Is Intuitive Surgical Still Attractive After Strong Multi Year Gains and Rich Valuation Metrics?

- If you have been wondering whether Intuitive Surgical is still worth buying at these levels, you are not alone. This breakdown is designed to help you decide with numbers, not hype.

- The stock has cooled off recently, down about 2.4% over the last week and 3.5% over the last month, but it is still up 6.1% year to date and 98.1% over three years and 117.7% over five years.

- Those moves sit against a backdrop of steady demand for robotic assisted surgery systems, with hospitals continuing to expand their programs and regulators generally supportive of minimally invasive procedures. Ongoing product innovation and procedural growth expectations have kept sentiment constructive, even as investors debate how much future upside is already priced in.

- Despite all of that enthusiasm, Intuitive Surgical currently scores just 0/6 on our valuation checks. We will walk through multiple ways of valuing the stock, then finish with a more holistic way to think about what the market might really be paying for. Analyst Price Targets don't always capture the full story. Head over to our Company Report to find new ways to value Intuitive Surgical.

Intuitive Surgical scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, DCF, model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back into today’s dollars. For Intuitive Surgical, the latest twelve month free cash flow is about $1.90 billion, and analysts expect this to rise steadily as procedure volumes increase and installed systems grow.

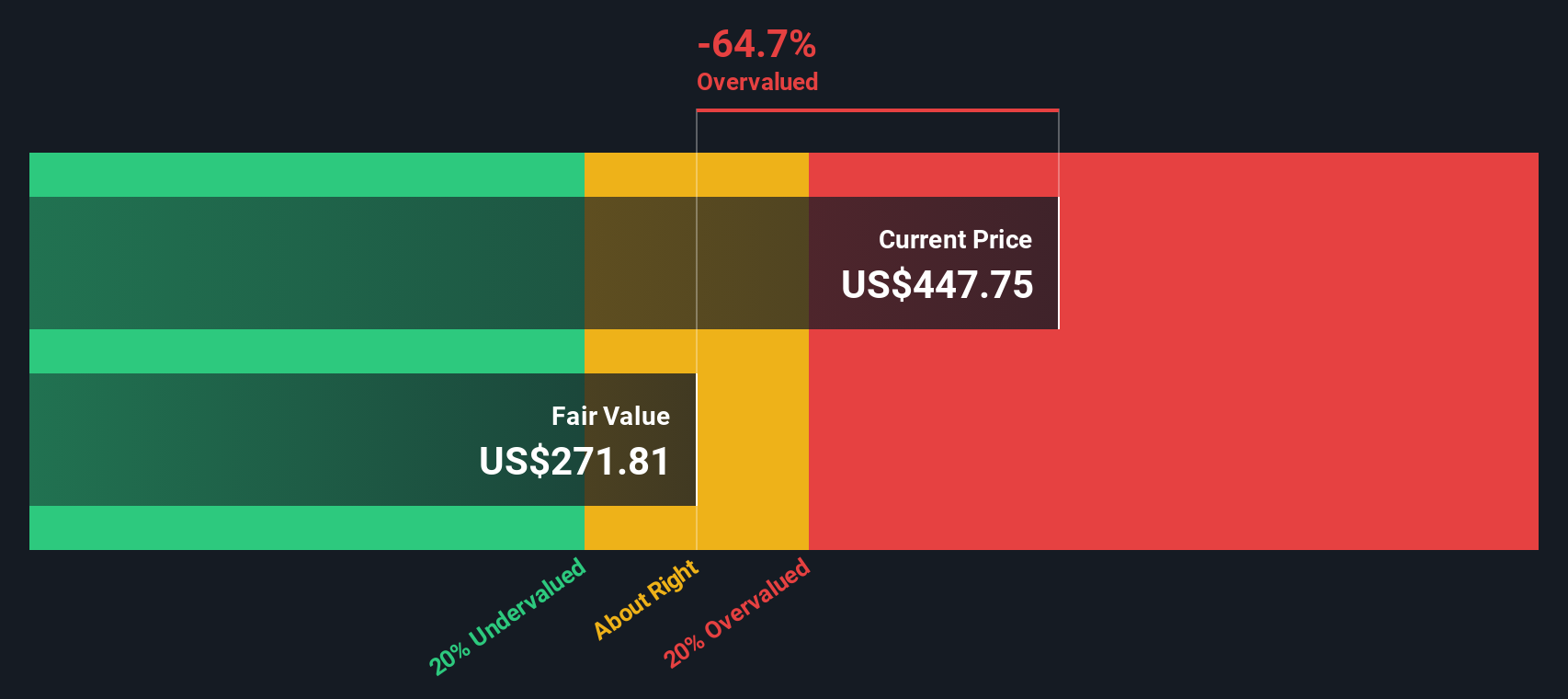

The current model uses a 2 Stage Free Cash Flow to Equity approach. It combines analyst estimates for the next few years with Simply Wall St extrapolations thereafter. On this basis, projected free cash flow reaches roughly $5.31 billion by 2029 and continues to climb through 2035, with each future cash flow discounted back into today’s value in $. When all those discounted cash flows are added together and divided by the number of shares, the implied fair value is around $329.75 per share.

Compared with the current market price, this DCF points to the stock trading at about a 68.6% premium, suggesting it is significantly overvalued on cash flow fundamentals alone.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 68.6%. Discover 909 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intuitive Surgical Price vs Earnings

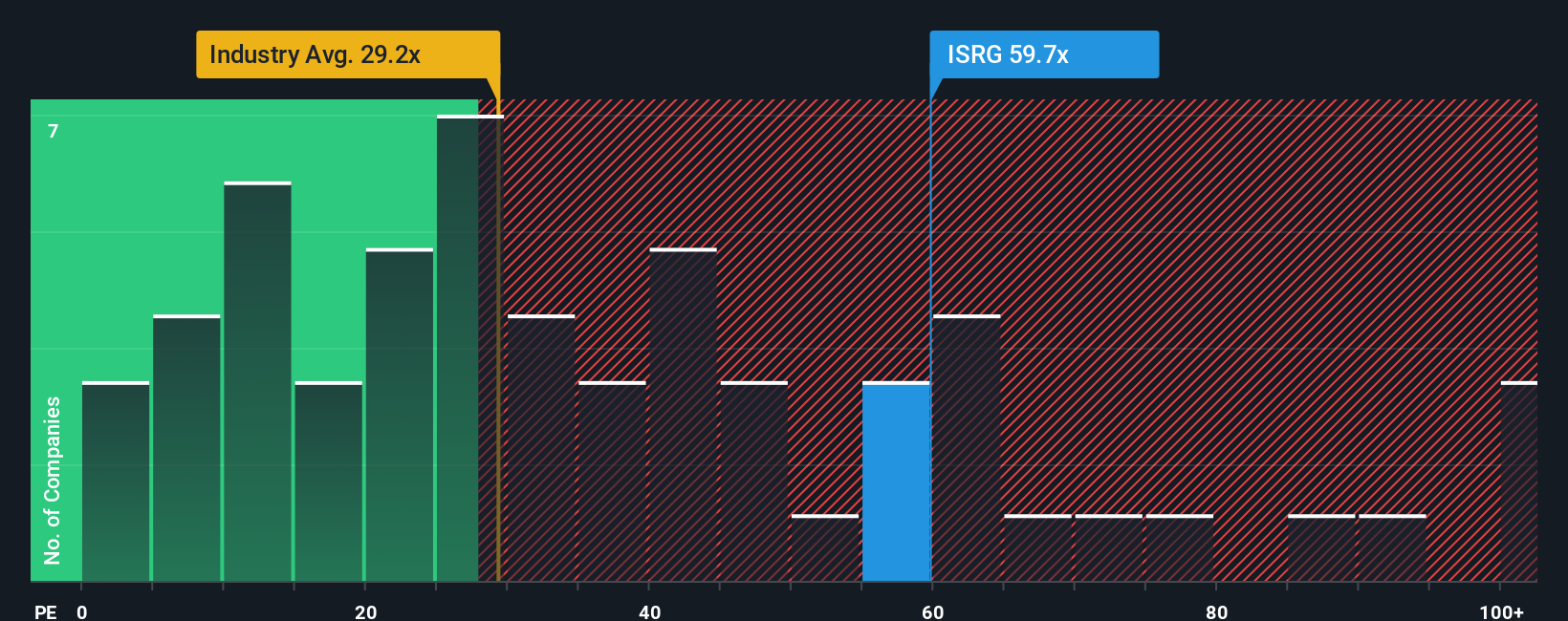

For profitable companies like Intuitive Surgical, the price to earnings, PE, ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current profits. In general, faster earnings growth and lower perceived risk justify a higher, or more expensive, PE multiple, while slower growth or higher uncertainty should translate into a lower, or cheaper, multiple.

Intuitive Surgical currently trades on a PE of about 71.74x, which is more than double the Medical Equipment industry average of roughly 29.65x and well above the peer group average of around 34.41x. That already signals a rich valuation relative to many comparable names.

Simply Wall St’s Fair Ratio framework goes a step further by estimating the PE multiple the market might reasonably pay given Intuitive Surgical’s specific mix of earnings growth, profitability, industry positioning, market cap and risk profile. For Intuitive Surgical, this Fair Ratio comes out at about 38.71x. Because it is tailored to the company rather than just benchmarking against broad industry or peer averages, it offers a more nuanced view of what “fair value” looks like. With the actual PE of 71.74x sitting well above the 38.71x Fair Ratio, the shares look expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story to a set of numbers such as future revenue, earnings, margins and ultimately a fair value estimate. A Narrative on Simply Wall St’s Community page captures your perspective on how and why a business will grow, then links that story to a structured financial forecast and a resulting fair value per share. Because the platform is used by millions of investors, you can easily compare different Narratives, see how each one’s fair value stacks up against today’s market price, and decide whether a stock looks like a buy, hold or sell under assumptions you actually believe. Narratives are also dynamic, automatically updating as new earnings, news or guidance come in, so your story and fair value stay current without you needing to rebuild a model from scratch. For example, some Intuitive Surgical Narratives currently point to fair values near $325 while others sit closer to $600, reflecting how different, reasonable stories about growth and risk can lead to very different conclusions about whether the stock is attractive at its current price.

For Intuitive Surgical however we will make it really easy for you with previews of two leading Intuitive Surgical Narratives:

🐂 Intuitive Surgical Bull Case

Fair value: $596.36

Implied undervaluation vs last close: -6.8%

Forecast revenue growth: 13.47%

- Analysts expect mid teens annual revenue growth and only slight margin pressure, supported by strong global procedure expansion, a growing installed base, and rising system utilization.

- New products like da Vinci 5, AI enabled digital tools, and broader adoption across more procedures and geographies are expected to reinforce Intuitive Surgical's competitive moat and recurring revenue strength.

- The bullish view assumes that regulatory and payer support for robotic assisted surgery continues to deepen, offsetting risks from tariffs, reimbursement shifts, and international budget constraints.

🐻 Intuitive Surgical Bear Case

Fair value: $400.91

Implied overvaluation vs last close: 38.7%

Forecast revenue growth: 12.02%

- This more cautious Narrative sees Intuitive Surgical as an excellent business but argues that the stock price embeds overly optimistic cash flow assumptions, resulting in modest prospective returns from current levels.

- The author highlights how the high valuation leaves little room for disappointment if free cash flow or procedure growth underperforms, especially given broader MedTech volatility and sector headwinds.

- Even with a resilient recurring revenue model and powerful moat, the bear case suggests patient investors may prefer to wait for a pullback closer to fair value before adding exposure.

Do you think there's more to the story for Intuitive Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal