StandardAero (SARO) Valuation Check as New $450 Million Buyback Signals Long-Term Confidence

StandardAero (SARO) just rolled out a fresh catalyst for its stock, authorizing a share repurchase program of up to $450 million, a clear signal about how management views long term value.

See our latest analysis for StandardAero.

Those moves come after StandardAero’s October 2024 IPO and a string of growth focused updates, with the latest buyback coinciding with a 12.1% year to date share price return and a 7.4% one year total shareholder return. This suggests momentum is quietly building.

If this capital return story has your attention, it could be a good moment to see what else is taking off among aerospace and defense stocks.

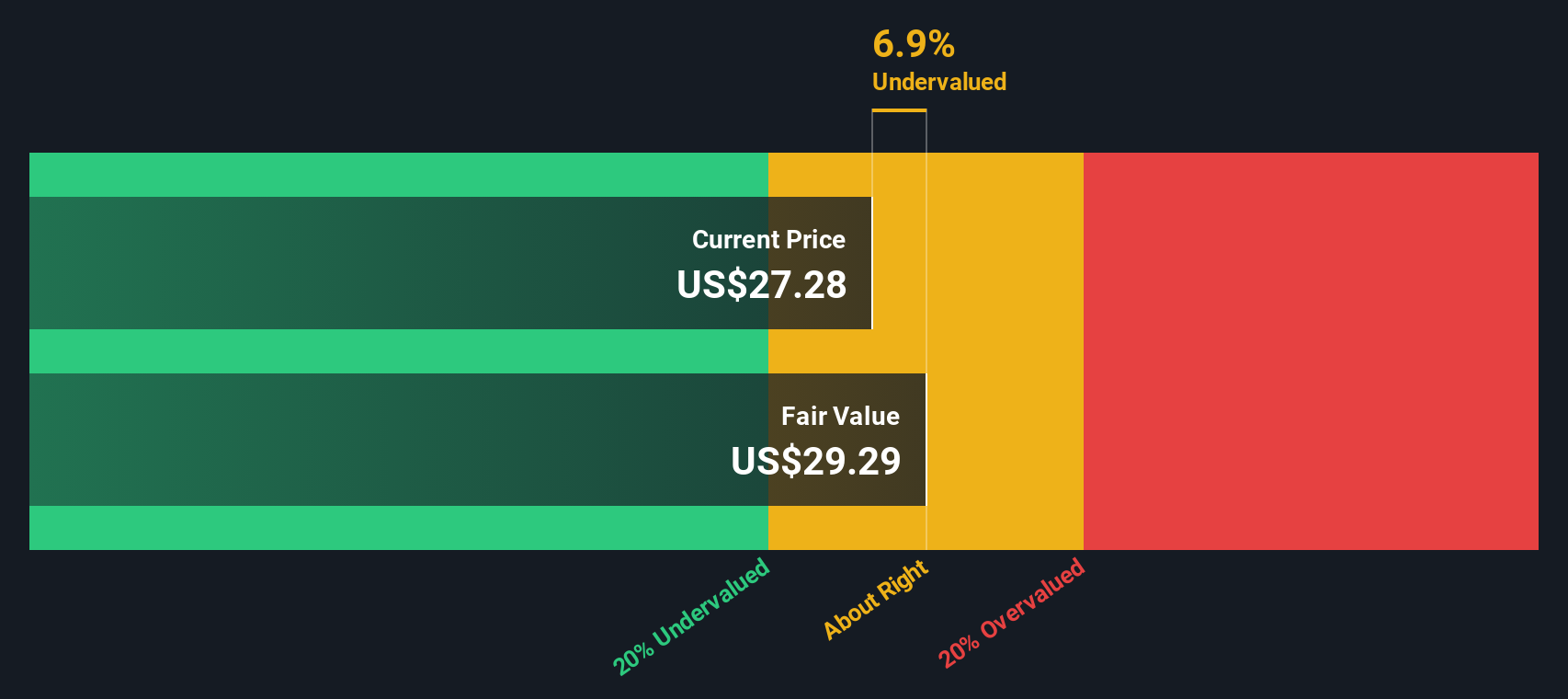

But with StandardAero trading below analyst targets and still early in its public market journey, is the market underestimating its cash flow runway or are investors already paying up for the next leg of growth?

Price-to-Earnings of 49.8x: Is it justified?

StandardAero trades at $27.51, which equates to a rich 49.8x price to earnings multiple, signaling investors are already paying up for its story.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, a common yardstick in aerospace and defense where profitability and cash flows are closely watched. At nearly 50x, the market is baking in strong earnings expansion and sustained profitability rather than treating SARO as a low growth industrial.

That optimism has some numerical backing, with earnings forecast to grow at a brisk pace of around the mid twenties annually and recent profit growth far outpacing both the broader US market and the aerospace and defense industry. Still, the current 49.8x multiple stands well above the industry average of 36.7x and even higher than the peer average of 43.8x. Our fair value framework points to a more moderate earnings multiple of about 34x, a level the valuation could eventually gravitate toward if expectations cool.

Explore the SWS fair ratio for StandardAero

Result: Price-to-Earnings of 49.8x (OVERVALUED)

However, investors should watch for slower aftermarket demand or execution missteps in scaling services, as these could challenge lofty growth assumptions and valuation multiples.

Find out about the key risks to this StandardAero narrative.

Another View: DCF Suggests Shares Look Cheaper

While the 49.8x earnings multiple looks stretched, our DCF model points the other way and suggests a fair value of $30.85 versus today’s $27.51, about an 11% discount. If cash flows are closer to the truth than sentiment, is SARO actually a quiet value story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StandardAero for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StandardAero Narrative

If you see the numbers differently or simply prefer to dig into the details yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before the market moves without you, put Simply Wall Street’s Screener to work and line up your next wave of high conviction opportunities today.

- Target reliable income by scanning for companies in these 12 dividend stocks with yields > 3% that pair attractive yields with solid underlying businesses.

- Capitalize on innovation by focusing on these 25 AI penny stocks that harness artificial intelligence to power scalable, long term growth.

- Position yourself ahead of the crowd by filtering for these 905 undervalued stocks based on cash flows where cash flow potential may not yet be fully priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal