Deutsche Bank (XTRA:DBK): Has the Share Price Rally Outrun Its Valuation?

Deutsche Bank (XTRA:DBK) has quietly turned into one of Europe’s stronger bank stock stories, with the share price nearly doubling over the past year and comfortably outpacing the wider financial sector.

See our latest analysis for Deutsche Bank.

That strength is not just a short burst either, with a near 94% year to date share price return and a roughly 300% five year total shareholder return signalling powerful momentum as markets reassess Deutsche Bank’s earnings power and risk profile.

If this kind of turnaround story has your attention, it could be worth seeing what else is setting up for a re rating by exploring fast growing stocks with high insider ownership.

With earnings rebounding and the share price already near or above analyst targets, is Deutsche Bank still trading below its intrinsic potential, or are investors now fully pricing in its turnaround and future growth?

Most Popular Narrative: 4.3% Overvalued

Based on the most followed narrative, Deutsche Bank’s fair value of roughly €31.27 sits just below the last close of €32.61, framing a tight valuation gap that hinges on specific growth and margin assumptions.

The bank's continued investment in digitalization and technology, combined with ongoing operational streamlining (such as branch closures and workforce reductions in the Private Bank), is unlocking cost savings and delivering improved efficiency. With €2.2 billion of targeted efficiency gains already secured, there is confidence in achieving further cost reductions through front to back process reengineering and digital transformation, which is supporting higher net margins and sustainable earnings improvement.

Want to see how modest revenue growth, rising margins and a trimmed share count combine to justify this price tag? The narrative’s math might surprise you.

Result: Fair Value of €31.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit losses or costly litigation setbacks could quickly undermine margin gains and challenge the assumption that earnings will continue to compound from this point forward.

Find out about the key risks to this Deutsche Bank narrative.

Another View: Multiples Point to Clear Value

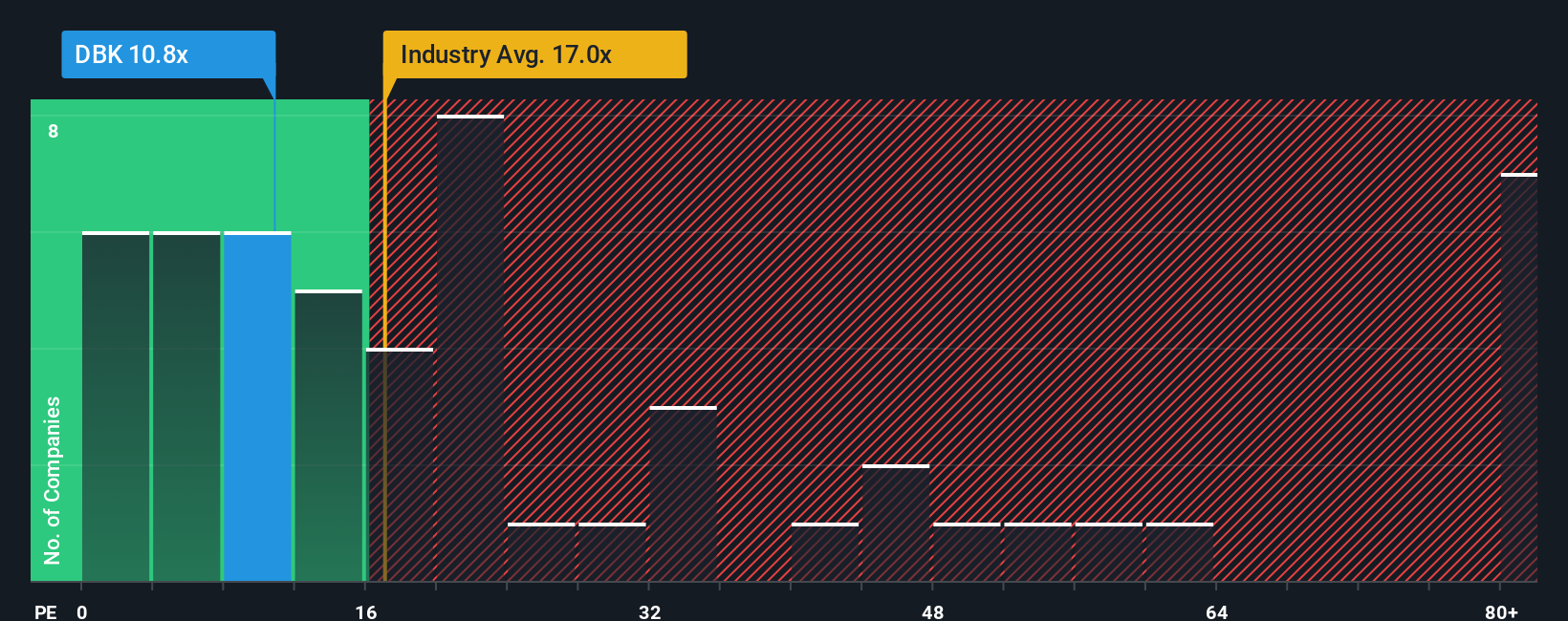

While the leading narrative has Deutsche Bank at about 4.3% overvalued on earnings forecasts, its current price to earnings ratio of 12.1x sits well below peers at 17.6x and a fair ratio of 25.1x. This suggests the market still discounts its recovery, or is it mispricing the risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deutsche Bank Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a full narrative in just minutes: Do it your way.

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at Deutsche Bank, put Simply Wall Street’s Screener to work so you do not miss other high conviction opportunities building under the surface.

- Explore potential growth opportunities by targeting early stage businesses using these 3609 penny stocks with strong financials with strong balance sheets and the capacity to compound over time.

- Position yourself within the productivity revolution by screening for companies that support intelligent automation through these 25 AI penny stocks.

- Enhance your portfolio’s income stream by focusing on established cash generators via these 12 dividend stocks with yields > 3% that seek to deliver attractive, sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal