Assessing BWX Technologies (BWXT) Valuation After Major Nuclear Contract Win and Project Pele Fuel Delivery

BWX Technologies (BWXT) just stacked two meaningful wins: a long term Owner's Engineer role on Bulgaria's Kozloduy nuclear expansion and delivery of TRISO fuel for the U.S. Project Pele microreactor, and investors are paying attention.

See our latest analysis for BWX Technologies.

These wins come after a powerful run, with BWX Technologies’ share price delivering a year to date return of 61.15 percent and a three year total shareholder return of 210.11 percent, suggesting momentum is still firmly on the side of the bulls.

If this kind of defense linked nuclear growth story interests you, it could be worth exploring other opportunities across aerospace and defense stocks to see what else fits your strategy.

With revenue and earnings still growing double digits and the stock trading about 23 percent below analyst targets but well above some intrinsic estimates, is BWX Technologies a fresh buying opportunity, or is the market already banking on years of nuclear growth?

Most Popular Narrative Narrative: 18.3% Undervalued

BWX Technologies last closed at $179.65, while the narrative fair value of $220.00 points to meaningful upside if its long term growth thesis plays out.

With over 80% of revenues coming from government operations, BWXT is set to maintain, if not grow, its revenue from government spending and contracts issued by the current administration. Building on government contracts and spending, BWXT continues the expansion of commercial operations with the help of the Kinectrics acquisition, and increases in demand for medical isotopes only add bonus points to its revenue diversification.

Curious how this story arrives at a premium price tag? The narrative leans on accelerating top line growth, rising margins and a bold future earnings multiple. Want to see how those moving parts stack together into that valuation call?

Result: Fair Value of $220.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained defense budget pressure or renewed regulatory backlash against nuclear could quickly derail growth assumptions and compress the valuation narrative.

Find out about the key risks to this BWX Technologies narrative.

Another View: Rich on Earnings

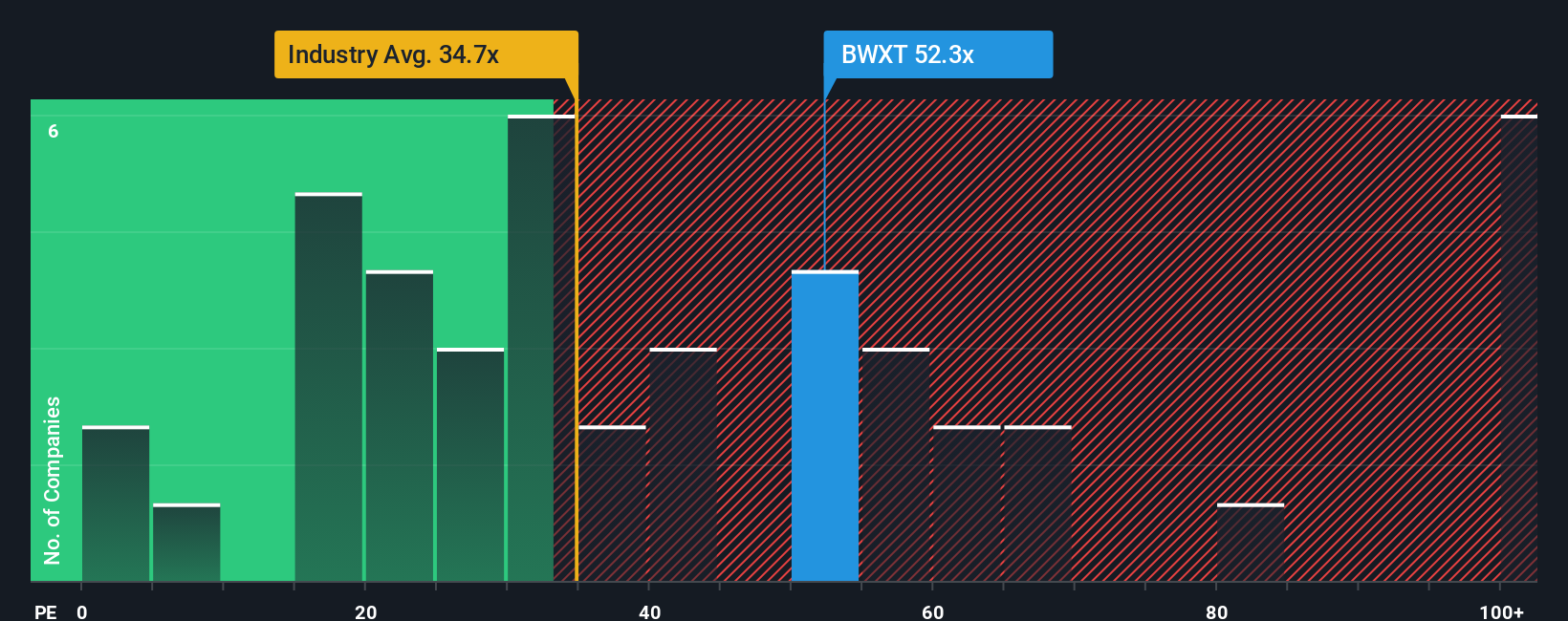

Looking at valuation through earnings, BWX Technologies trades on a 53.5 times price to earnings ratio, versus a 30.4 fair ratio, 36.7 for the Aerospace and Defense industry and 34.5 for peers, which signals a steep premium. Is the market overpaying for this nuclear growth runway?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

If you are not fully convinced by this view, or simply prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your BWX Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities with the Simply Wall Street Screener so you are not relying on just one story.

- Capture value by targeting companies trading below intrinsic estimates through these 909 undervalued stocks based on cash flows that highlight strong cash flow potential.

- Ride structural shifts in healthcare by zeroing in on innovators powered by smart algorithms using these 30 healthcare AI stocks.

- Strengthen your income stream by focusing on reliable payouts with these 12 dividend stocks with yields > 3% that can help anchor your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal