Lennox International (LII): Assessing Valuation After a Recent Short-Term Share Price Rebound

Lennox International (LII) has quietly outperformed the broader market over the past month, even as the stock remains well below its highs from earlier this year and the past year.

See our latest analysis for Lennox International.

That recent 5.6% 1 month share price return looks more like a short term bounce within a weaker trend, with the year to date share price still well down and the 1 year total shareholder return negative despite a strong multi year track record.

If Lennox’s moves have you reassessing the sector, it could be a good moment to scout other established industrial names, including aerospace and defense stocks.

With earnings still growing, a decade long track record of strong returns and the stock trading below analyst targets, is Lennox now quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 9.9% Undervalued

With Lennox last closing at 514.86 dollars versus a narrative fair value near 571 dollars, the story leans toward upside and sets up a key growth driver.

Investments in digital platforms, AI-based pricing tools, and proprietary data analytics are enabling Lennox to optimize pricing, streamline dealer interactions, and maintain premium pricing power, supporting higher net margins and recurring revenue as digital adoption in the HVAC market accelerates.

Curious how steady mid single digit growth, rising margins, and a richer future earnings multiple can still justify upside from here? Unpack the full playbook behind this valuation.

Result: Fair Value of $571.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer residential demand and persistent inflation could pressure Lennox’s pricing power and margins and challenge the upbeat growth and valuation narrative.

Find out about the key risks to this Lennox International narrative.

Another Angle on Valuation

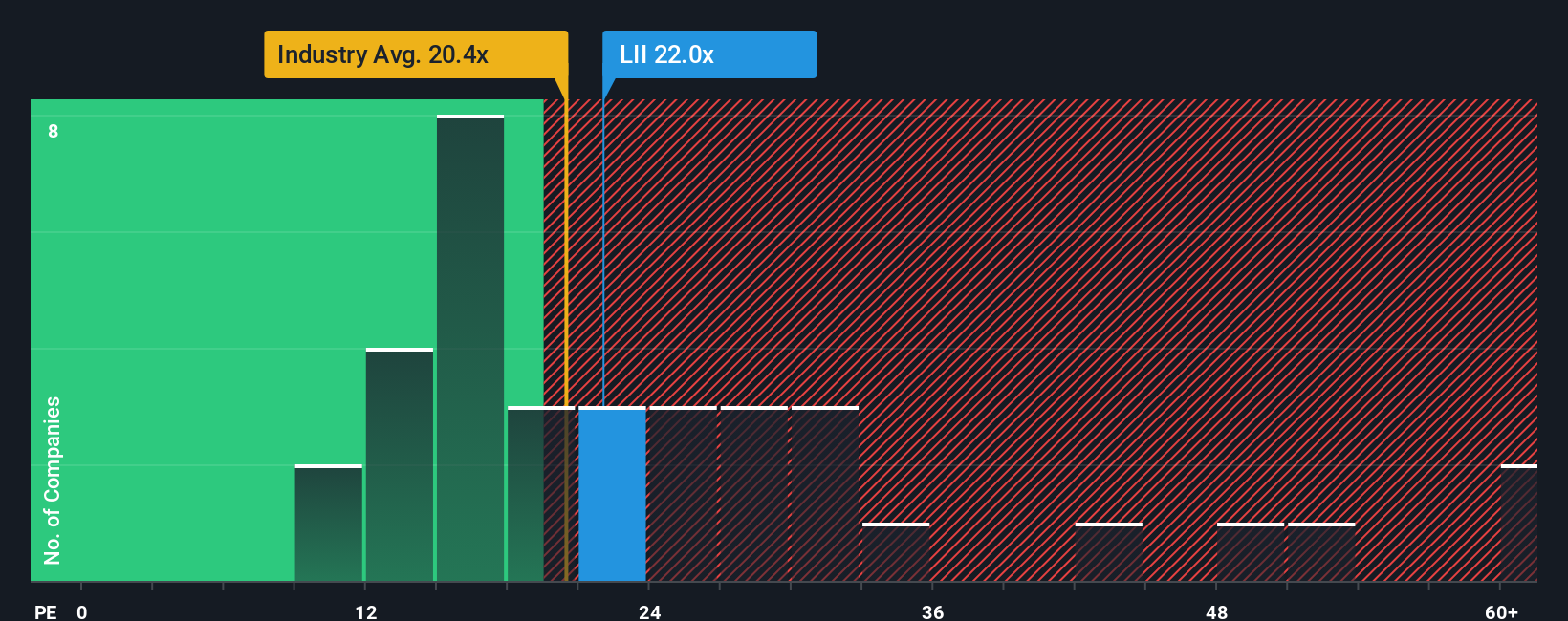

On earnings, Lennox looks pricey today, trading on a 21.5 times price to earnings ratio versus 19.8 times for the US Building industry and 20.6 times for peers, yet still below a 24.5 times fair ratio. Is this a margin of safety or a warning that expectations are already rich?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lennox International Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom perspective in just minutes, Do it your way.

A great starting point for your Lennox International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Make your research count by using the Simply Wall Street Screener to uncover focused opportunities that match your strategy before the market fully catches on.

- Capture potential mispricing by targeting these 907 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Ride powerful secular trends by zeroing in on these 25 AI penny stocks positioned at the heart of the AI transformation.

- Strengthen your income strategy by screening for these 11 dividend stocks with yields > 3% that can support more reliable long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal