Cui Dongshu: Passenger car retail sales fell 8% in November 2025, much lower than the 2% increase in wholesale

The Zhitong Finance App learned that on December 11, Cui Dongshu announced the passenger car segment model trend for November 2025. The anti-domestic wave is driving the car market to a shift in the direction of “reduced price cuts and smooth promotions”, and the car market is running more and more smoothly. The number of statistics based on car companies' official price cuts or new car prices actually breaking through the rules of the lowest guide price in the past two years has decreased, but the incremental effect of new cars entering the market directly at low prices is obvious.

Passenger car retail sales fell 8% in November 2025, significantly lower than the 2% increase in wholesale sales. Due to high interest rate restrictions and the suspension of subsidies, retail sales of A-class cars and MPVs were lower in November. A0 class cars and C-class SUVs became the main retail force in November. The high-end performance of SUVs was strong. Among sedans, sales of A0 class cars mainly rebounded, and sales of A00 class cars performed well.

NEV retail sales should be strong in December. Due to the expiration of the NEV tax exemption this year, and affected by the policy of buying 5 more cars next year, consumers have a stronger sense of urgency to buy cars at the end of the year, so when choosing a model, they consider the pick-up schedule more. In order to cope with the increase in consumer car purchase costs due to extended delivery cycles, car companies have introduced purchase tax subsidy programs one after another. This back-up plan is only a temporary act at the end of this year and is unsustainable in the future. Consumers are greatly affected by factors in the car buying environment. Due to queues to buy popular models, many consumers are instead buying low-selling models. This has driven the continued rise in consumer popularity in the car market, and sales of new energy sources will further increase. Due to high profits from overseas sales, the trend of “going out of the market if you don't go overseas” is obvious, and strong export growth has exceeded expectations. Since the second half of the year, China's automobile export situation has continued to improve, the recognition of independent new energy in overseas markets has continued to increase, overseas marketing networks have expanded rapidly, and some overseas markets have grown well. The new parallel export policy is about to be implemented. The enthusiasm for parallel exports of 0-kilometer used cars is very high this year, in stark contrast to the slump in parallel imports.

Recently, domestic car companies are close to balance their inventories in the Russian market, driving the negative growth pressure on China's automobile exports to Russia and Central Asia to reduce. In 2026, Chinese automobile exports to Russia will become another bright spot.

Due to strong trade-in subsidies, the automobile trade-in scale is expected to exceed 180 billion yuan in 2025; in addition, the NEV purchase tax discount is 10%, benefiting 22% more sales than in 2024, which means that the vehicle purchase tax of more than 200 billion dollars corresponding to NEV sales of more than 2 trillion dollars has been reduced. Therefore, with the support of tax exemptions and subsidies of nearly 400 billion dollars, the car market in 2025 will exceed expectations. However, in 2026, the 5% reduction in the NEV purchase tax alone will reduce duty-free concessions by more than 100 billion dollars, so the growth of the car market in 2026 is under tremendous pressure. Taking into account the wish for a good start to the “15th Five-Year Plan”, the end of 2025 is expected to be more stable, and there is no need to overdraft next year's growth potential.

I. Economical passenger car market trends

1. A00 class car market performance

In November 2025, 171,900 A00 cars were sold, accounting for 13.81% of the wholesale share. Wholesale sales decreased by 1% year-on-year compared to the same period last year, and wholesale increased 4% month-on-month; retail sales in November 2025 fell 22% year-on-year compared to the same period last year, and retail sales fell 13% month-on-month. From January to November 2025, the wholesale volume was 1,548,300 units, with a cumulative increase of 42%; from January to November 2025, domestic retail sales were 1.273,300 units, with a cumulative retail increase of 15%.

The A00 class market has returned to the competitive pattern of 20 years ago. Back then, Xiali, Chery (09973), Geely (00175), Changan (000625.SZ), and BYD (01211) all had better A00 grade products. Recently, diversified A00 class main models and new products such as BYD, Geely, Changan, Chery, and FAW Pentium have shown outstanding performance, and miniature electric vehicles are gradually showing incremental potential.

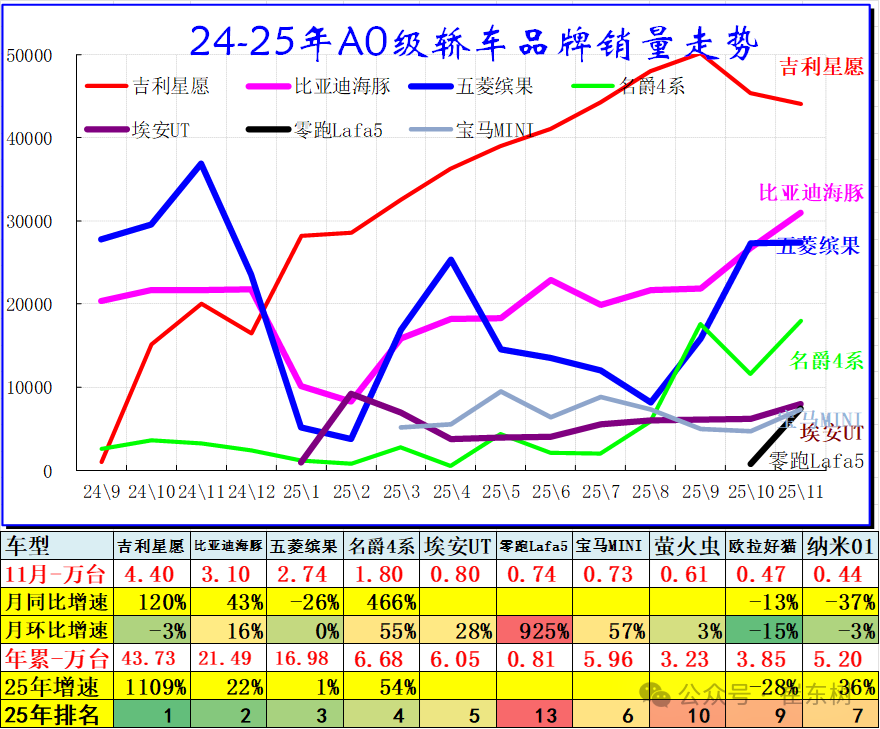

2. Market trends of the main A0 class sedan models

In November 2025, 183,500 A0 cars were sold, accounting for 14.75% of the wholesale share. Wholesale increased 25% year-on-year over the same period last year, and wholesale increased 11% month-on-month; retail sales in November 2025 increased 30% year-on-year compared to the same period last year, and retail sales increased 3% month-on-month. From January to November 2025, the wholesale volume was 1.492,200 units, with a cumulative increase of 60% in wholesale sales; from January to November 2025, the number of domestic retail sales was 1.017,200 units, with a cumulative retail increase of 63%.

The characteristics of autonomous electric vehicles replacing fuel vehicles are obvious, and the competitive pattern is shifting from being dominated by joint ventures to a new trend dominated by autonomy. In the early days, Japanese companies Toyota and Honda maintained a strong position, and the trend of autonomous fuel-fueled small entry-level cars has been relatively difficult in recent years.

The trend of full electrification of A0 class cars is obvious. Basically, there are no strong fuel vehicle products, which shows the obvious advantages of autonomous pure electric products.

3. Sales trend of A0 class SUVs

In November 2025, 203,000 A0 SUVs were sold, accounting for 12.28% of the wholesale share. Wholesale fell 9% year-on-year compared to the same period last year, and wholesale fell 7% month-on-month; retail sales fell 22% year-on-year in November 2025 compared to the same period last year, and retail sales fell 10% month-on-month. From January to November 2025, the wholesale volume of wholesale sales by manufacturers decreased by 4%; from January to November 2025, the total number of domestic retail sales was 1,138,300 units, and retail sales decreased by 5%.

Mainstream small SUVs in Japan and South Korea have basically withdrawn from the market, and autonomous electric vehicles have shown strong performance.

II. Trends in the A-class passenger car market

1. Market trends of the main compact car models

In November 2025, 445,800 A-class cars were sold, accounting for 35.84% of the wholesale share. Wholesale sales decreased 7% year-on-year from the same period last year, and wholesale increased 3% month-on-month; retail sales in November 2025 fell 16% year-on-year compared to the same period last year, and retail sales increased 2% from the previous month of this year. From January to November 2025, the wholesale volume was 3.9898 million units, with a cumulative decrease of 5%; from January to November 2025, domestic retail sales were 3.664 million units, and retail sales decreased by 7%.

In 2024, new energy will dominate the mainstream car market, with BYD definitely leading the way. The fuel vehicle market will gradually pick up in 2025, and Volkswagen's fuel vehicles still have some market space. Mainstream domestic cars are still the most practical fuel vehicles.

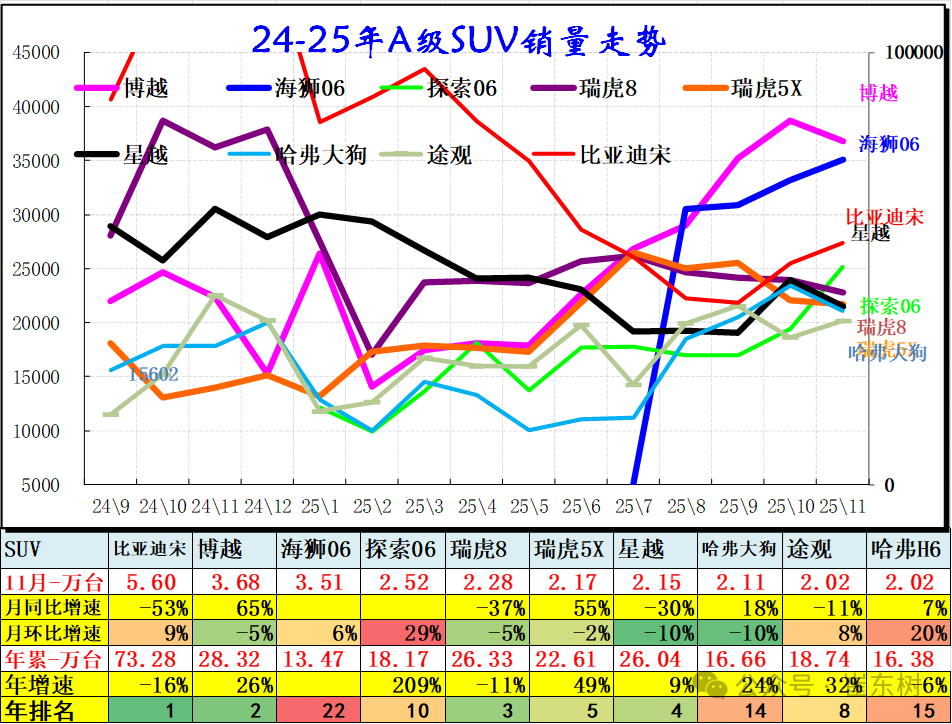

2. Market trends of the main compact SUV models

In November 2025, 880,000 A-class SUVs were sold, accounting for 53.52% of the wholesale share. Wholesale sales fell 2% year-on-year from the same period last year, and wholesale remained the same as last month; retail sales in November 2025 fell 16% year-on-year compared to the same period last year, and retail sales fell 7% month-on-month. From January to November 2025, the wholesale volume was 8.108,600 units, with a cumulative increase of 15% in wholesale sales by manufacturers; from January to November 2025, the number of domestic retail sales was 5.761 million units, with a cumulative retail increase of 9%.

The mainstream SUV market pattern is rapidly changing. The SUVs of BYD, Geely, Changan, and Chery have performed excellently, achieving comprehensive breakthroughs in autonomous SUVs at home and abroad.

III. B-Class Passenger Vehicle Market Trends

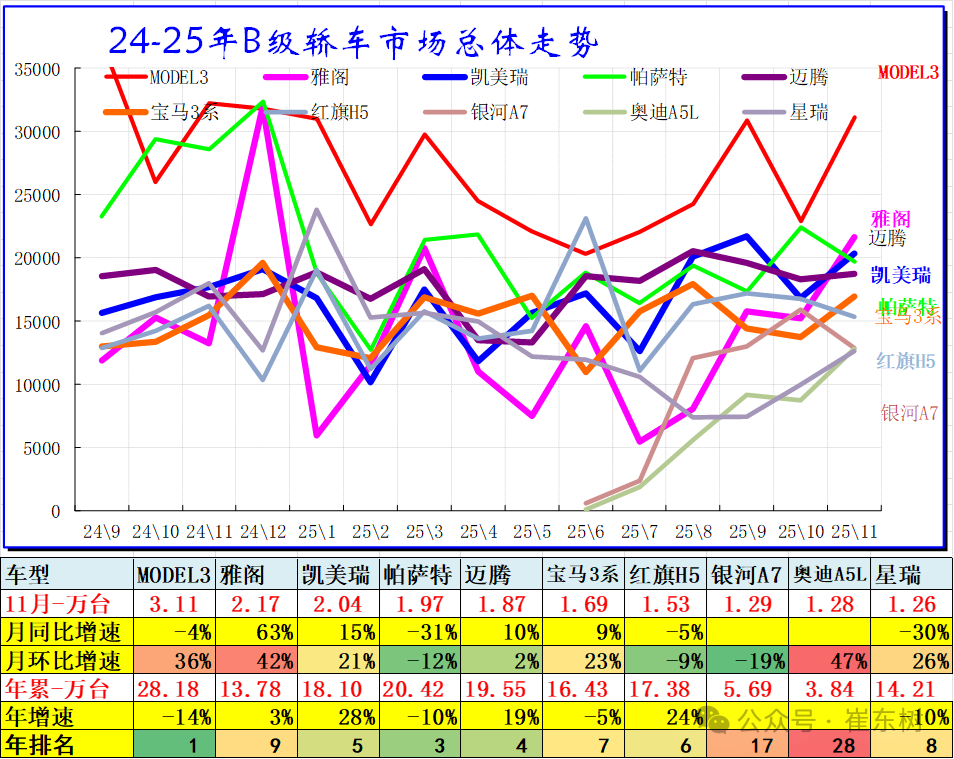

1. B-class car market trends

B-Class cars were sold in November 2025, accounting for 30.59% of the wholesale share. Wholesale sales increased 3% year-on-year over the same period last year, and wholesale sales in November 2025 increased 5% month-on-month; retail sales in November 2025 fell 9% year-on-year compared to the same period last year, and retail sales fell 1% month-on-month compared to the previous month of this year. From January to November 2025, the wholesale volume was 3.5712 million units, with a cumulative increase of 7% in wholesale sales; from January to November 2025, domestic retail sales were 3.296,800 units, with a cumulative retail increase of 8%.

There is still some stable demand in the Japanese high-end car market. High-end autonomy from new energy sources is rapidly rising. In particular, the high-end market with online rental contracts is dominated by autonomous electric vehicles.

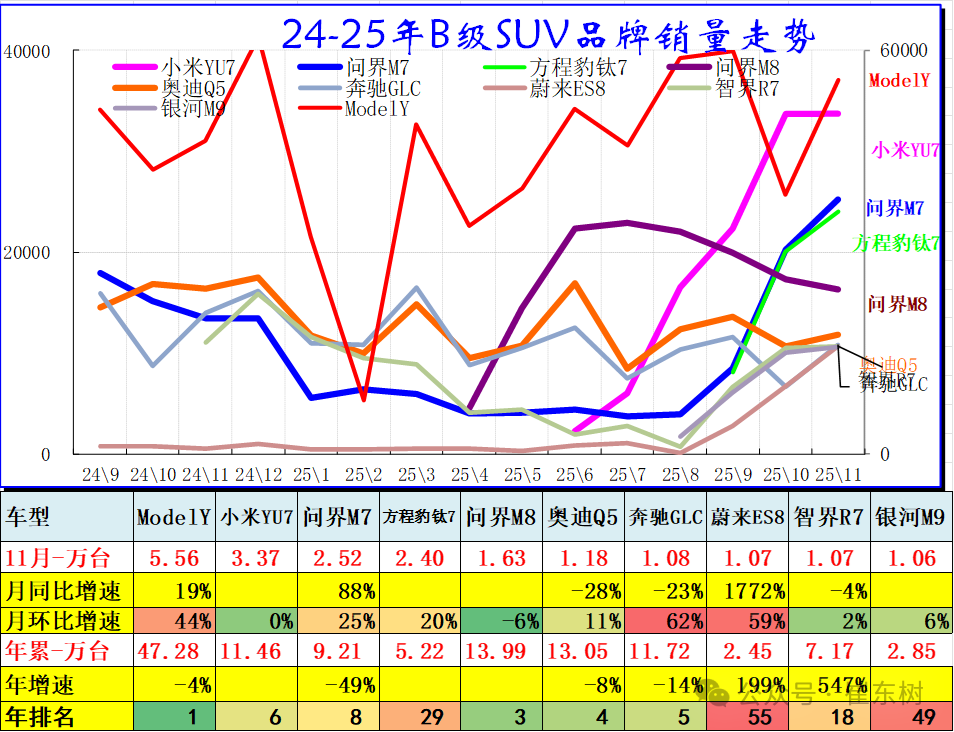

2. B-class SUV market trends

B-class SUVs were sold in November 2025, accounting for 27.47% of the wholesale share. Wholesale increased 10% year-on-year over the same period last year, and wholesale increased 3% month-on-month; retail sales increased 5% year-on-year in November 2025 compared to the same period last year, and retail sales increased 9% over the previous month of this year. From January to November 2025, the wholesale volume was 3.6393 million units, with a cumulative increase of 7% in wholesale sales; from January to November 2025, the number of domestic retail sales was 3.107,700 units, with a cumulative retail increase of 3%.

Autonomous new energy sources are rapidly rising in the high-end SUV market, the high-end advantages of traditional fuel vehicles are weakening, and high-end ones such as BMW have improved recently.

3. B-grade and above MPV market trends

B-grade MPVs were wholesale in November 2025, accounting for 44.82% of the wholesale share. Wholesale increased 40% year-on-year over the same period last year, and wholesale fell 8% month-on-month; retail sales in November 2025 increased 31% year-on-year over the same period last year, and retail sales increased 17% over the previous month of this year. From January to November 2025, the wholesale volume was 377,900 units, with a cumulative increase of 26%; from January to November 2025, domestic retail sales were 289,000 units, with a cumulative retail increase of 7%.

C-grade MPVs were sold 45,300 units in November 2025, accounting for 45% of the wholesale share. Wholesale fell 20% year-on-year compared to the same period last year, and wholesale fell 8% month-on-month; retail sales in November 2025 fell 25% year-on-year compared to the same period last year, and retail sales fell 5% month-on-month. From January to November 2025, the wholesale volume was 5261,000 units, with a cumulative increase of 17% in wholesale sales; from January to November 2025, the number of domestic retail sales was 501,700 units, with a cumulative retail increase of 7%.

The high growth phase of the MPV market has changed to a low growth trend. GL8 has performed well recently. The MPV performance of BYD, Tension, and Trumpchi is excellent, and the Japanese MPV advantage has declined rapidly.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal