Reassessing Ferrari (NYSE:RACE) Valuation After Recent Share Price Pullback

Ferrari (RACE) has quietly slipped about 13% over the past month and roughly 23% in the past 3 months, even as revenue and net income keep growing at mid single digit rates.

See our latest analysis for Ferrari.

Zooming out, the recent 1 month and 3 month share price pullback contrasts with a still strong 3 year total shareholder return. This suggests momentum has cooled, but the longer term Ferrari story remains intact.

If Ferrari’s recent slide has you reassessing the auto space, it could be a good moment to explore other auto manufacturers that might fit your strategy.

With earnings still climbing and the share price in reverse, investors now face a key question: is Ferrari trading at a rare discount to its luxury-growth potential, or is the market already pricing in every lap of future performance?

Most Popular Narrative: 19.4% Undervalued

Ferrari’s most followed narrative pegs fair value well above the last close of $367.96, pointing to upside if its premium growth thesis plays out.

The launch of six new models in 2025, including the anticipation of the Ferrari full electric, is likely to drive revenue growth, capturing both existing and new customers while expanding Ferrari's electrification journey.

Want to see the math behind this premium tag? The narrative leans on steady expansion in sales, fatter margins, and a future earnings multiple more often reserved for elite growth franchises. Curious how those moving parts combine into a higher fair value than today’s price suggests? Dive in to unpack the assumptions powering this long term outlook.

Result: Fair Value of $456.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on Ferrari avoiding brand dilution from an aggressive model rollout and navigating macro headwinds that could sap ultra luxury demand.

Find out about the key risks to this Ferrari narrative.

Another View: Market Multiples Flash a Warning

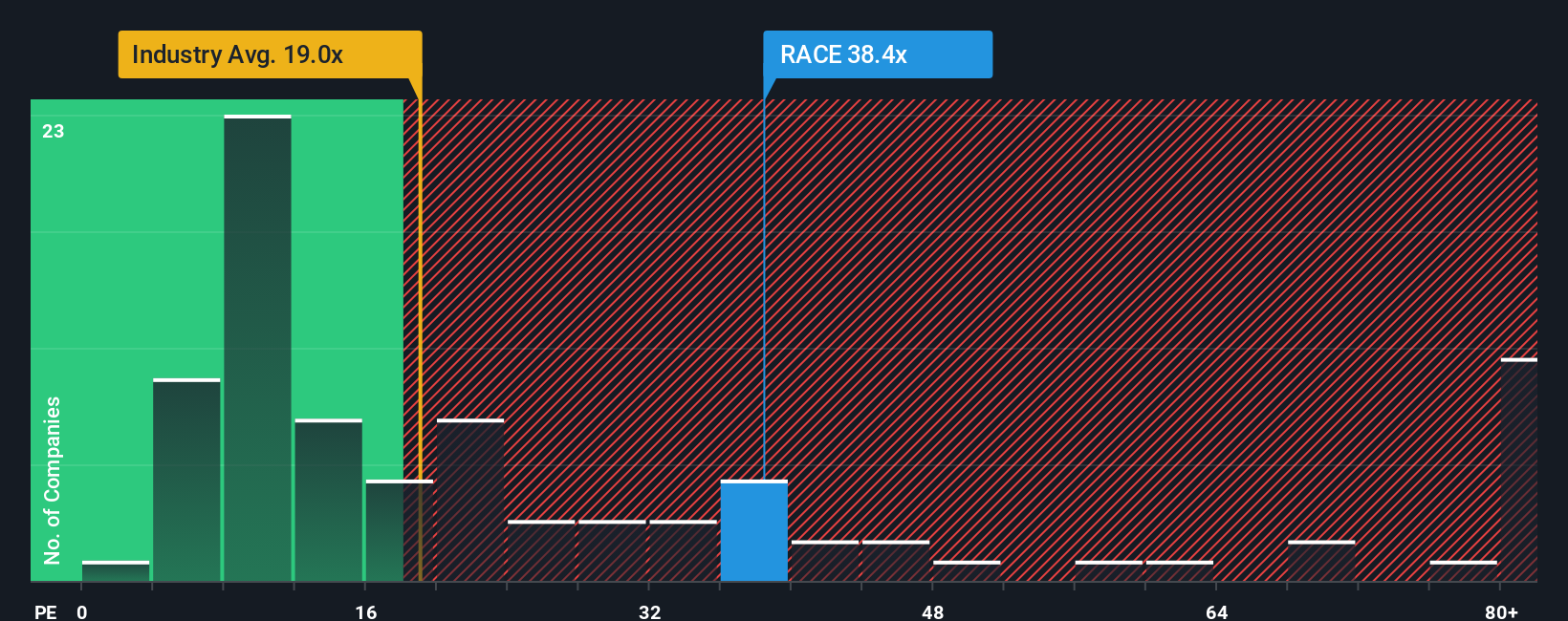

While the narrative points to upside, Ferrari’s current valuation looks stretched on earnings. The shares trade at about 34.8 times earnings versus 18.5 times for the global auto group and a fair ratio of 17.1 times. This implies meaningful downside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see the story differently or want to dig into the data on your own terms, you can craft a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ferrari.

Looking for more investment ideas?

Before you move on, lock in your next steps with focused stock ideas from Simply Wall St’s screener so you are never guessing where to look next.

- Target income first by reviewing these 12 dividend stocks with yields > 3% that aim to blend reliable payouts with solid business fundamentals.

- Tap into innovation by scanning these 25 AI penny stocks positioned at the forefront of artificial intelligence adoption and monetization.

- Sharpen your value hunt using these 905 undervalued stocks based on cash flows that may offer strong cash flow potential at prices the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal