Yun Lee Marine Group Holdings' (HKG:2682) Earnings May Just Be The Starting Point

Yun Lee Marine Group Holdings Limited (HKG:2682) just reported healthy earnings but the stock price didn't move much. Our analysis suggests that investors might be missing some promising details.

Zooming In On Yun Lee Marine Group Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

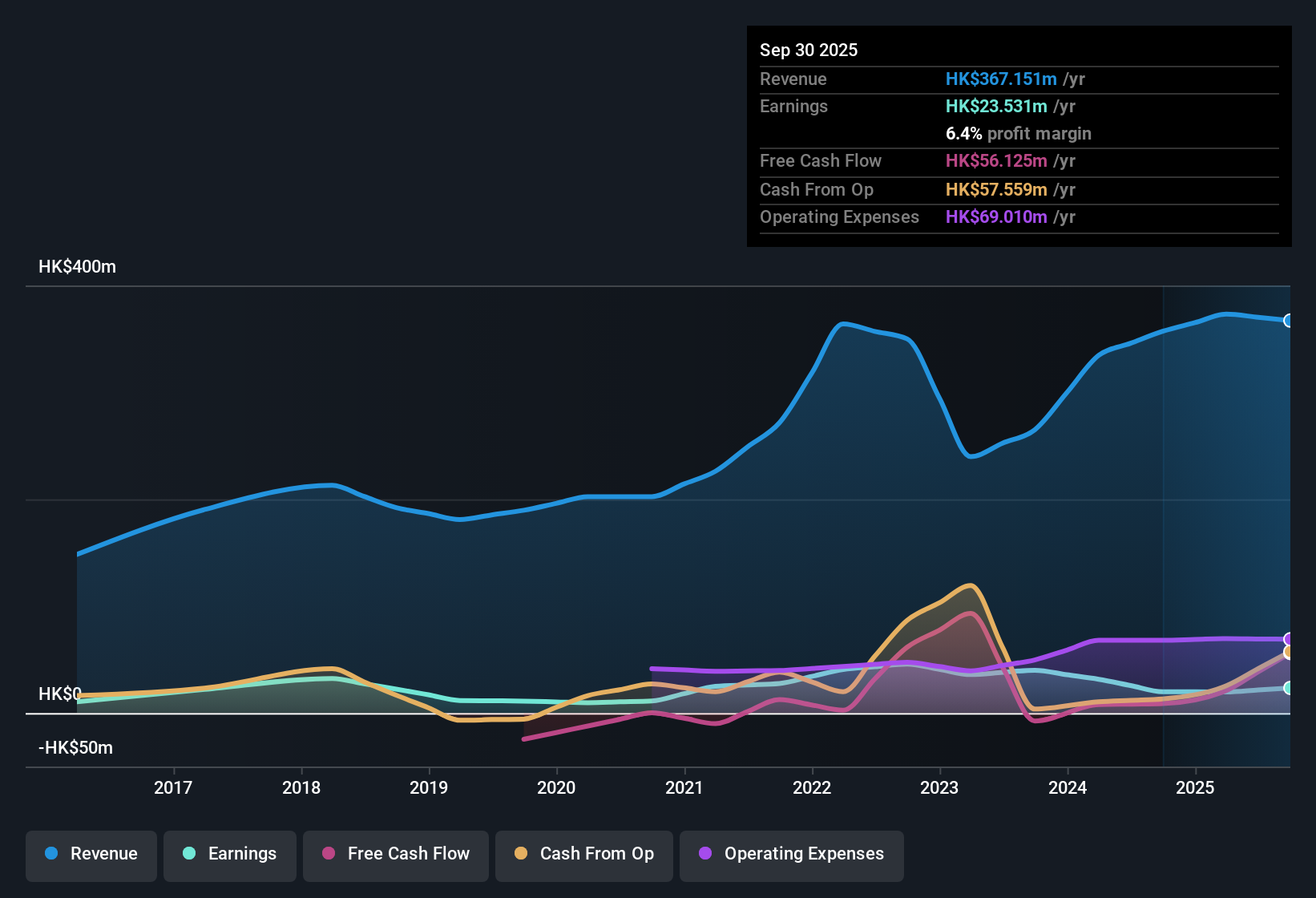

Yun Lee Marine Group Holdings has an accrual ratio of -0.14 for the year to September 2025. That indicates that its free cash flow was a fair bit more than its statutory profit. In fact, it had free cash flow of HK$56m in the last year, which was a lot more than its statutory profit of HK$23.5m. Yun Lee Marine Group Holdings shareholders are no doubt pleased that free cash flow improved over the last twelve months. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

View our latest analysis for Yun Lee Marine Group Holdings

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yun Lee Marine Group Holdings.

How Do Unusual Items Influence Profit?

While the accrual ratio might bode well, we also note that Yun Lee Marine Group Holdings' profit was boosted by unusual items worth HK$2.3m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. If Yun Lee Marine Group Holdings doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Yun Lee Marine Group Holdings' Profit Performance

In conclusion, Yun Lee Marine Group Holdings' accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Considering the aforementioned, we think that Yun Lee Marine Group Holdings' profits are probably a reasonable reflection of its underlying profitability; although we'd be confident in that conclusion if we saw a cleaner set of results. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 3 warning signs for Yun Lee Marine Group Holdings (of which 1 doesn't sit too well with us!) you should know about.

Our examination of Yun Lee Marine Group Holdings has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal