Heineken (ENXTAM:HEIO): Revisiting Valuation After a Steady 6.8% One-Year Shareholder Return

Heineken Holding (ENXTAM:HEIO) has quietly outpaced the broader market over the past year, with the stock up about 7% as earnings and revenue continue to grow despite a mixed consumer backdrop.

See our latest analysis for Heineken Holding.

The latest move in the share price to around $61.25 comes after a steady 90 day share price return of 3.9%. The one year total shareholder return of 6.8% suggests solid but not explosive momentum as investors reassess its growth and defensive qualities.

If Heineken Holding has you rethinking your defensive and growth mix, this could be a good moment to explore fast growing stocks with high insider ownership and see what else is quietly gaining traction.

With earnings moving up and the shares still trading below analyst targets and intrinsic estimates, the key question now is whether Heineken Holding is quietly undervalued, or whether the market is already pricing in its future growth.

Most Popular Narrative: 42.8% Undervalued

With the narrative fair value set at €107 per share versus the last close of €61.25, the valuation view leans decisively toward upside potential.

Analysts are assuming Heineken Holding's revenue will grow by 4.1% annually over the next 3 years.

Analysts assume that profit margins will increase from 3.2% today to 9.3% in 3 years time.

Curious how modest top line growth could still justify such a large gap to today’s price, and why profitability expectations quietly transform the earnings outlook? The full narrative reveals the specific growth, margin and valuation steps behind that ambitious fair value, including the future earnings multiple it believes the market will ultimately accept.

Result: Fair Value of €107 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, hefty regulatory pressures and structural volume declines in mature beer markets could quickly erode the margin and growth optimism embedded in this narrative.

Find out about the key risks to this Heineken Holding narrative.

Another Angle on Valuation

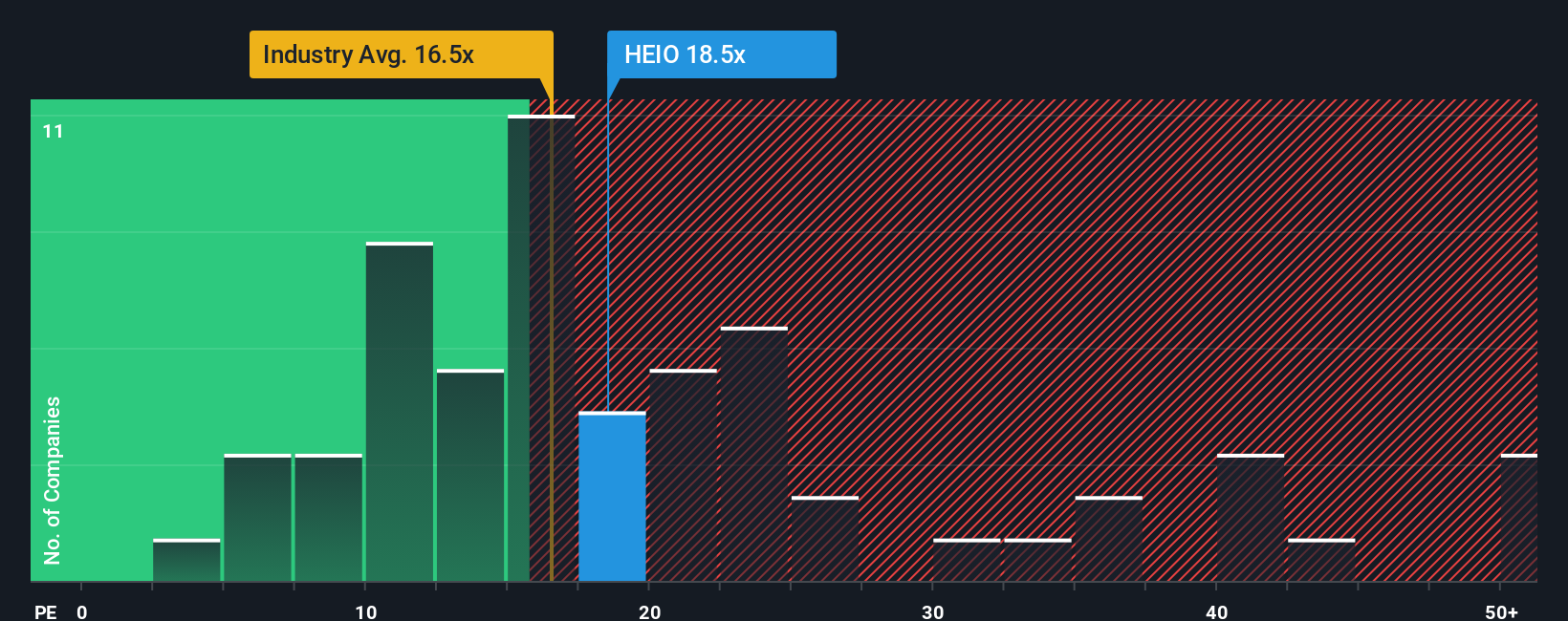

While the narrative fair value points to meaningful upside, the current price of 18.5 times earnings is actually richer than the European beverage average of 17 times, though still below a fair ratio of 22.4 times. Is the market being cautious, or just early?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heineken Holding Narrative

If this perspective does not quite align with your own, or you would rather dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Heineken Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put the market to work for you by using the Simply Wall St Screener to uncover opportunities most investors are still overlooking.

- Boost your hunt for mispriced opportunities by zeroing in on these 905 undervalued stocks based on cash flows that pair strong fundamentals with attractive entry points.

- Capture the next wave of innovation by focusing on these 25 AI penny stocks positioned at the crossroads of artificial intelligence and real-world applications.

- Strengthen your income strategy by targeting these 12 dividend stocks with yields > 3% that can support long term returns with consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal