Lattice Semiconductor (LSCC): Assessing Valuation After New $250 Million Share Buyback and Rising Investor Optimism

Lattice Semiconductor (LSCC) just rolled out a fresh 250 million dollar share repurchase program, a clear signal that management sees value in the current share price and future earnings power.

See our latest analysis for Lattice Semiconductor.

That confidence backed by the new buyback comes after a strong run, with the share price at 78.41 dollars and a year to date share price return of just over 40 percent. The 1 year total shareholder return above 25 percent suggests momentum is still building rather than fading.

If Lattice’s move has you thinking about what else could surprise to the upside in chips and automation, it is worth exploring high growth tech and AI stocks as your next hunting ground.

But with Lattice now trading almost exactly in line with analyst targets after a powerful multi year run, is the market underestimating its earnings runway, or already fully pricing in the next leg of growth?

Most Popular Narrative Narrative: 0.5% Undervalued

With Lattice Semiconductor last closing at 78.41 dollars against a narrative fair value of about 78.77 dollars, the story leans toward finely balanced optimism rather than deep discount.

The ongoing AI and edge computing boom is driving hyperscale data center spend and increasing Lattice's attach rate as a companion chip for AI accelerators, servers, and networking equipment, leading to higher ASPs and robust design wins; this should accelerate revenue growth and support gross margin expansion.

Curious how that AI tailwind, future profit jump, and a rich earnings multiple are stitched together into one valuation story? The full narrative joins the dots.

Result: Fair Value of $78.77 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in low and mid range FPGAs and any slowdown in AI infrastructure spending could quickly challenge today’s upbeat growth assumptions.

Find out about the key risks to this Lattice Semiconductor narrative.

Another View: Rich Multiples Send a Different Signal

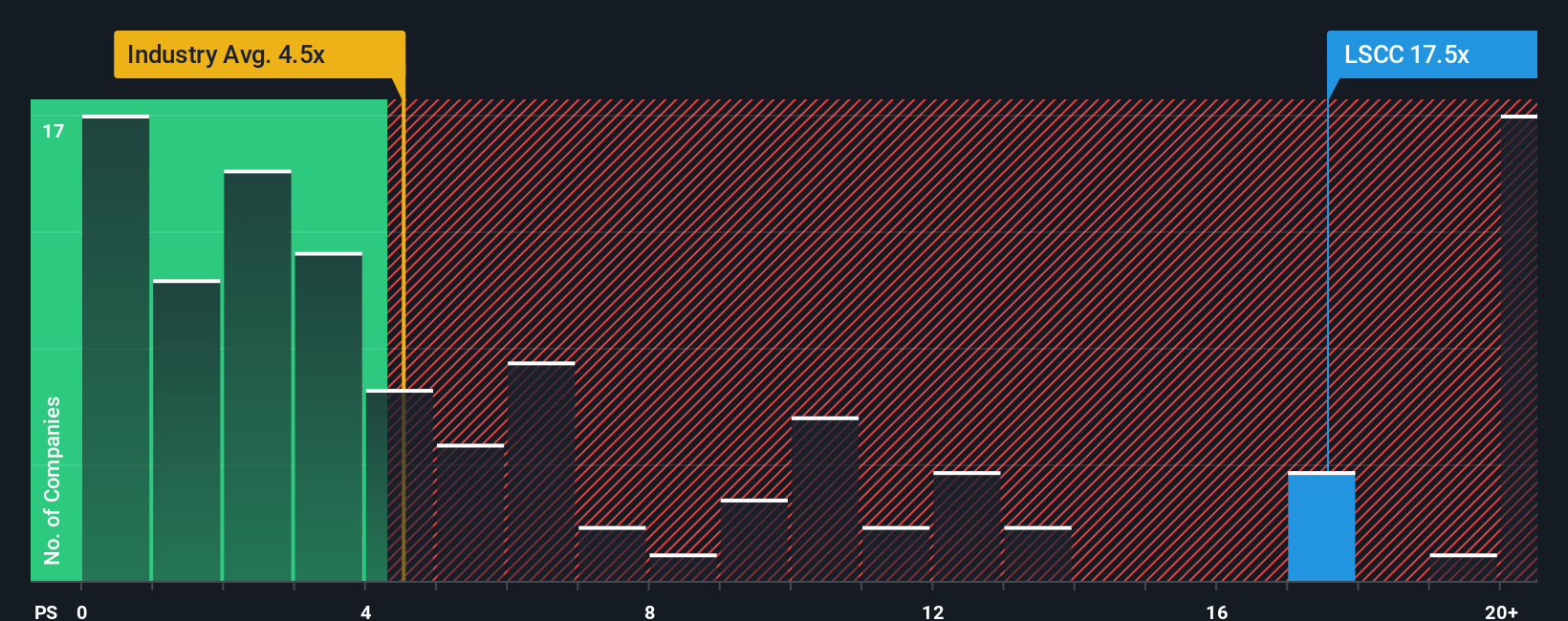

Step away from the narrative fair value, and the price to sales lens looks far less forgiving. Lattice trades on about 21.7 times sales versus roughly 5.4 times for the US semiconductor group and an estimated fair ratio near 9.1 times. This leaves little room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lattice Semiconductor Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can craft a complete perspective in under three minutes: Do it your way.

A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity when the market offers so many angles. Use the Simply Wall Street Screener to spot what others are missing.

- Capture potential mispricings by scanning these 904 undervalued stocks based on cash flows that could offer stronger upside based on future cash flows.

- Ride the AI acceleration by targeting these 25 AI penny stocks positioned at the heart of data, automation, and intelligent software.

- Secure dependable income streams with these 12 dividend stocks with yields > 3% that may strengthen portfolio stability while still leaving room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal