Assessing Insmed’s Valuation After a 171% Surge Fueled by Pipeline Optimism

- If you are looking at Insmed and wondering whether the huge run up has already priced in the story, you are not alone. This article will walk through what the numbers are really saying about value from here.

- The stock has cooled off a bit in the very short term, slipping 8.2% over the last week and 1.1% over the last month, but that comes after an eye catching 171.4% gain year to date and 849.7% over three years.

- Recent momentum has been fueled by investor optimism around Insmed's late stage pipeline in rare and serious respiratory diseases and growing confidence that its therapies could address sizeable unmet medical needs. At the same time, regulatory and competitive developments in the biotech space have kept risk firmly on the radar, which helps explain the sharp moves in both directions.

- On our framework, Insmed scores a 3 out of 6 valuation checks. This means it screens as undervalued on half of the metrics we track, and we will break down what each method is implying before circling back to a more holistic way to think about its true worth by the end of this piece.

Approach 1: Insmed Discounted Cash Flow (DCF) Analysis

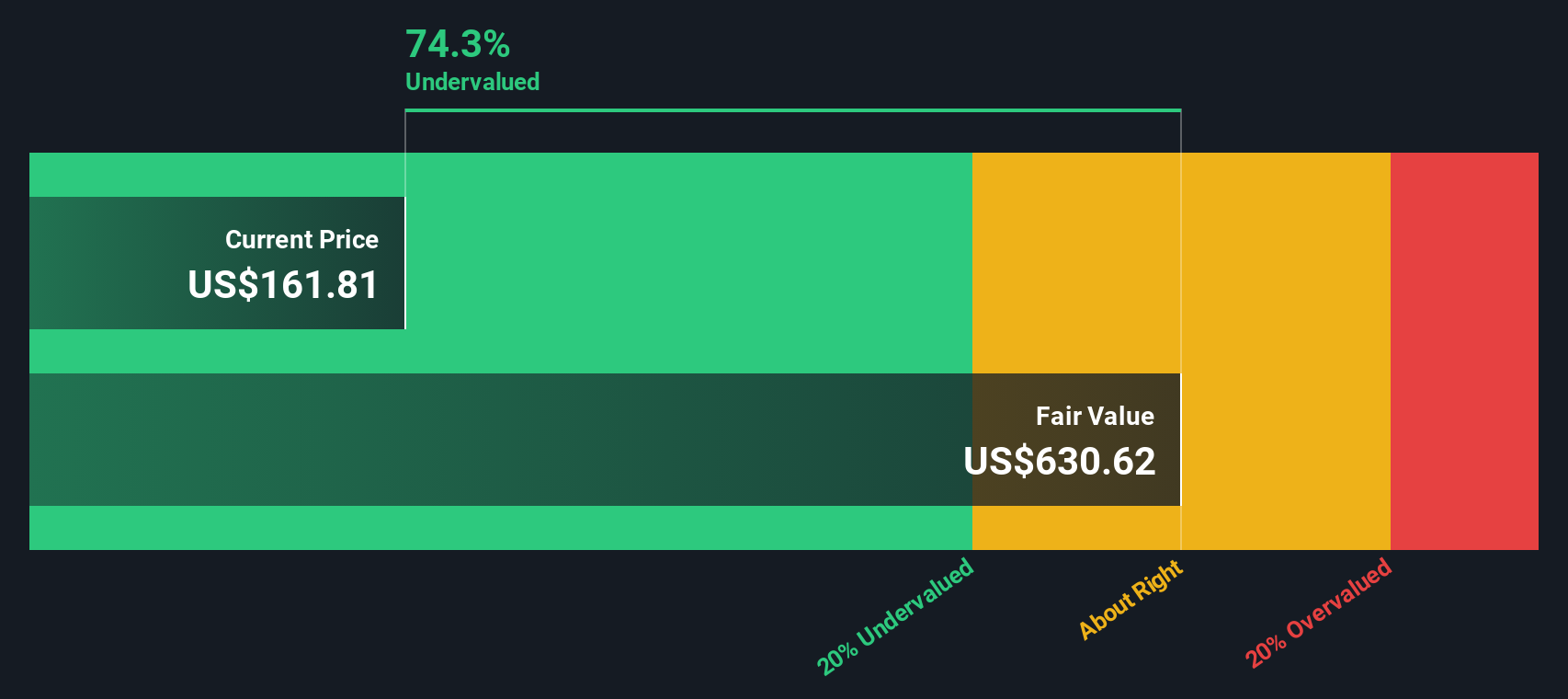

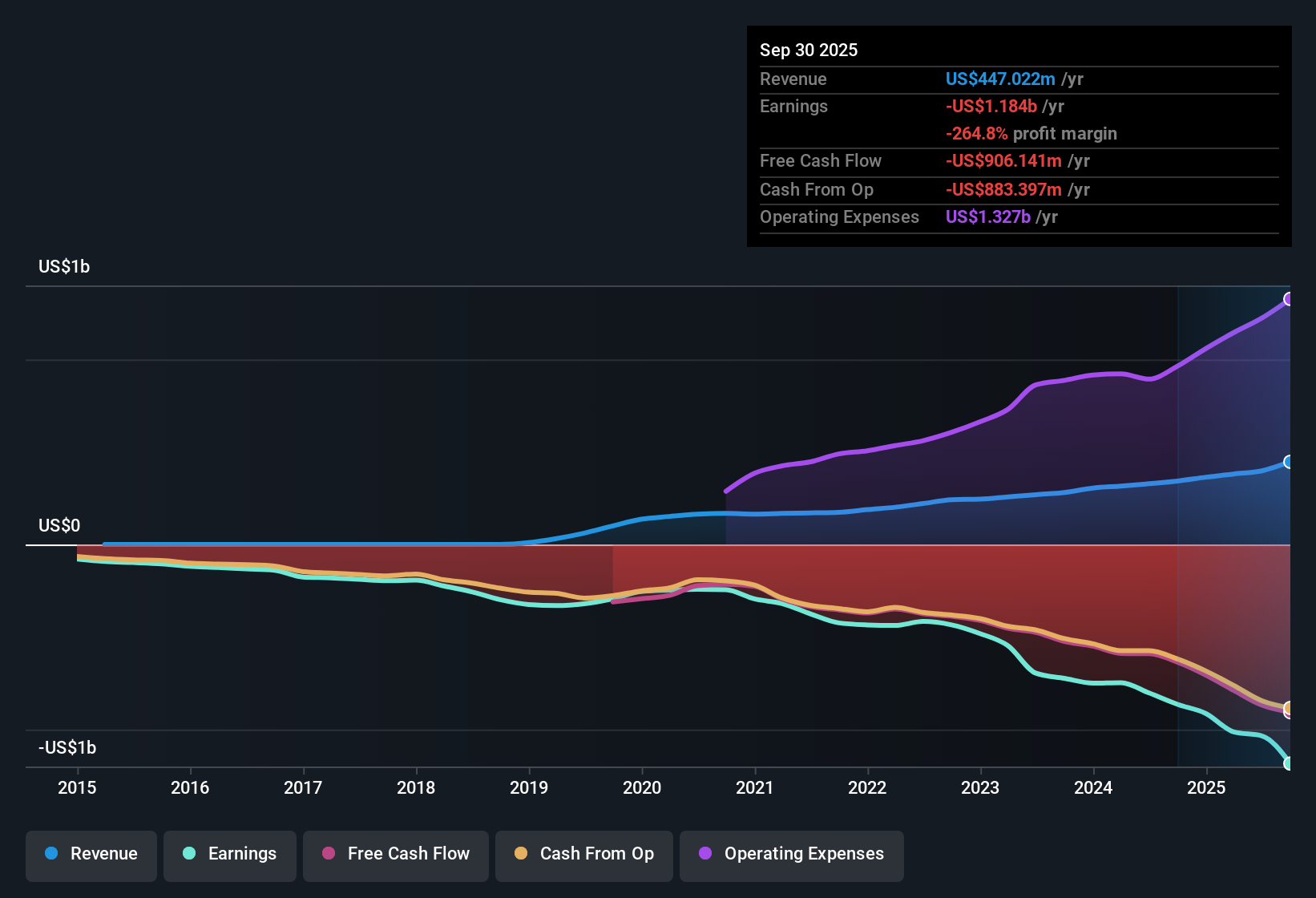

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Insmed, this 2 stage Free Cash Flow to Equity model starts from a last twelve month free cash outflow of about $906.7 Million, reflecting heavy investment and ongoing losses.

Analysts expect cash flow to gradually turn positive, with estimates out to 2029 pointing to free cash flow of roughly $1.54 Billion. Beyond the explicit analyst horizon, Simply Wall St extrapolates cash flows further, with projections in the early 2030s rising into the low to mid single digit Billions of dollars each year, all still expressed in dollars and discounted back to today.

Adding up these discounted projections produces an estimated intrinsic value of about $522.61 per share. Compared with the current market price, the model suggests the stock is about 63.7% undervalued, indicating that the market may be skeptical that Insmed will fully deliver on these cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Insmed is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

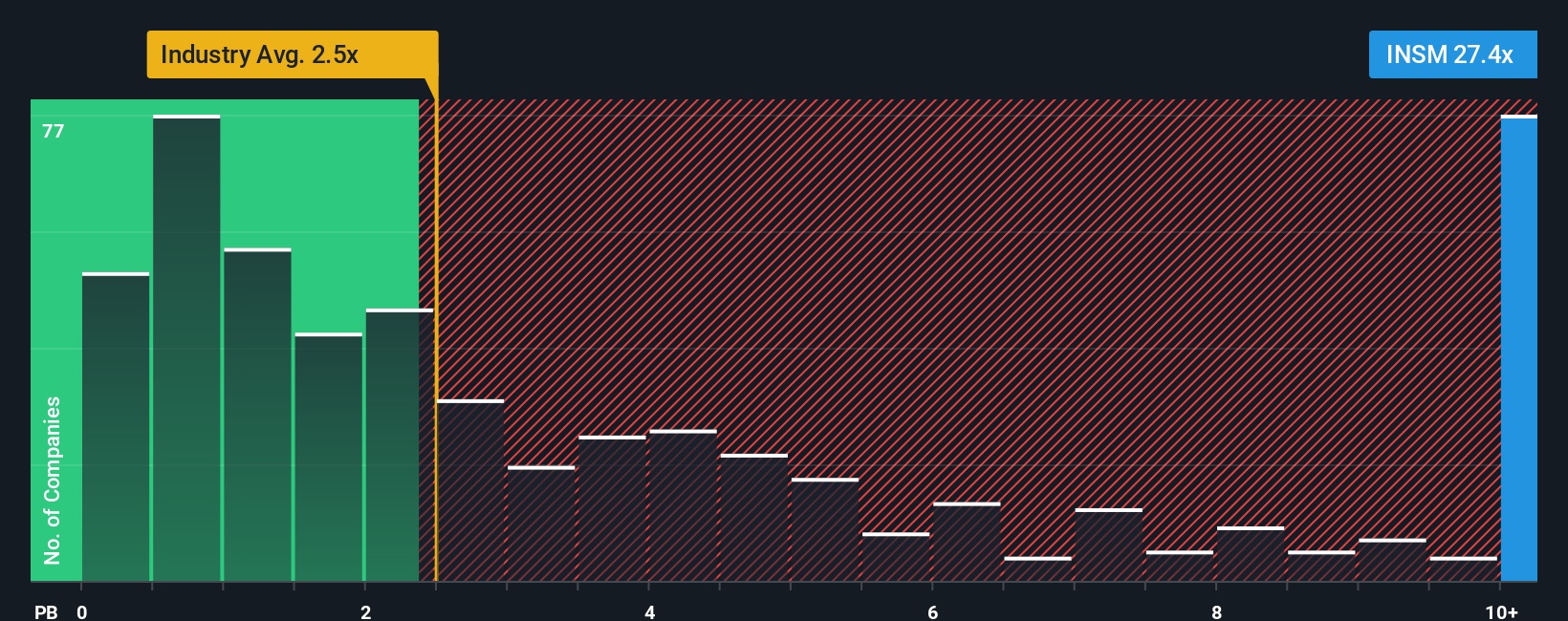

Approach 2: Insmed Price vs Book

For companies that are already generating meaningful assets and investing heavily in R and D, the price to book ratio can be a useful way to see how much investors are willing to pay for each dollar of net assets. In general, faster growth and lower perceived risk justify a higher multiple, while slower growth or higher uncertainty typically warrant a lower one.

Insmed currently trades at about 42.82x book value, far above the broader Biotechs industry average of roughly 2.69x and also below the peer group average of around 66.49x. On the surface, that wide gap to the sector might suggest a stretched valuation, but the elevated peer multiple shows that high growth and risk profiles can command a premium to book value in this niche.

Simply Wall St’s Fair Ratio is designed to cut through those blunt comparisons by estimating the price to book multiple that would be appropriate given Insmed’s specific growth outlook, risk profile, profitability, industry positioning and market cap. While the exact Fair Ratio is not available here, the fact that Insmed’s 42.82x sits between the low industry benchmark and the richer peer group implies the market is already pricing in substantial optimism, with limited clear evidence of a large undervaluation based on book value alone.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Insmed Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where you connect your view of a company’s story to a concrete forecast for revenues, earnings and margins, and then to a Fair Value that you can compare with today’s share price to decide whether to buy, hold or sell. That Fair Value automatically updates as new news or earnings arrive, and different investors can express very different Insmed Narratives. For example, one investor might see a high growth path similar to a projected Fair Value around $223 based on rapid respiratory portfolio expansion and successful European launches, while another might build a more cautious story with slower uptake, lower margins and a much lower Fair Value, all using the same framework but different assumptions.

Do you think there's more to the story for Insmed? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal