WESCO International (WCC): Valuation Check After Governance-Focused Board Refresh and New Independent Directors

WESCO International, Inc. is refreshing its board with two new independent directors, Michael L. Carter and David C. Wajsgras, a governance move that could subtly shape strategy and capital allocation over time.

See our latest analysis for WESCO International.

The board refresh comes as WESCO’s $276.98 share price sits on the back of a strong run, with a 90 day share price return of 25.61 percent and a five year total shareholder return of 272.01 percent suggesting momentum is still very much intact.

If this kind of sustained rally has you thinking about what else is working in the market, it may be worth exploring fast growing stocks with high insider ownership for more ideas that combine growth potential with aligned insiders.

With shares trading near record highs, modest upside to analyst targets and healthy profit growth, the key question now is whether WESCO still trades at a discount to its fundamentals or if the market has already priced in its next leg of growth.

Price-to-Earnings of 21.3x: Is it justified?

On a price-to-earnings basis, WESCO trades at 21.3 times earnings, a modest premium to both peers and its broader US trade distributor group.

The price-to-earnings ratio compares the company’s current share price with its per share earnings, making it a direct snapshot of how much investors are paying for each dollar of current profit. For a mature, cash generative distributor like WESCO, it is a core yardstick of how the market is valuing its earnings power today.

WESCO’s current multiple is slightly higher than the peer average of 20.6 times. This implies investors are paying more for its track record of 5 year earnings growth and expectations that profits will continue to rise at a solid, if not spectacular, double digit pace. At the same time, our SWS DCF model suggests the stock is trading about 4 percent below an estimated fair value of 288.4 dollars, and the fair price-to-earnings ratio implied by that work is a much higher 28.9 times, a level the market could move towards if growth and margins deliver as expected.

Compared with the wider US trade distributors industry average price-to-earnings of 19.5 times, WESCO’s richer multiple underlines that the market already distinguishes it from the pack and sees above average quality and resilience in its earnings stream. Yet when set against the estimated fair price-to-earnings of 28.9 times, that premium still looks restrained rather than excessive.

Explore the SWS fair ratio for WESCO International

Result: Price-to-Earnings of 21.3x (UNDERVALUED)

However, WESCO’s valuation case could be challenged by slowing industrial demand or execution missteps in large utility and broadband projects, which could pressure margins and earnings growth.

Find out about the key risks to this WESCO International narrative.

Another Angle on Valuation

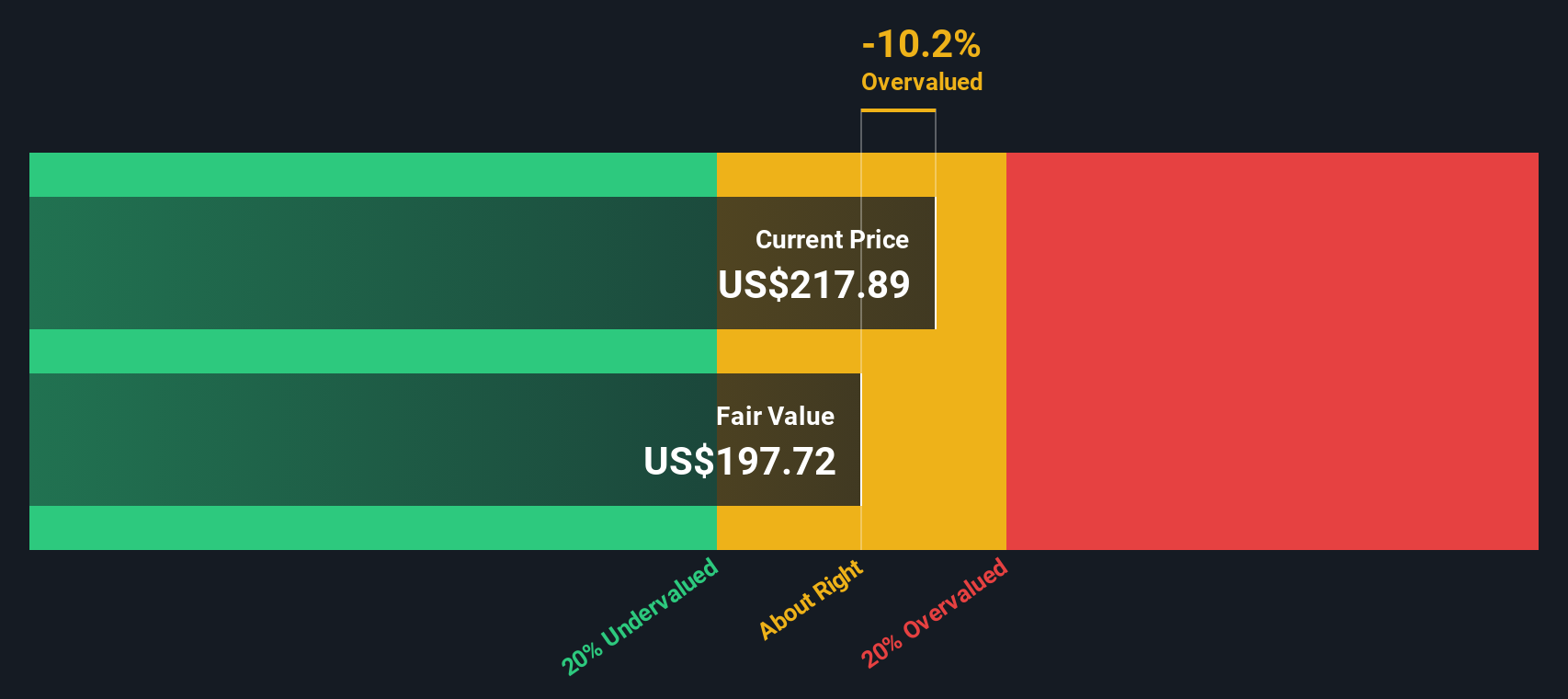

Our SWS DCF model paints a slightly different picture, putting fair value at 288.4 dollars, about 4 percent above today’s 276.98 dollar price, which again points to mild undervaluation. If both earnings multiples and cash flows say there is still upside, what could derail that case?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WESCO International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WESCO International Narrative

If you would rather dig into the numbers yourself and shape your own view, you can build a personalised thesis in just a few minutes: Do it your way.

A great starting point for your WESCO International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to consider additional opportunities by exploring fresh ideas other investors may be overlooking.

- Explore these 3607 penny stocks with strong financials featuring smaller market caps alongside balance sheets and earnings profiles that may help support meaningful upside.

- Review these 25 AI penny stocks to evaluate companies that could be positioned to benefit as artificial intelligence spending develops across industries.

- Assess these 12 dividend stocks with yields > 3% to identify potential income streams that combine attractive yields with fundamentals that may support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal