Has Berkshire Hathaway’s 2025 Pullback Created a Fresh Opportunity for Long Term Investors?

- If you are wondering whether Berkshire Hathaway is still a smart consideration at its current sky high absolute prices, or if most of the upside has already been taken off the table, this article is designed to help you cut through the noise and focus on value.

- Despite the stock pulling back around 3% over the last week and slipping roughly 1.2% over the past month, long term holders have still seen the share price rise 8.8% year to date and more than double over 5 years.

- Recent headlines have focused on Warren Buffett's continued capital allocation discipline, from sizable buybacks to selective portfolio tweaks. This has influenced how investors think about Berkshire's potential growth runway and risk profile. At the same time, ongoing discussion around higher for longer interest rates and their impact on insurers and financials has kept sentiment uneven, helping explain some of the recent share price volatility.

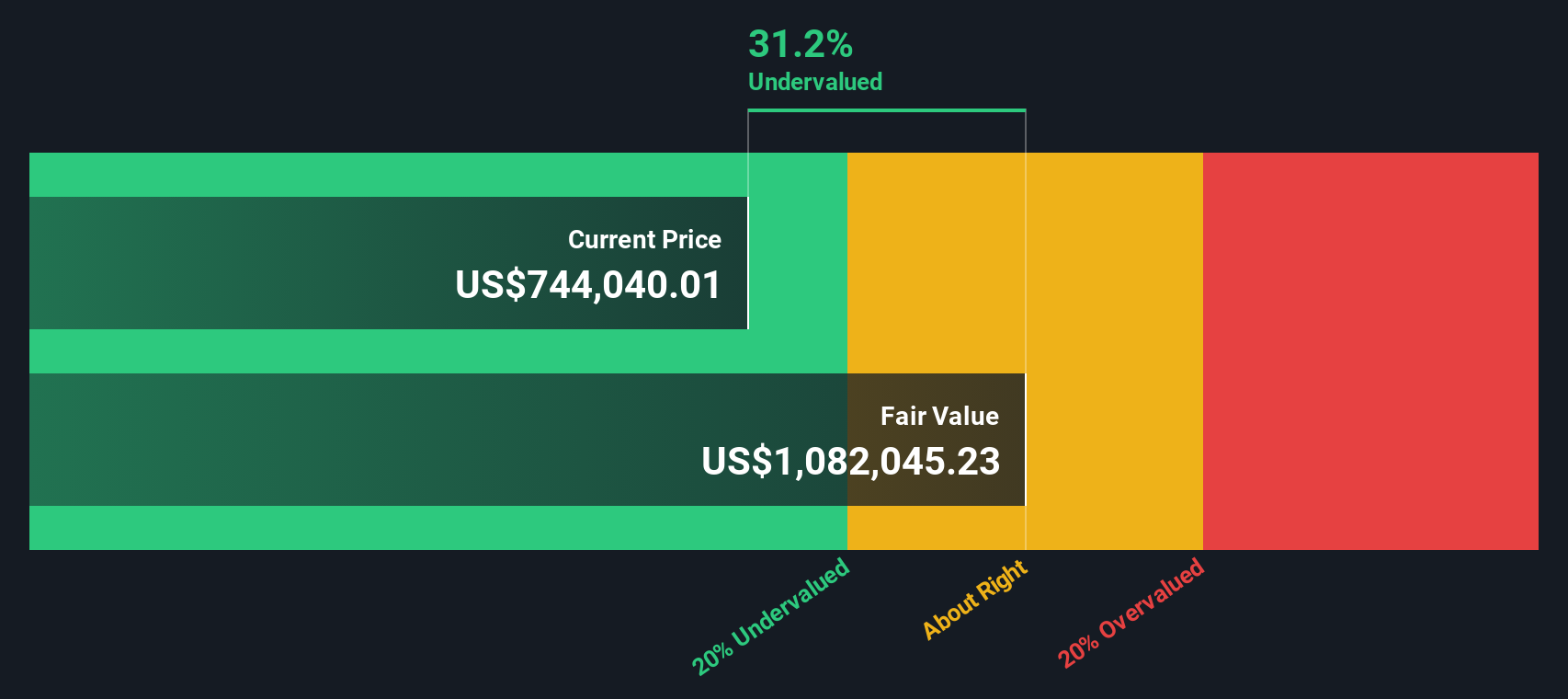

- On our numbers, Berkshire currently scores a 4/6 valuation check, suggesting it screens as undervalued on several key fronts but not all. Next we will walk through what different valuation approaches indicate about the stock and finish with a more holistic way to think about its overall worth.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model looks at how much profit Berkshire earns on its equity above the return that investors require, then capitalizes those extra profits to estimate what the business is worth today.

For Berkshire, the starting point is a substantial Book Value of $485,274.36 per share and a Stable EPS of $66,154.88 per share, based on the median return on equity from the past 5 years. Against a Cost of Equity of $38,908.03 per share, this implies an Excess Return of $27,246.84 per share. That excess is supported by an Average Return on Equity of 12.85% and a projected Stable Book Value of $514,986.06 per share, using weighted future book value estimates from two analysts.

Combining these inputs, the Excess Returns valuation implies an intrinsic value that is about 36.0% above the current share price, meaning the stock appears notably undervalued on this framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 36.0%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Berkshire Hathaway Price vs Earnings

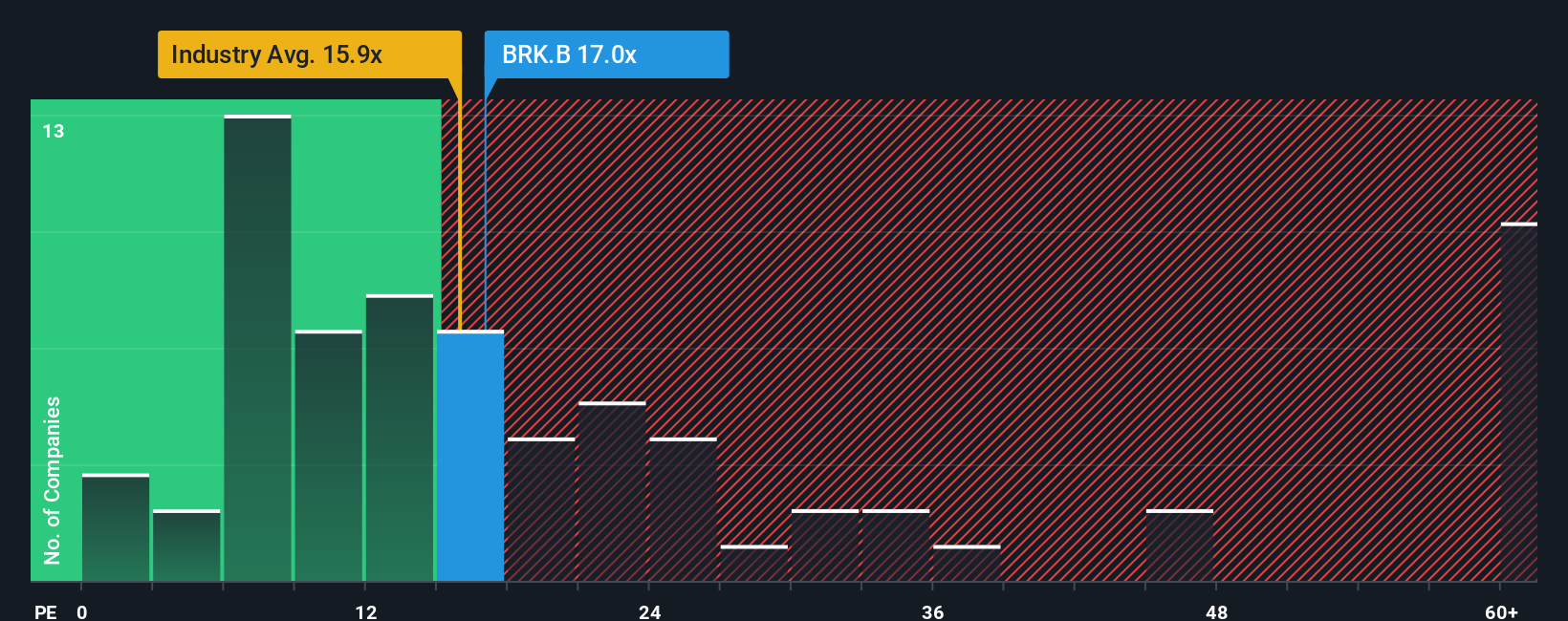

For a profitable, relatively mature business like Berkshire Hathaway, the price to earnings, or PE, ratio is a practical way to judge whether the market price makes sense relative to the cash generating power of the company today. Investors are essentially asking how many dollars they are willing to pay for each dollar of current earnings.

What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and more resilient profits can justify a higher PE, while slower or more uncertain earnings usually warrant a lower one.

Berkshire currently trades on a PE of about 15.7x. That is above the Diversified Financial industry average of roughly 13.6x, but well below the broader peer group average of around 25.3x. Simply Wall St’s proprietary Fair Ratio for Berkshire is 16.8x. This estimates the PE the company should trade on after factoring in its earnings growth outlook, industry, profit margins, size and risk profile. This is more informative than a simple comparison to peers or the industry because it adjusts for Berkshire’s specific fundamentals rather than assuming all financials deserve the same multiple. With the actual PE sitting modestly below the 16.8x Fair Ratio, the stock screens as slightly undervalued on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind it. A Narrative lets you spell out what you believe about Berkshire’s future, then translates that story into specific assumptions for revenue growth, earnings and profit margins, and ultimately into a fair value estimate. Narratives are available on Simply Wall St’s Community page, where millions of investors use them as an easy, accessible tool to compare their fair value to today’s price and decide whether a stock looks like a buy, hold or sell. Because Narratives update dynamically when new information like earnings releases or major news arrives, your story and valuation never have to fall out of date. For example, one Berkshire Narrative on the Community page might assume very conservative growth and assign a relatively low fair value. Another might assume stronger compounding and support a much higher fair value, reflecting how different investors can reasonably see the same company in very different ways.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal