Has Mitsubishi UFJ Financial Group’s Strong Multi Year Rally Left Much Upside in 2025?

- If you are wondering whether Mitsubishi UFJ Financial Group still offers good value after such a strong run, or if you are arriving too late, this breakdown is designed to help you decide with a cool head.

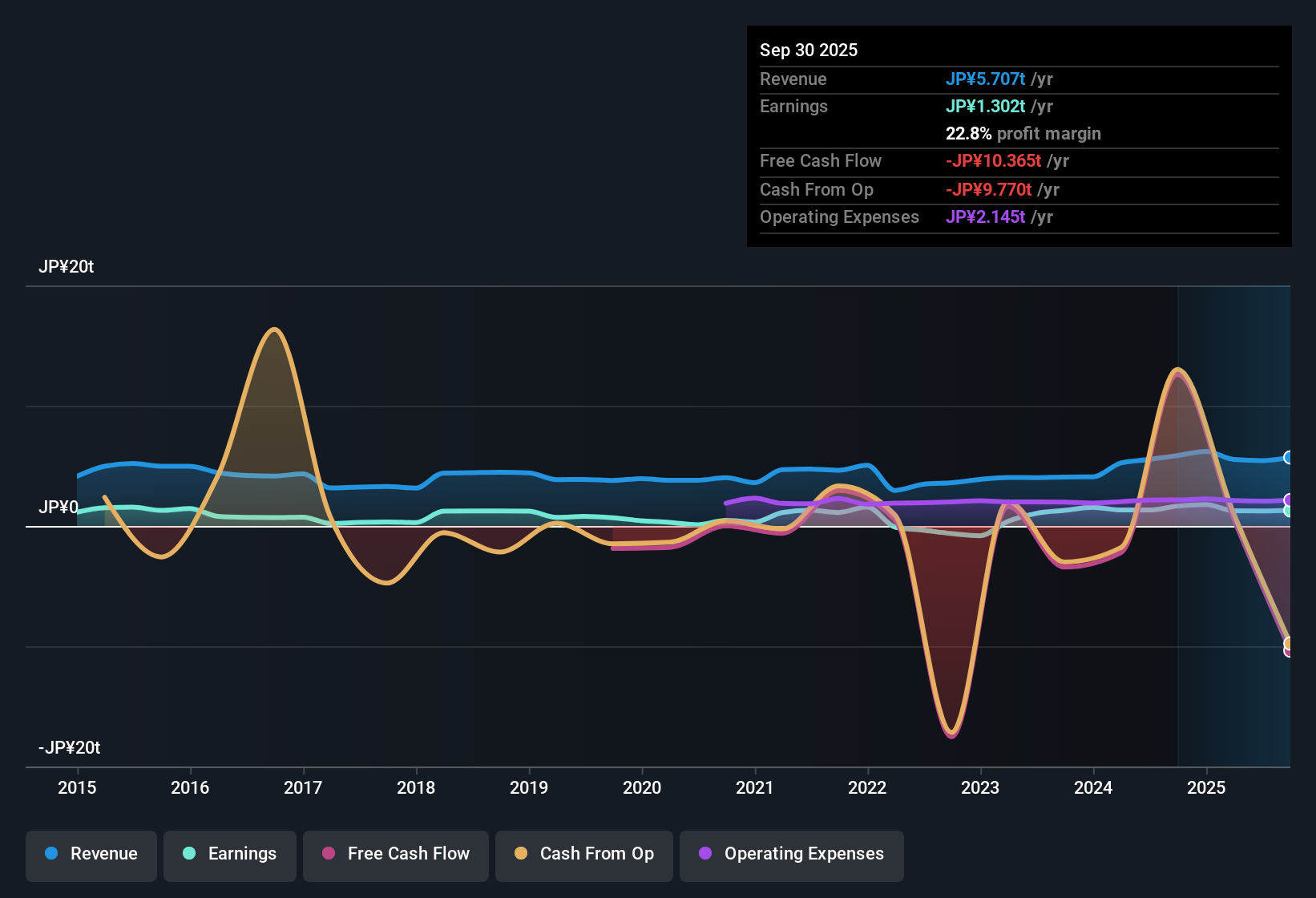

- The stock has slipped 2.7% over the last week but is still up 5.4% over the past month, 31.7% year to date, 36.5% over 1 year, and an eye catching 254.1% over 3 years and 557.6% over 5 years. This naturally raises the question of how much upside is left from here.

- Recent market attention has centered on Japan's shifting interest rate environment and ongoing financial sector reforms. Both developments tend to reshape how investors value the big banks. In addition, global investors have been rotating back into Japanese financials as they look for exposure to improving corporate governance and higher return on equity across the market.

- Right now, Mitsubishi UFJ Financial Group scores just 2/6 on our valuation checks. We will unpack what that actually means by walking through multiples, asset based and cash flow approaches, before finishing with a more intuitive way to connect valuation to the long term narrative behind the stock.

Mitsubishi UFJ Financial Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsubishi UFJ Financial Group Excess Returns Analysis

The Excess Returns model asks a simple question: is Mitsubishi UFJ Financial Group earning more on its equity than investors require for the risk they take, and can it sustain that gap over time? It does this by comparing the return on equity to the cost of equity and capitalising the surplus.

For Mitsubishi UFJ Financial Group, the starting point is a book value of ¥1,834.28 per share and an average return on equity of 10.71%. That supports a stable earnings power of about ¥218.40 per share, based on forecasts from 9 analysts. Against a required cost of equity of roughly ¥126.50 per share, this leaves an excess return of ¥91.90 per share, which is then projected on a growing stable book value base of ¥2,039.24 per share over time.

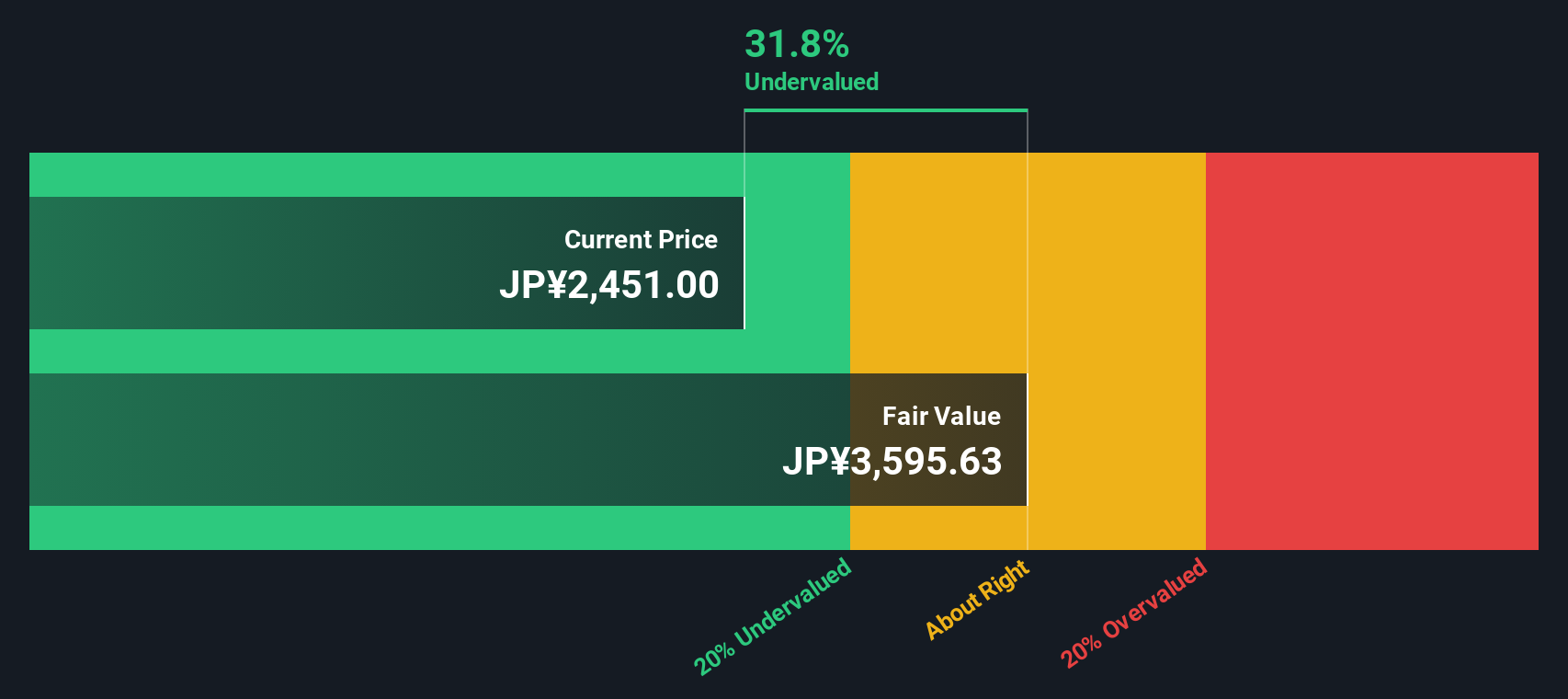

When these excess returns are summed and discounted, the model points to an intrinsic value around ¥3,680 per share, implying the stock is about 33.5% undervalued versus its current price. On this framework, investors are not yet paying fully for Mitsubishi UFJ Financial Group's earning power.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mitsubishi UFJ Financial Group is undervalued by 33.5%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Mitsubishi UFJ Financial Group Price vs Earnings

For profitable, relatively mature businesses like major banks, the price to earnings ratio is often the most intuitive way to think about valuation. It links what investors are willing to pay today directly to the profits the company is generating and can be a useful shorthand for how the market is pricing growth and risk.

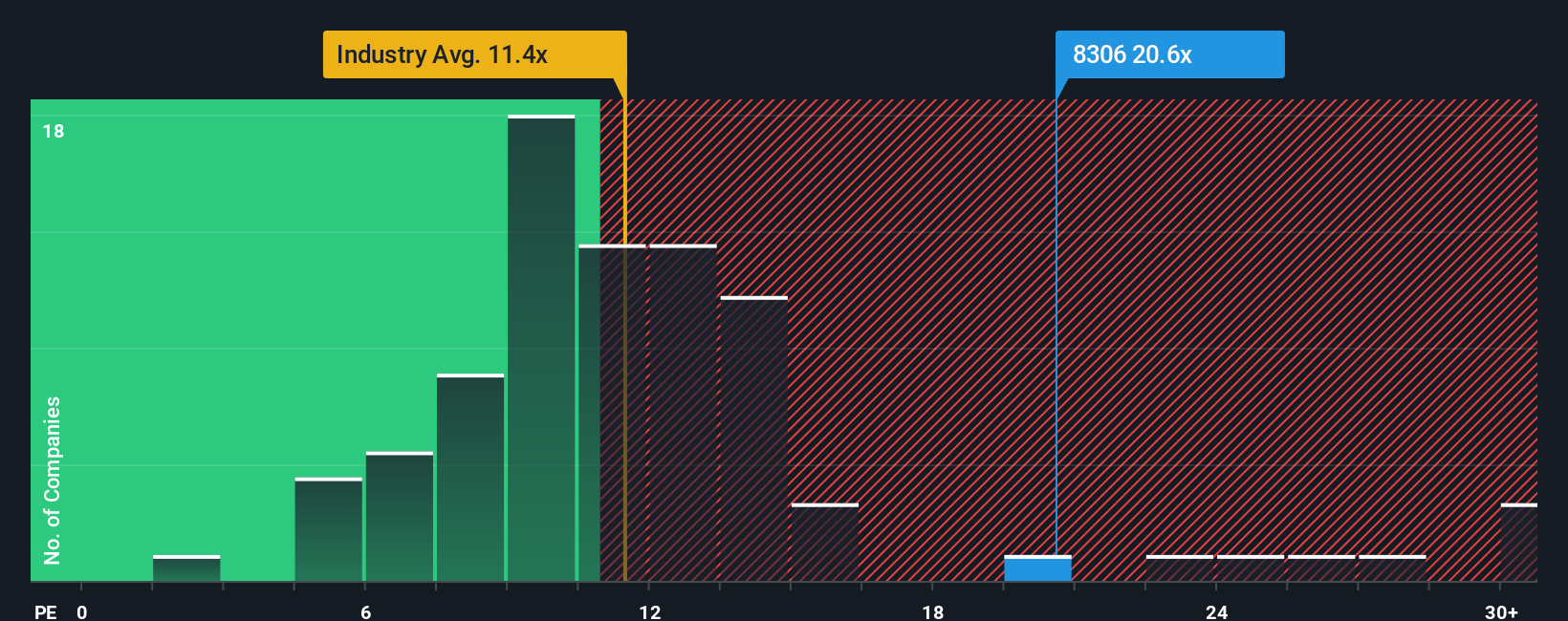

In simple terms, companies with stronger, more reliable earnings growth and lower perceived risk usually deserve a higher PE ratio, while slower growing or riskier firms typically trade on lower multiples. Mitsubishi UFJ Financial Group currently trades at about 21.36x earnings, which is well above the broader Banks industry average of around 11.47x and also higher than the 17.16x average of its closest peers.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what a “normal” PE should be for the company, given its specific earnings growth outlook, profit margins, risk profile, size and industry. For Mitsubishi UFJ Financial Group, that Fair Ratio sits at roughly 19.08x. This suggests the shares are priced somewhat richer than its fundamentals alone would justify. On this basis, the stock appears modestly overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi UFJ Financial Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to the numbers you think are reasonable for its future revenue, earnings, margins, and ultimately fair value.

On Simply Wall St, Narratives live in the Community page and are designed to be easy and accessible, helping you turn a view like “buybacks and dividend growth will steadily lift Mitsubishi UFJ Financial Group’s earnings power” into a concrete financial forecast and a fair value estimate you can compare with today’s share price.

Because Narratives constantly update when new information such as earnings releases, guidance changes, or major news appears, they can help you quickly reassess whether the stock looks attractive, fairly priced, or expensive, and therefore whether it may be a time to buy, hold, or trim.

For example, one investor might argue Mitsubishi UFJ Financial Group deserves a fair value near ¥2,700 based on strong buybacks, margin expansion, and rising dividends, while another might set fair value closer to ¥1,830 due to concerns about reliance on equity sales and macro risk, and Narratives let you see, test, and refine both perspectives against the current market price.

Do you think there's more to the story for Mitsubishi UFJ Financial Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal