How VinFast’s New Indonesian EV Aftermarket Partnerships At VinFast Auto (VFS) Have Changed Its Investment Story

- In recent days, VinFast Auto has signed agreements with five Indonesian companies, including Goodyear Indonesia, Dunlop, Denso Sales Indonesia, CARfix, and Scuto Paint, to build out a comprehensive aftermarket and after-sales ecosystem for its electric vehicles in the country.

- Together with its push into full-scale EV production and new plants across Southeast Asia and India, these partnerships highlight VinFast’s attempt to pair regional manufacturing expansion with local service depth, aiming to make ownership and maintenance less of a barrier for new EV buyers.

- We’ll now examine how VinFast’s new Indonesian aftermarket partnerships might reshape its investment narrative around Southeast Asian EV expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

VinFast Auto Investment Narrative Recap

To own VinFast Auto, you need to believe it can turn heavy losses and high cash burn into scale and eventually better unit economics by winning share in fast-growing emerging EV markets. The new Indonesian aftermarket deals modestly support that thesis near term by reducing ownership friction in a key target market, but they do not change the central near term catalyst of proving sustainable demand outside Vietnam, nor the core risk around liquidity and continued funding needs.

The Indonesian agreements sit alongside VinFast’s broader Southeast Asian push, including its expanding manufacturing footprint in Vietnam, Indonesia and India and its progress at the Hai Phong plant. Together, these moves connect directly to the main catalyst of scaling volumes in emerging markets, where rising urbanization and EV adoption could help absorb fixed costs, even as persistent losses and limited brand recognition keep execution risk high.

Yet against this expansion story, investors should also recognize the growing concern around liquidity risk and potential dilution...

Read the full narrative on VinFast Auto (it's free!)

VinFast Auto’s narrative projects ₫177,527.7 billion revenue and ₫8,991.9 billion earnings by 2028. This requires 48.9% yearly revenue growth and a ₫89,207.8 billion earnings increase from ₫-80,215.9 billion today.

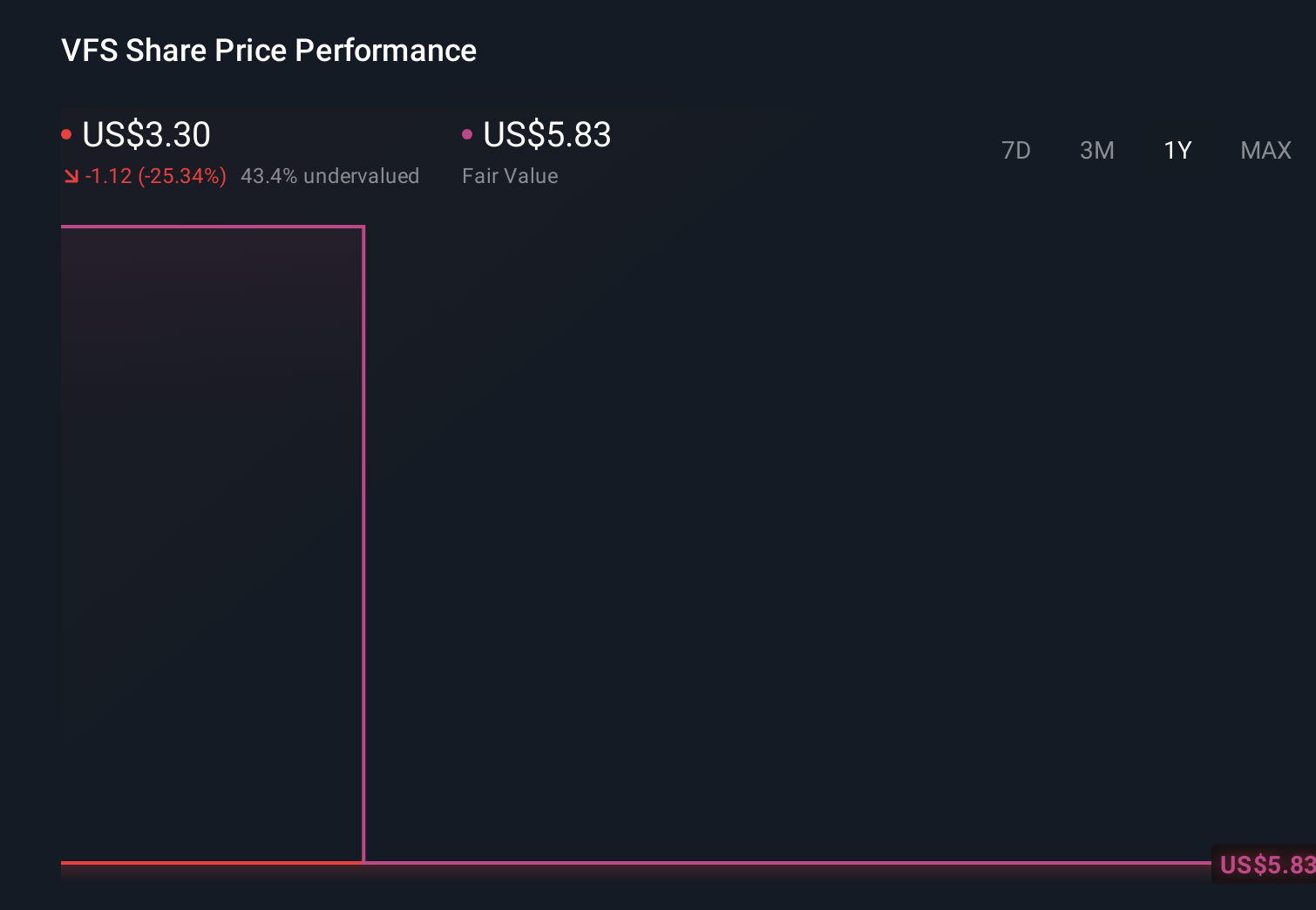

Uncover how VinFast Auto's forecasts yield a $5.83 fair value, a 78% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$5.83 to US$88 per share, showing how far apart individual views can be. Readers weighing these perspectives may want to set them against VinFast’s ongoing high cash burn and reliance on external funding, and then explore several alternative viewpoints before forming a view on the company’s long term potential.

Explore 3 other fair value estimates on VinFast Auto - why the stock might be a potential multi-bagger!

Build Your Own VinFast Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VinFast Auto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VinFast Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VinFast Auto's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal