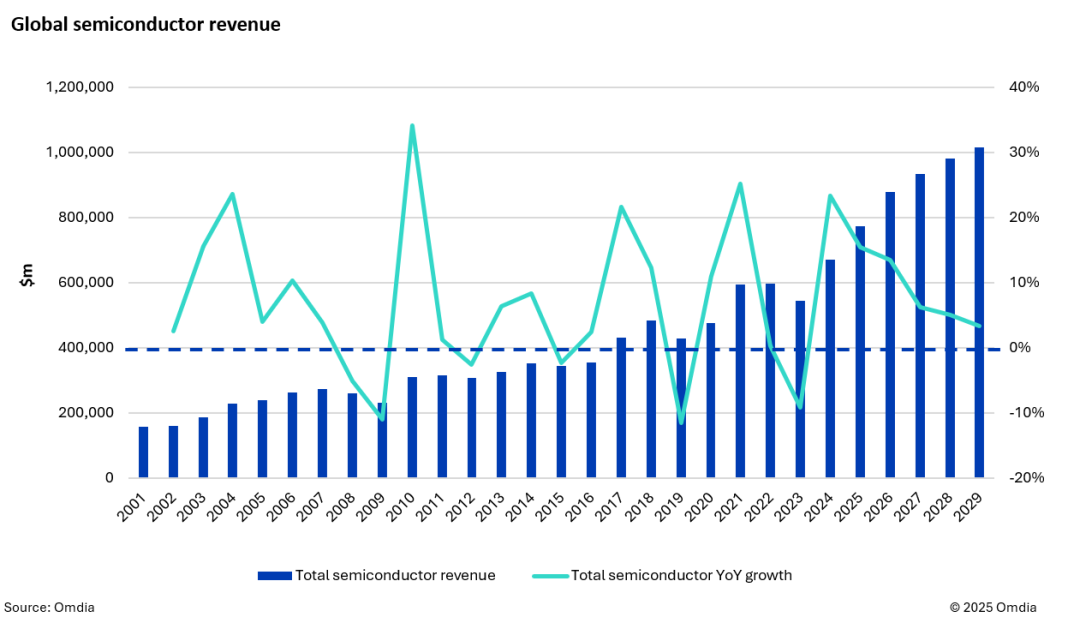

In the past 25 years, the semiconductor market only achieved more than three consecutive years of year-on-year growth (early 2000s). Since then, there have only been two three-year year-on-year growth cycles. One occurred during the corporate expansion period in the late 2010s, and the other during the COVID-19 pandemic.

The forecast shows that 2025 will usher in the second round of AI-driven growth cycle, and the year-on-year growth trend is expected to run through the entire forecast range (total semiconductor market revenue is expected to grow for six consecutive years).

In 2026, will semiconductor revenue in the data computing sector exceed 50% of total semiconductor revenue?

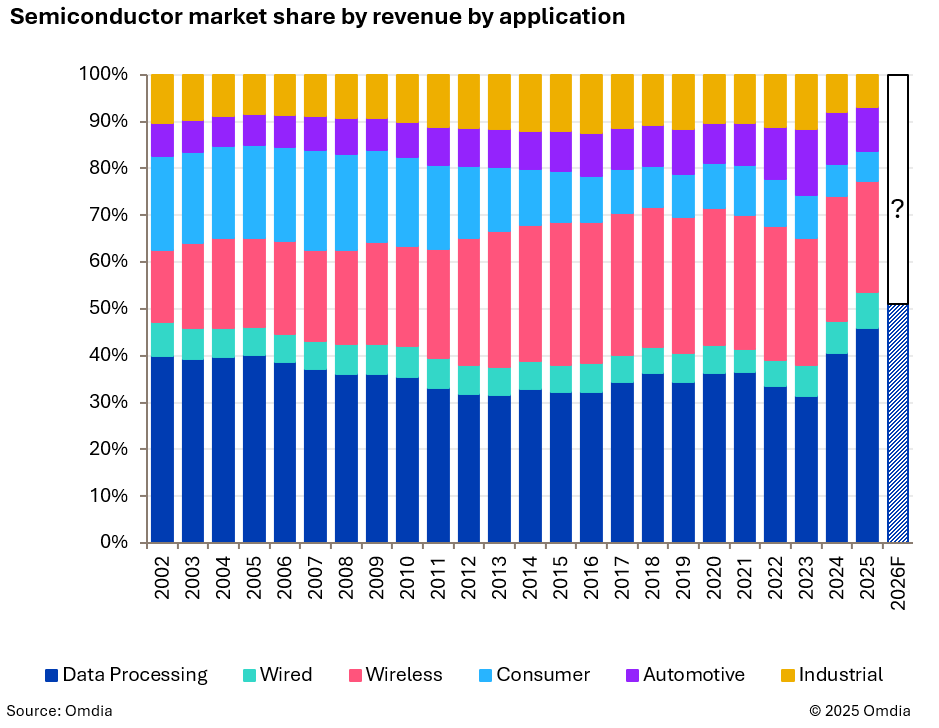

In terms of revenue, data computing has always been the largest sector in the six major semiconductor application fields.

Twenty years ago, PCs were the main field of application.

Currently, data centers are driving growth in this field.

However, the sector's share of the semiconductor market has never been so high — it won't break the 40% mark for the first time until 2025.

Over the past 20 years, its market share has fluctuated between 30% and 40% of total semiconductor revenue.

Ten years ago, the rise of smartphones reduced the market share of data computing to a low range of around 30%.

Although the size of the wireless sector has grown by nearly 100 billion dollars from 10 years ago, this sector currently accounts for less than 25% of total semiconductor revenue.

Revenue in the data computing sector has doubled in just two years, and there is currently no sign of slowing down. Revenue in this sector increased by $200 billion in 2025 compared to 2023, and its market share reached a record high, accounting for about 46% of total semiconductor revenue. In 2026, will the share of data calculation exceed 50% for the first time?

Data center servers: Driven by the AI wave, will be the core driver of semiconductor revenue in 2026

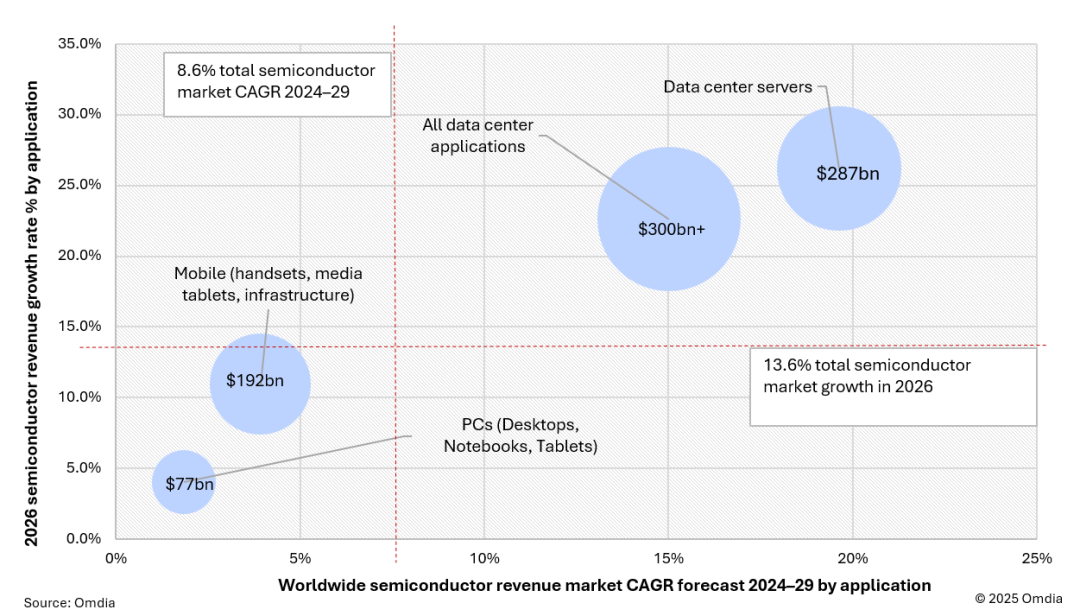

Data center servers have become the biggest driver of semiconductor revenue growth. If related applications such as data center network switches are further incorporated, this demand trend has an overwhelming advantage over traditional fields such as mobile phones and PCs.

Core topics related to data centers in 2026 include: the scale of AI model training continues to expand and accelerate implementation; cloud service providers such as Google, Microsoft, and Amazon continue to increase investment and expansion; upgrading of old server components; upgrading of power and cooling equipment; and growing demand for edge AI. These growth factors will drive semiconductor revenue growth from GPUs, ASSP/ASICs for computing and high-speed network communications, DRAM (HBM), and power management chips.

Threats to growth in this sector include: a slowing AI commercialization process; government and/or community resistance to new facilities; trade restrictions; reduced IT spending (weak economy); and supply chain issues.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal