Brown & Brown (BRO): Reassessing Valuation After a Recent Share Price Pullback

Brown & Brown (BRO) has quietly slipped this year, with the stock down around 23% year to date even as the business continues to post double digit revenue and earnings growth. So what is the market missing?

See our latest analysis for Brown & Brown.

The recent slide in Brown & Brown’s share price, with a roughly 23% year to date share price decline to around $77.51, contrasts sharply with a solid three year total shareholder return of about 36%. This suggests long term momentum remains intact even as short term sentiment cools.

If this pullback has you thinking about where else growth and conviction might line up, it could be a good time to explore fast growing stocks with high insider ownership.

With double digit growth but a sharp share price pullback and a modest discount to analyst targets, is Brown & Brown now trading below its true worth, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 17.1% Undervalued

With Brown & Brown last closing at $77.51 against a narrative fair value of about $93.50, the current weakness sits at the heart of a valuation gap.

The company's effective cost management and debt repayment strategies have led to reduced interest expenses and an improved EBITDAC margin by 110 basis points. This focus on managing financial liabilities could enhance future net margins and earnings.

Want to see how strong growth, steady margins, and a premium future earnings multiple could all align with a much higher price tag? The narrative explains revenue projections, profit trajectory, and a valuation framework that treats Brown & Brown as a structural compounder rather than a typical insurer. Curious which assumptions would need to hold for that gap to close?

Result: Fair Value of $93.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro and regulatory risks, from softer CAT property pricing to shifting Florida insurance reforms, could easily derail the bullish growth narrative.

Find out about the key risks to this Brown & Brown narrative.

Another View: Market Ratios Point to Caution

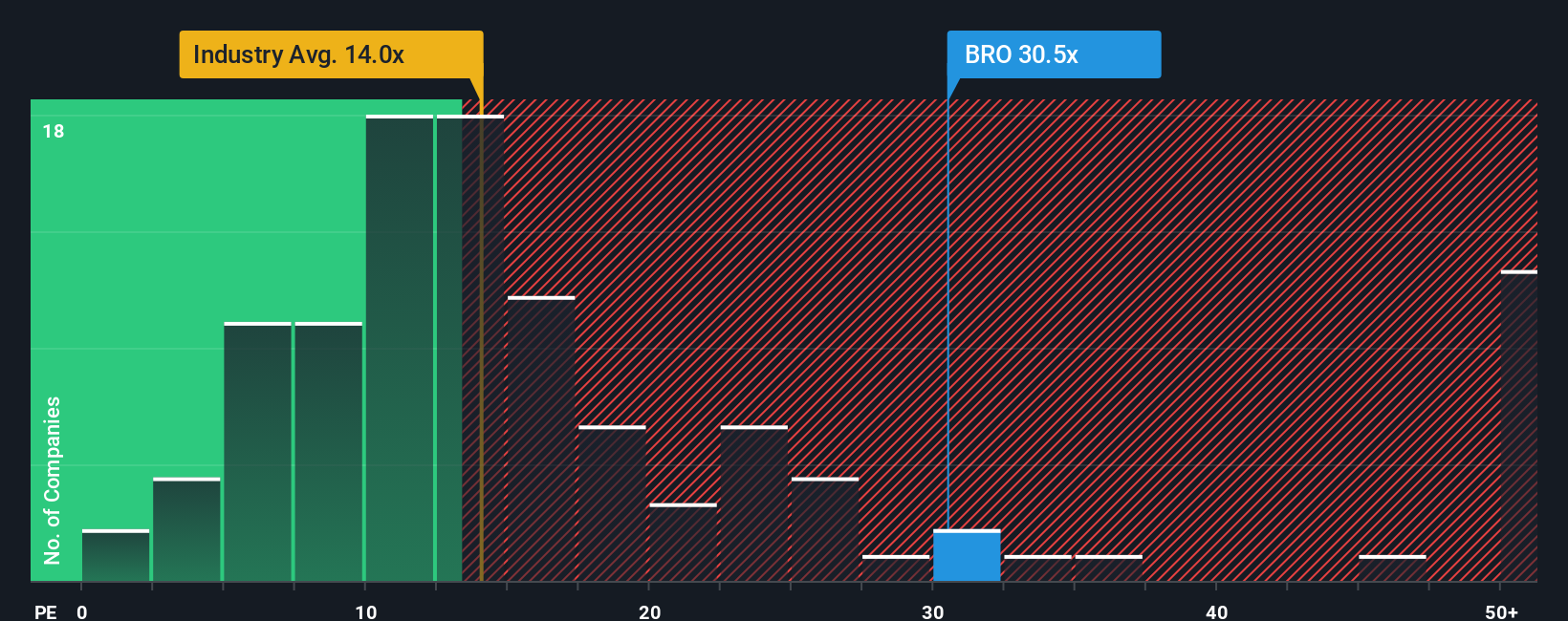

While the narrative fair value suggests upside, our ratio based lens sends a cooler message. On today’s numbers, Brown & Brown trades on 26.8 times earnings versus a fair ratio of 16.9 times and a US insurance industry average of about 13.1 times. This implies investors are already paying a steep premium that could unwind if growth or sentiment slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brown & Brown Narrative

If you would rather stress test the assumptions or dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Brown & Brown research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities on Simply Wall Street’s screener, where high potential ideas are already filtered for you.

- Lock in potential income streams by targeting reliable payers through these 12 dividend stocks with yields > 3% with yields that stand out from the broader market.

- Capitalize on innovation at the frontier of medicine and automation by focusing on these 30 healthcare AI stocks shaping tomorrow’s healthcare landscape.

- Seize pricing mismatches by zeroing in on these 909 undervalued stocks based on cash flows that look cheap relative to their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal