High Insider Ownership Fuels Growth Stocks In December 2025

As the Dow Jones Industrial Average reaches new heights, contrasting with declines in the Nasdaq and S&P 500 due to tech sector pressures, investors are keenly observing market dynamics shaped by interest rate cuts and evolving economic indicators. In this fluctuating environment, stocks with high insider ownership often attract attention for their potential alignment of interests between company leaders and shareholders, a factor that can be particularly appealing amid broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Here we highlight a subset of our preferred stocks from the screener.

So-Young International (SY)

Simply Wall St Growth Rating: ★★★★★☆

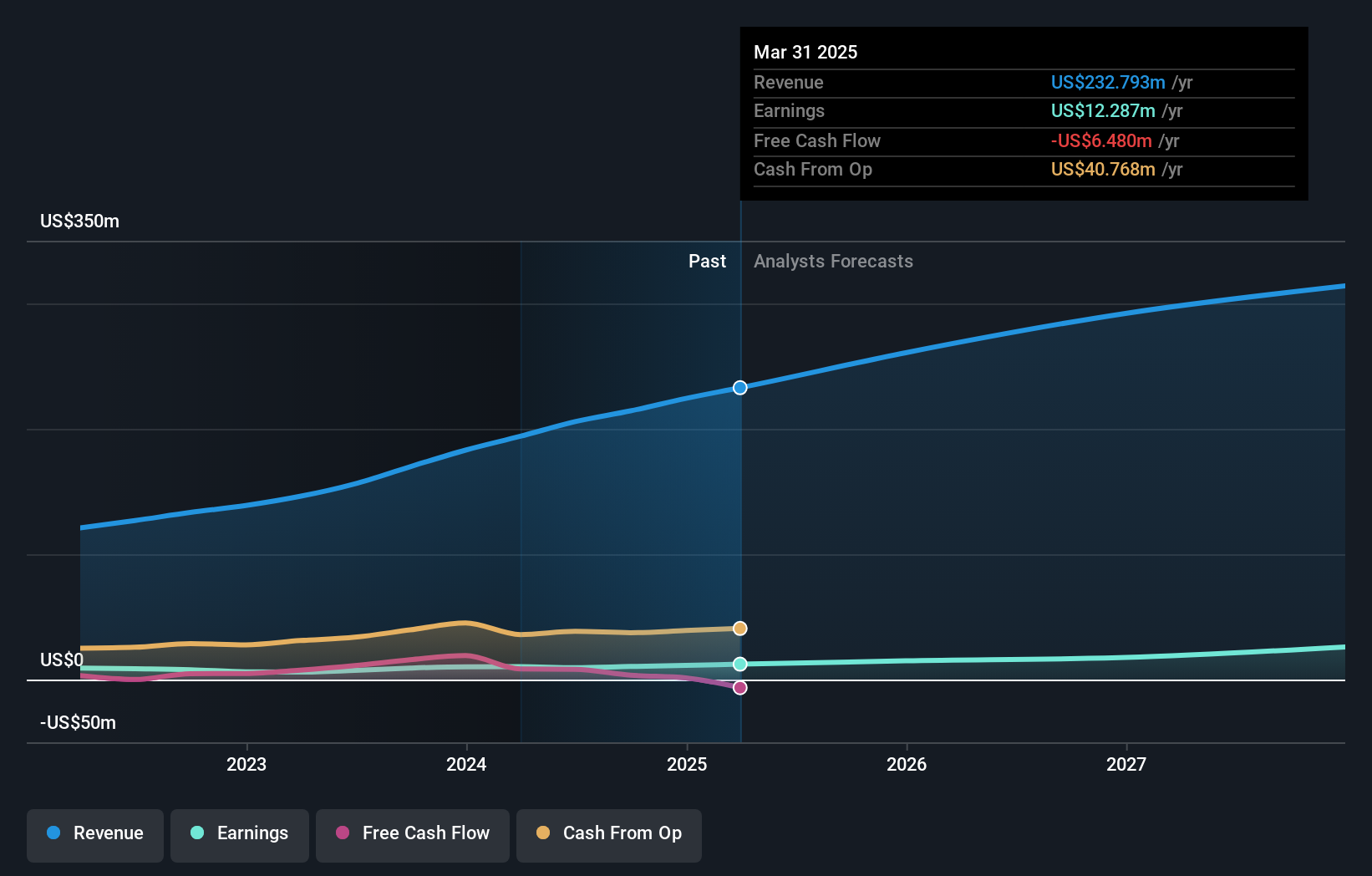

Overview: So-Young International Inc. operates an online platform for consumption healthcare services in the People’s Republic of China and has a market cap of approximately $324.82 million.

Operations: The company's revenue segments include online advertising and information services, reservation services, and other related healthcare services.

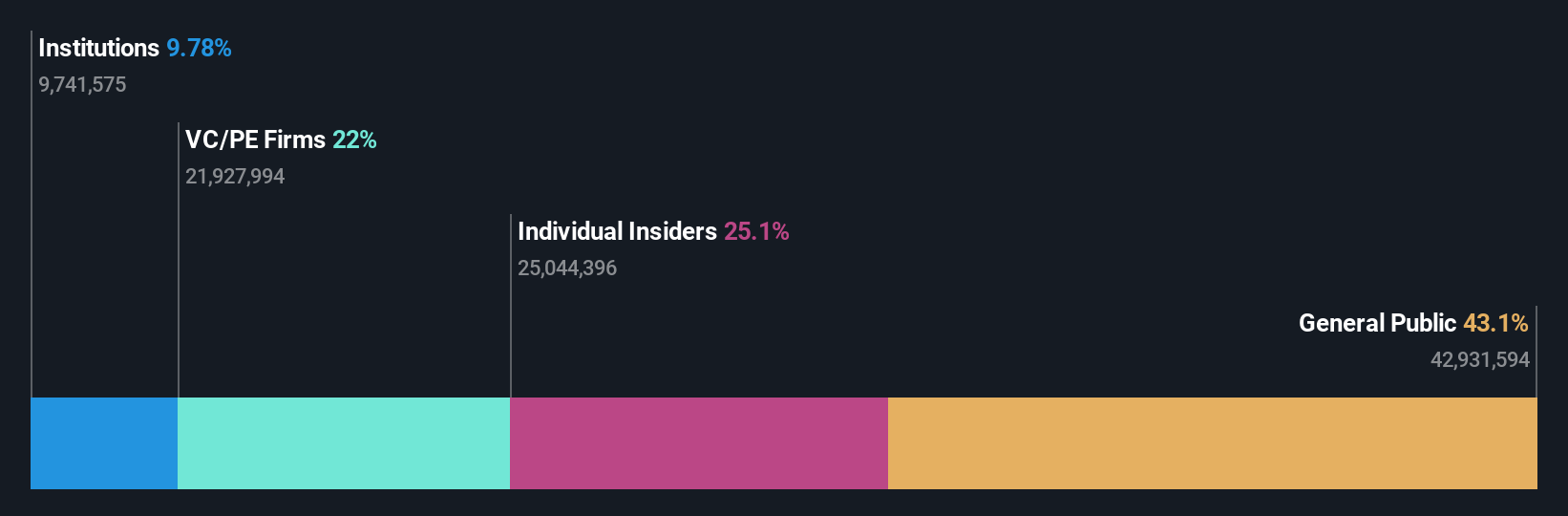

Insider Ownership: 25.1%

So-Young International, recently added to the S&P Global BMI Index, is forecasted to achieve profitability within three years, with revenue growth expected at 32% annually—surpassing the broader US market. Despite trading at a significant discount to its estimated fair value, recent earnings revealed a net loss for Q3 2025. The company anticipates substantial revenue increases in aesthetic treatment services for Q4 2025. Share price volatility and lack of insider trading activity are noted concerns.

- Take a closer look at So-Young International's potential here in our earnings growth report.

- According our valuation report, there's an indication that So-Young International's share price might be on the cheaper side.

Viemed Healthcare (VMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viemed Healthcare, Inc. operates in the United States offering home medical equipment and post-acute respiratory healthcare services, with a market cap of approximately $279.05 million.

Operations: The company generates revenue of $254.79 million from its healthcare facilities and services segment.

Insider Ownership: 13.3%

Viemed Healthcare's earnings are projected to grow significantly at 30% annually, outpacing the US market. The company trades at a favorable price-to-earnings ratio of 20.5x, below the healthcare industry average, suggesting good value relative to peers. Recent guidance lowered revenue expectations slightly for 2025 to US$271-273 million. Despite lower Q3 net income compared to last year, Viemed completed a share buyback program worth US$13.23 million, enhancing shareholder value through reduced share count.

- Unlock comprehensive insights into our analysis of Viemed Healthcare stock in this growth report.

- The valuation report we've compiled suggests that Viemed Healthcare's current price could be quite moderate.

Equity Bancshares (EQBK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Equity Bancshares, Inc. is the bank holding company for Equity Bank, offering a variety of banking and financial services to both individual and corporate clients, with a market cap of $886.29 million.

Operations: Equity Bank, a subsidiary of Equity Bancshares, Inc., generated $191.23 million from its banking and financial services offered to individual and corporate clients.

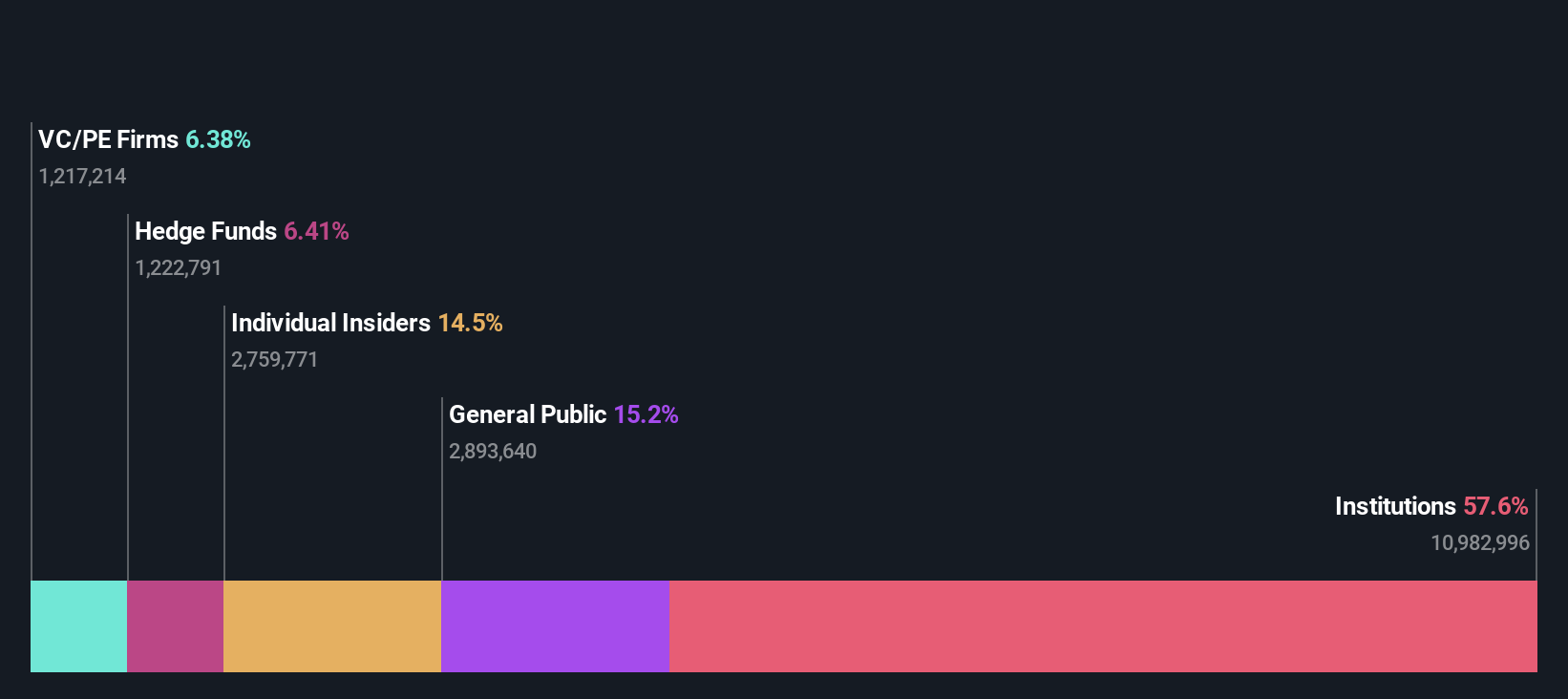

Insider Ownership: 14.5%

Equity Bancshares is poised for substantial growth, with revenue expected to rise 26.8% annually, surpassing the US market average. Earnings are forecast to grow significantly at 79.8% per year, despite a recent quarterly net loss of US$29.66 million due to large one-off items impacting results. Insider buying exceeds selling in recent months, indicating confidence in future prospects. The company trades below estimated fair value and has initiated a share repurchase program enhancing shareholder returns through reduced share count.

- Dive into the specifics of Equity Bancshares here with our thorough growth forecast report.

- Our valuation report unveils the possibility Equity Bancshares' shares may be trading at a premium.

Where To Now?

- Delve into our full catalog of 204 Fast Growing US Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal