ASX Penny Stocks To Consider In December 2025

As the Australian market shows signs of a potential rally to close out the year, investors are eyeing opportunities that extend beyond the major indices. Penny stocks, often associated with smaller or newer companies, continue to attract attention for their potential growth and value propositions. Despite being considered an outdated term by some, these stocks remain relevant as they can offer unique opportunities for those looking to explore under-the-radar investments with strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.475 | A$69.58M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$430.33M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.20 | A$236.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.76 | A$3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.935 | A$134.58M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.42 | A$634.71M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Dimerix (ASX:DXB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dimerix Limited is an Australian biopharmaceutical company focused on developing and commercializing pharmaceutical products for unmet medical needs, with a market cap of A$372.25 million.

Operations: The company generates revenue solely from the development of occupational drug testing devices and new therapeutic agents, amounting to A$5.59 million.

Market Cap: A$372.25M

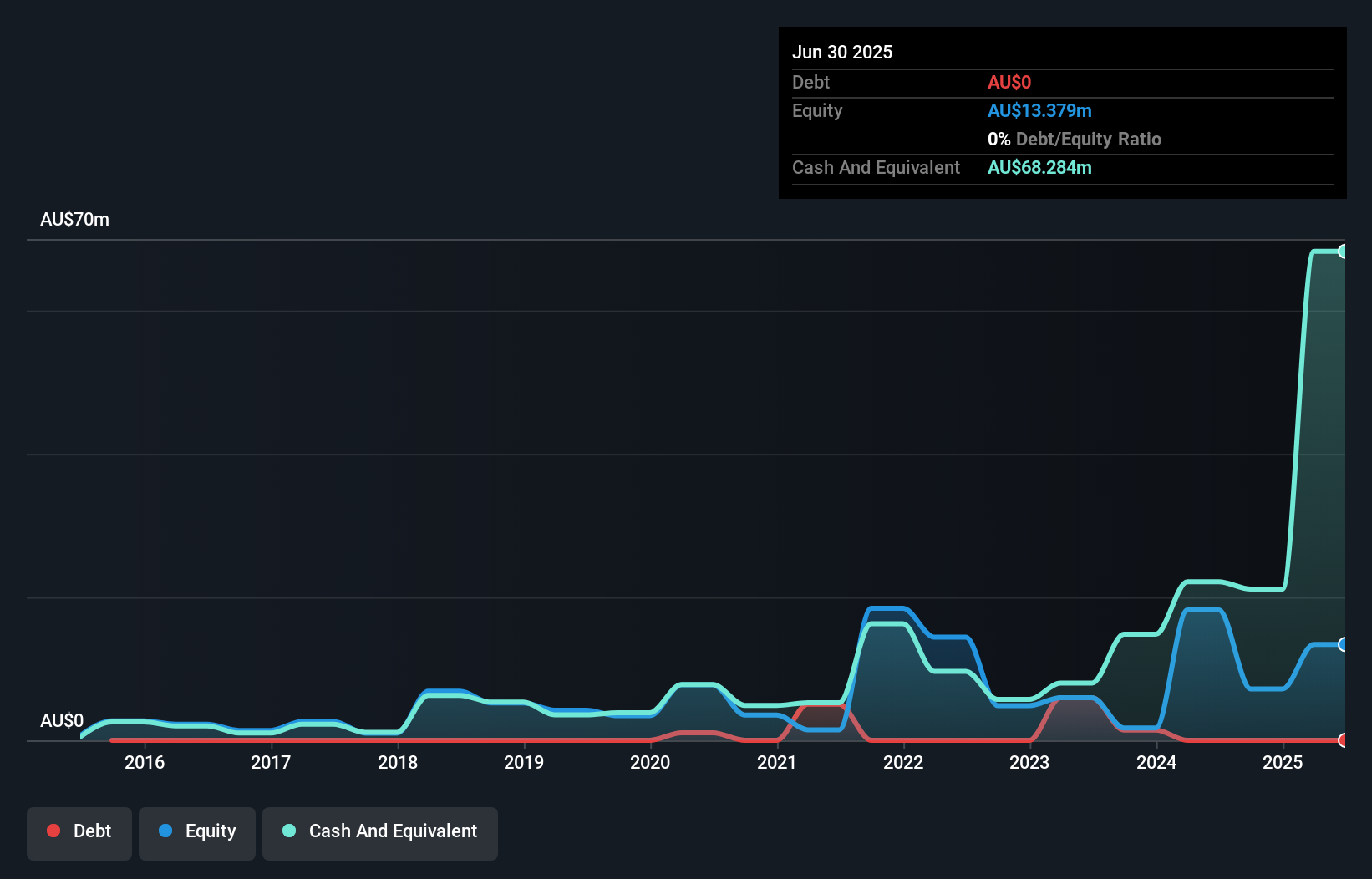

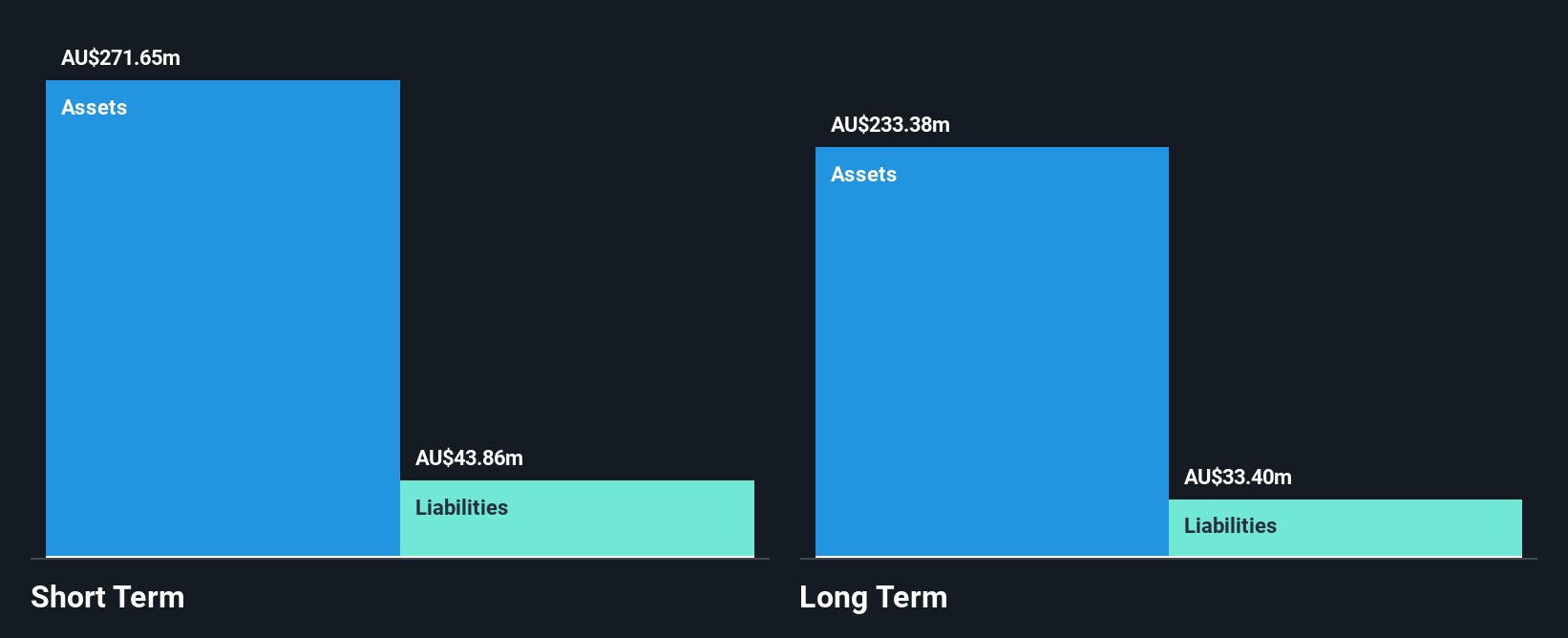

Dimerix Limited, an Australian biopharmaceutical company, is currently pre-revenue with its focus on developing pharmaceutical products for unmet medical needs. Despite being unprofitable, it maintains a robust financial position with no debt and sufficient cash runway extending over three years due to positive free cash flow. The company's board and management team are experienced, contributing to stable weekly volatility over the past year. Dimerix's short-term assets significantly exceed both its short- and long-term liabilities. Recent events include presentations at investment summits and discussions on strategic decisions at their annual general meeting.

- Click here and access our complete financial health analysis report to understand the dynamics of Dimerix.

- Gain insights into Dimerix's past trends and performance with our report on the company's historical track record.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production with a market cap of A$855.37 million.

Operations: The company's revenue is primarily derived from its 50% stake in the Renison Tin Operation, which generated A$271.38 million.

Market Cap: A$855.37M

Metals X Limited has demonstrated significant financial growth, with its net profit margins improving from 9.3% to 51.7% over the past year and earnings surging by a very large 708.2%, outpacing the industry average of 10.1%. The company benefits from its debt-free status, strong short-term assets (A$312.7M) covering both short- and long-term liabilities, and a seasoned management team with an average tenure of five years. Despite these strengths, future earnings are forecasted to decline by an average of 27.5% annually over the next three years, which may affect overall valuation prospects despite current good relative value indicators like a low price-to-earnings ratio (6.1x).

- Take a closer look at Metals X's potential here in our financial health report.

- Assess Metals X's future earnings estimates with our detailed growth reports.

Neurizon Therapeutics (ASX:NUZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neurizon Therapeutics Limited, with a market cap of A$64.16 million, is a clinical stage biotechnology company focused on developing therapeutics for neurodegenerative diseases.

Operations: Neurizon Therapeutics generates revenue primarily from its Corporate & Research segment, amounting to A$1.54 million.

Market Cap: A$64.16M

Neurizon Therapeutics Limited, with a market cap of A$64.16 million, is navigating its clinical stage as a pre-revenue biotechnology company focused on neurodegenerative therapeutics. Recent developments include the FDA lifting the clinical hold on its lead drug NUZ-001, paving the way for Phase 2/3 trials and potentially accelerating patient access to treatments. The company's financials reveal short-term assets of A$4.4 million exceeding liabilities and a debt-free status, though it faces challenges with an inexperienced management team and limited cash runway despite recent capital raising efforts totaling A$5.2 million through equity offerings.

- Click here to discover the nuances of Neurizon Therapeutics with our detailed analytical financial health report.

- Evaluate Neurizon Therapeutics' historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 424 ASX Penny Stocks here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal