Certara (CERT) Valuation Revisited as New CEO Jon Resnick Takes the Helm

Certara (CERT) just set its next chapter in motion by naming longtime IQVIA executive Jon Resnick as incoming CEO and board member, a planned handoff that could reshape how investors think about the stock’s longer term trajectory.

See our latest analysis for Certara.

At a share price of $9.28, Certara’s roughly 7.7 percent 1 month share price return contrasts with a 12.9 percent year to date decline and a much steeper 18.4 percent 1 year total shareholder return drop. This suggests sentiment is stabilising but not yet fully repaired as investors weigh whether the new CEO can turn operational progress into a more durable rerating.

If this leadership shake up has you rethinking your exposure to healthcare innovators, it could be a good moment to explore healthcare stocks for other ideas riding different catalysts.

With the shares trading at a steep discount to analyst targets despite solid revenue and profit growth, investors now face a key question: Is Certara an overlooked value play, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 29.7% Undervalued

With Certara last closing at $9.28 compared to a narrative fair value of about $13.21, the valuation case leans heavily on powerful growth catalysts.

The upcoming commercial launch of Certara's next-generation, AI-enabled MIDD platform and CertaraIQ QSP software leverages advanced analytics and machine learning, providing differentiated capabilities that democratize access and increase the potential customer base, which should translate to higher recurring revenue and margin expansion through cloud-based SaaS models.

Want to see what kind of revenue runway and profitability lift this scenario is built on, and how those assumptions reshape the long term earnings profile? The narrative leans on accelerating topline growth, expanding margins, and a bolder future earnings multiple than the market is currently pricing in. Curious which specific forecasts justify that gap between today’s price and the projected fair value? Read on to see the full playbook behind this valuation call.

Result: Fair Value of $13.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pharma budget caution and slower than expected adoption of Certara’s AI enabled platforms could delay bookings growth and undermine the undervaluation thesis.

Find out about the key risks to this Certara narrative.

Another Angle on Valuation

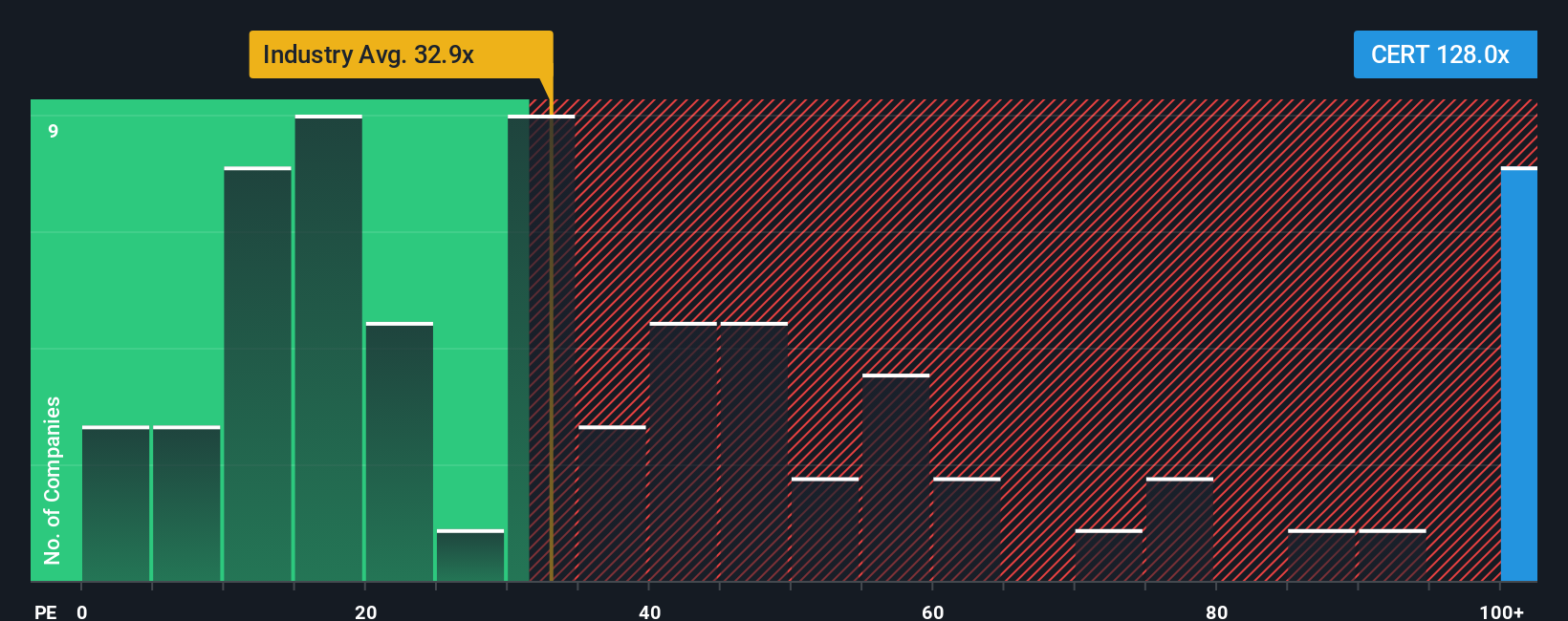

There is a twist once you look at Certara through its earnings multiple. The shares trade on a rich 135.9x price to earnings ratio, far above both the 33.1x global healthcare services average and a 44.5x fair ratio that the market could eventually gravitate toward.

This big gap suggests that, despite the headline discount to fair value, a lot of optimism is already embedded in the price, leaving less room for execution missteps. Could stretched multiples, rather than discounted cash flows, be what ultimately anchors returns from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Certara Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your Certara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with Certara, you could miss smarter opportunities, so use the Simply Wall St Screener now to uncover fresh, high conviction stocks worth your attention.

- Capture potential hidden bargains by scanning these 907 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows and fundamentals.

- Ride powerful secular trends by targeting these 26 AI penny stocks positioned at the intersection of automation, data, and next generation software demand.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that combine solid yields with the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal