Kite Realty Group Trust (KRG): Reassessing Valuation After Major Asset Sales and Capital Reallocation Strategy

Kite Realty Group Trust (KRG) just wrapped up roughly $474 million of property sales, mainly large format retail centers, and is recycling that cash into new assets, buybacks, debt reduction, and possibly a special dividend.

See our latest analysis for Kite Realty Group Trust.

Despite that decisive reshaping of the portfolio, Kite Realty Group Trust’s share price has drifted lower year to date, with a negative 1 year total shareholder return. However, a strong 5 year total shareholder return suggests longer term momentum is still intact.

If this kind of repositioning has you rethinking where the next durable returns might come from, it could be worth exploring fast growing stocks with high insider ownership.

Yet with Kite Realty Group Trust trading below both analyst targets and some intrinsic value estimates, investors are left wondering if today’s weakness reflects an overlooked bargain or whether the market already anticipates the next leg of growth.

Most Popular Narrative: 12.4% Undervalued

With the narrative fair value at $26 against a last close of $22.78, the current gap frames a bolder long term rerating story.

Strong leasing momentum, evidenced by record high leasing spreads (17% blended, 36.6% anchor new leases), embedded escalators, and sustained increases in small shop lease rates, signals significant mark to market potential and points to accelerating future revenue and cash flow growth as new tenant commencements ramp up in 2026 and 2027.

Curious how modest revenue growth, thinner margins and a punchy future earnings multiple can still add up to upside from here? The narrative connects those moving parts into one aggressive valuation roadmap. Want to see exactly how that forecasted earnings path underpins a higher fair value than today’s price?

Result: Fair Value of $26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering exposure to bankrupt anchors, along with higher-for-longer interest costs, could delay rent commencements and compress margins, challenging the upbeat rerating case.

Find out about the key risks to this Kite Realty Group Trust narrative.

Another Angle on Value

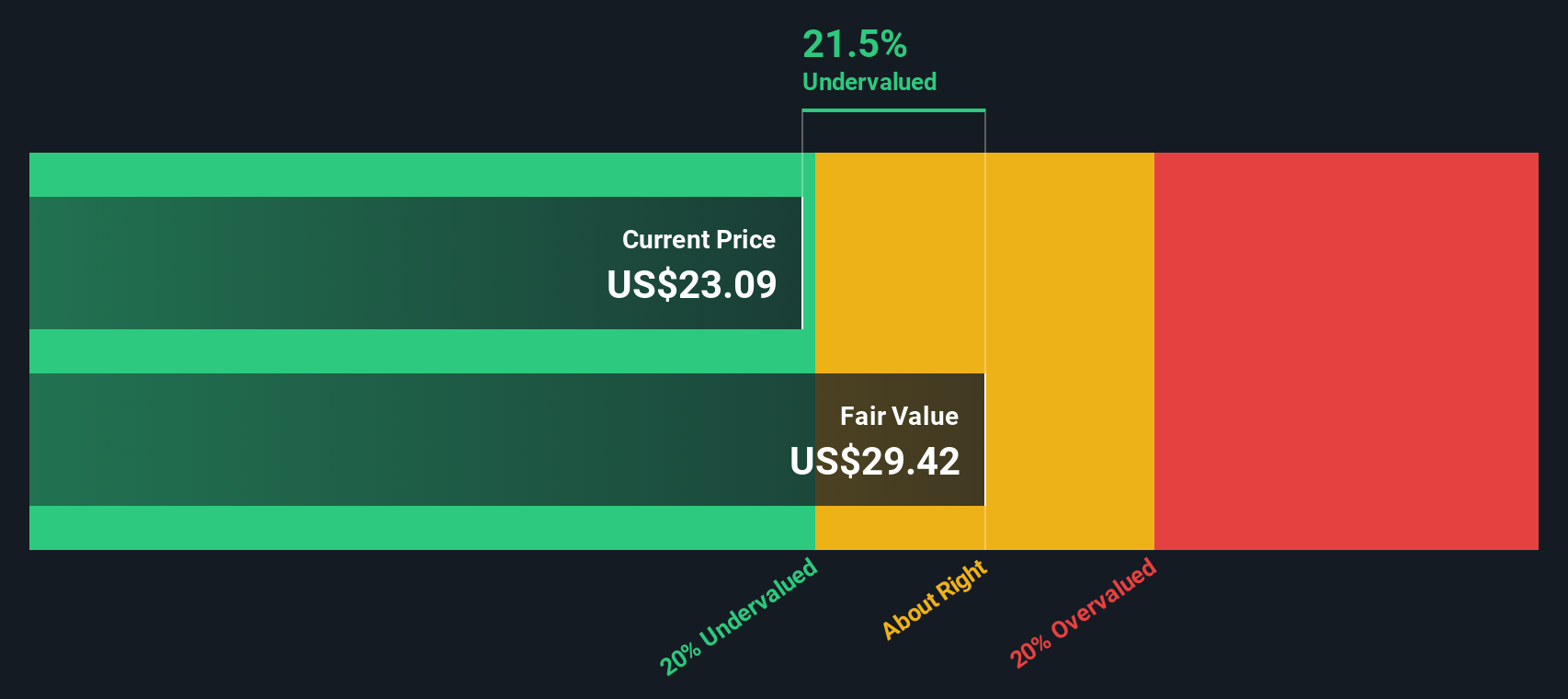

Our SWS DCF model suggests Kite Realty Group Trust is trading at a meaningful discount to its estimated fair value of $29.42 per share, even as earnings are forecast to decline. That points to upside if cash flows prove resilient. However, how comfortable are you backing falling earnings for a value payoff?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kite Realty Group Trust Narrative

If you see the story differently or want to stress test the assumptions with your own data, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Kite Realty Group Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more high conviction opportunities?

Before you wrap up your research, lock in an edge by scanning hand picked stock ideas on Simply Wall Street’s Screener, tailored to specific themes and strategies.

- Capture potential value rebounds by targeting companies trading below intrinsic worth using these 909 undervalued stocks based on cash flows that highlight mispriced cash flow opportunities.

- Position yourself for structural tailwinds in medical innovation by reviewing these 30 healthcare AI stocks tapping into smarter diagnostics and data driven treatments.

- Boost your income stream by scanning these 12 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal