Does L'Oréal Still Shine At €371 After Steady 2025 Gains And DCF Fair Value Signals

- Wondering if L'Oréal at around €371.95 is still a beauty worth paying up for, or if the share price has already had its glow up? This article will walk through whether the current tag looks stretched or still attractive.

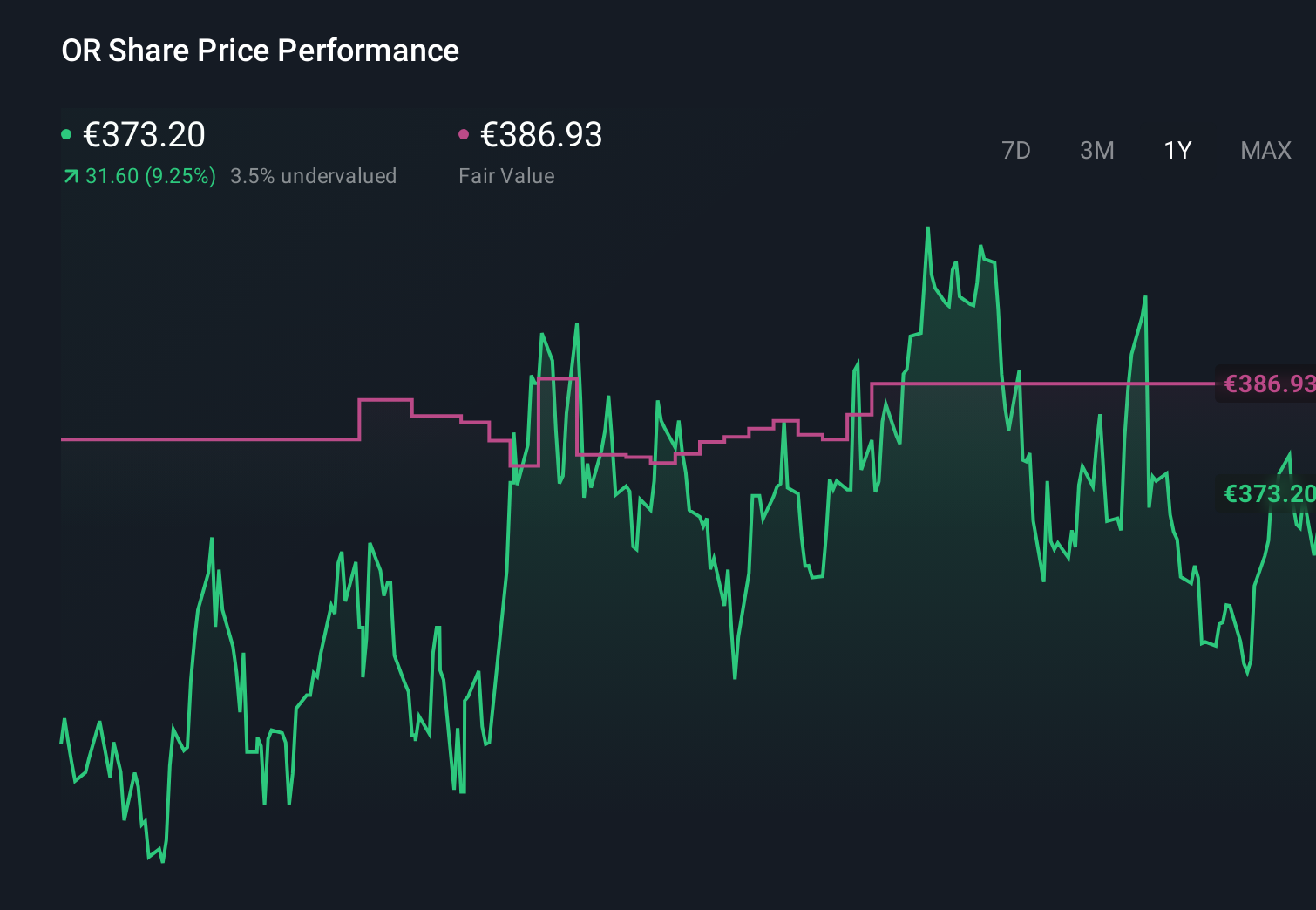

- The stock has quietly added 0.9% over the last week, 4.3% over the past month, and is up 10.0% year to date, with a solid 9.9% gain over the last year that builds on strong multi year compounding.

- Those moves have come as investors continue to back premium beauty and skin care as resilient, higher margin categories, and as L'Oréal leans into growth channels like e commerce, emerging markets, and higher end franchises. At the same time, shifting consumer spending patterns and competition in prestige brands keep the risk reward balance in focus.

- Despite its quality reputation, L'Oréal only scores 1 out of 6 on our undervaluation checks right now. We will unpack what different valuation methods say about that price tag, and finish by looking at a smarter way to think about fair value than headline multiples alone.

L'Oréal scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: L'Oréal Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

For L'Oréal, the latest twelve month Free Cash Flow is about €7.4 billion, and analysts expect this to rise steadily as the company grows its premium beauty and skincare franchises. Projections used in our 2 Stage Free Cash Flow to Equity model see Free Cash Flow climbing toward roughly €12.1 billion by 2035, with analyst forecasts guiding the nearer term and Simply Wall St extrapolating growth further out.

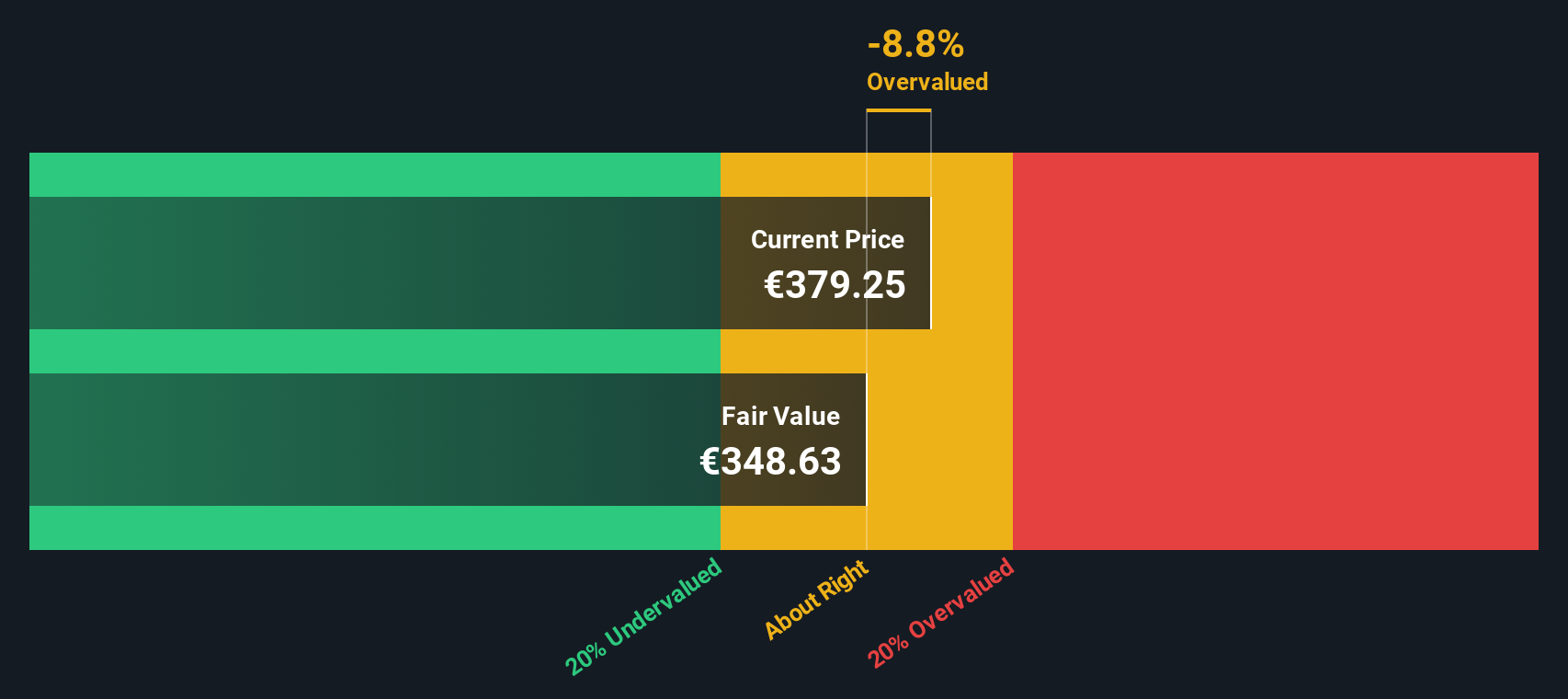

Aggregating and discounting these projected cash flows produces an estimated intrinsic value of about €383.53 per share. With the stock currently trading around €371.95, the model implies L'Oréal is roughly 3.0% undervalued, which is a very modest discount relative to its calculated fair value.

Result: ABOUT RIGHT

L'Oréal is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: L'Oréal Price vs Earnings

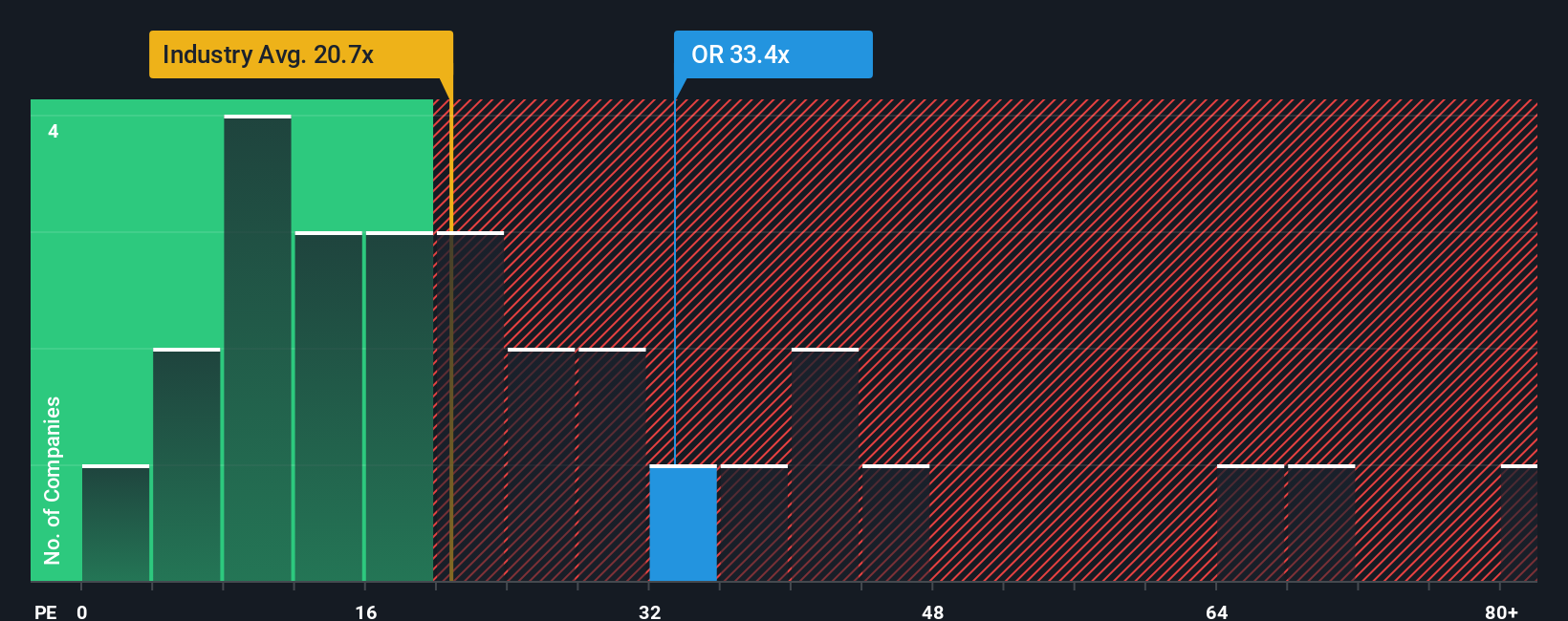

For a profitable, mature business like L'Oréal, the Price to Earnings ratio is a practical way to judge whether investors are paying a reasonable price for each euro of profit. A higher multiple can be justified when the market expects faster, more reliable growth, while slower or riskier earnings streams usually deserve a lower, more conservative PE.

L'Oréal currently trades on a PE of about 32.4x, which is a clear premium to the broader Personal Products industry at roughly 22.4x and still above the 27.7x average for closer peers. Simply Wall St's Fair Ratio framework estimates what PE would be appropriate given L'Oréal's growth outlook, profitability, size and risk profile, and arrives at a Fair PE of about 31.6x. This approach is more useful than a simple peer comparison because it adjusts for the fact that L'Oréal is larger, more profitable and often growing differently from many of its category rivals.

With the actual PE only modestly above the Fair Ratio, the multiple suggests L'Oréal is trading very close to its justified valuation level.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L'Oréal Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of L'Oréal's story with the numbers behind its future.

A Narrative is your own roadmap for a company, where you spell out the business story you believe in, link it to specific forecasts for revenue, earnings and margins, and from there arrive at a fair value that you can compare to today’s share price.

On Simply Wall St’s Community page, millions of investors use Narratives as a straightforward, accessible tool to help frame their decisions, because each Narrative clearly shows whether their Fair Value sits above or below the current Price and then updates automatically as fresh news, earnings or guidance come through.

For example, one L'Oréal Narrative might assume emerging markets and ecommerce keep powering ahead to justify a fair value closer to €430, while a more cautious Narrative might focus on competition and consumer shifts and land nearer to €325, giving you a clear, story driven framework for your own analysis.

Do you think there's more to the story for L'Oréal? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal