US stock outlook | Futures on the three major stock indexes plummeted, Oracle's performance reignited concerns about the AI bubble, and the market waited for Broadcom's earnings report after the market

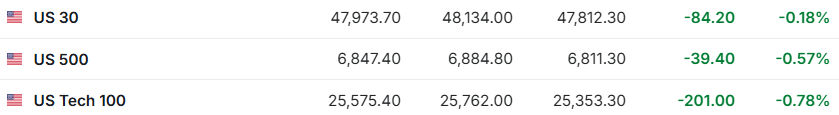

1. On December 11 (Thursday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.18%, S&P 500 futures were down 0.57%, and NASDAQ futures were down 0.78%.

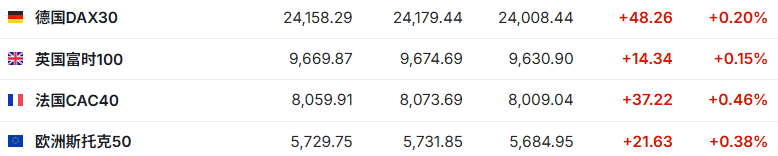

2. As of press release, the German DAX index rose 0.20%, the British FTSE 100 index rose 0.15%, the French CAC40 index rose 0.46%, and the European Stoxx 50 index rose 0.38%.

3. As of press release, WTI crude oil fell 1.45% to $57.61 per barrel. Brent crude fell 1.41% to $61.33 per barrel.

Market news

After the Federal Reserve meeting, the market expected two interest rate cuts in 2026. Traders are relieved that Fed policymakers have room for further easing next year. Currently, they believe that the Fed will cut interest rates twice in 2026, even though the latest forecast from the Federal Reserve indicates that it will only cut interest rates once. Powell said that the Federal Reserve has now taken sufficient measures to stabilize the labor market while maintaining high interest rates to continue to curb upward pressure on prices. Officials raised the median economic growth forecast for 2026 to 2.3% from the 1.8% forecast in September. They also expect the inflation rate to fall to 2.4% next year from the 2.6% previously forecast.

Societe Generale: Bearish in the short term, but the dollar will “return to the king” at the end of 2026. Société Générale said that although the US dollar will be under pressure in the short term, it will regain its upward trend in the medium to long term with the comparative advantage of the US economic fundamentals to achieve the “return of the king” of the US dollar. Societe Generale pointed out that weak US economic data, particularly weakening labor market data, is a core factor affecting the focus of the foreign exchange market. This weakness is offsetting the market's optimism about the AI revolution, prompting the market to shift its focus to drastic interest rate cuts that the next chairman of the Federal Reserve may implement. The forecast predicts that the dollar will face downward pressure in the next few weeks and early 2026 due to a slowdown in the US economy in the fourth quarter. Despite this, in the medium term, the bank believes that the US economic growth prospects will not deteriorate drastically, and the extent of deterioration will not exceed the part that has already been digested by the market.

The freight rate index soared 50% in 50 days! The shortage of oil tankers has intensified, and six newly built giant ships have joined the “air drive to grab oil” ranks. The shortage of tankers is getting worse, so much so that newly built vessels that usually carry refined oil products during their first voyage are now speeding up to load crude oil as soon as possible. According to Signal Ocean's ship tracking and chartering data, the six supertankers delivered this year went from East Asia Air Airlines to load crude oil to the Middle East, Africa, or the Americas without cargo on board. Tanker owners who are about to receive new ships almost always use them to transport fuel such as gasoline during the first voyage and then load crude oil. Now, a severe shortage of tankers is upending this logic. This year, both internal and external oil producers within OPEC increased production. At the same time, Western sanctions against Russia and the risk of crossing the Red Sea disrupted traditional routes, leading to longer voyages and the need to use more ships.

Individual stock news

The “Google Chain Core” Broadcom (AVGO.US) Q4 earnings report is about to be announced, and the performance is expected to exceed expectations again, driven by the AI engine. Broadcom will announce financial results for the fourth quarter of fiscal year 2025 after the market on December 11, EST. Wall Street currently expects Broadcom's Q4 revenue to grow 24.5% year over year to US$17.5 billion, and adjusted earnings per share will increase 31% year over year to US$1.87. As a key part of the “GOOGL.US (GOOGL.US) ecosystem”, benefiting from Google's opening of TPU usage/sales to external customers and strong growth in overall artificial intelligence (AI) spending, Broadcom is expected to once again exceed market expectations at that time. Like Nvidia, Broadcom is seen as a major beneficiary of the surge in AI spending, with data centers relying on its custom chips and network components to handle AI computing workloads. As one of the largest high-performance application-specific integrated circuit (ASIC) vendors for hyperscale computing companies, Broadcom performed well this year.

Oracle's (ORCL.US) earnings report rekindles concerns about the AI bubble. Oracle's second-fiscal quarter report showed that its spending on artificial intelligence data centers and other equipment increased dramatically, but the rate at which these rising investments were converted into cloud business revenue fell short of investors' expectations. This raised market concerns about whether AI-related investments could be quickly converted into profits, causing Oracle's stock price to plummet by more than 11% in pre-market trading. Dragged down by this, other AI and semiconductor stocks such as NVDA.US (NVDA.US) also generally fell before the market. Oracle's performance once again raised concerns about the overvaluation of technology stocks and whether capital investment in artificial intelligence infrastructure could bring returns, and rekindled doubts about the frequency of market movements caused in November. Although the tech sector has driven the S&P 500's impressive rise this year, given that the outlook for the US economy remains strong, these AI spending concerns have prompted some investors to shift capital to other sectors. Broadcom will release earnings reports after the market, at which time the market will once again evaluate the strong momentum of the artificial intelligence industry.

Adobe (ADBE.US) Q4 results and FY2026 guidance all exceeded expectations, yet it was difficult to overcome the anxiety of AI disruption in the market. Adobe issued an optimistic annual results guide, but investor response was lackluster. They're always looking for more clear signs that the software maker can thrive in the age of artificial intelligence (AI). Adobe said on Wednesday that it expects revenue for the 2026 fiscal year ending November 2026 to reach 25.9 billion to 26.1 billion US dollars. Although the median forecast range exceeded the average expectations of Wall Street analysts, it fell short of the $26.4 billion expected by some analysts. The company also expects adjusted earnings per share for the 2026 fiscal year of $23.30 to $23.50, which is slightly higher than the median forecast range of $23.37 expected by Wall Street analysts. Meanwhile, in the fourth fiscal quarter of fiscal year 2025 ending November 28, Adobe's revenue increased 10% year over year to a record $6.19 billion.

Synopsys (SNPS.US)'s “AI shift” strategy paid off: teaming up with Nvidia, the performance guidelines exceeded expectations. Chip design software provider Synopsys Q4's revenue was $2.26 billion, up 38% year over year, higher than the forecast of $2.24 billion. Adjusted earnings per share were $2.90 compared to the general market expectation of $2.88. Among them, the design automation business contributed 1.85 billion US dollars, and the design intellectual property business contributed 407 million US dollars. Adjusted operating profit increased 36% year over year to reach US$822.6 million, higher than the forecast of US$803 million. Looking ahead, the company expects revenue of 9.56 billion to 9.66 billion US dollars for the 2026 fiscal year, and analysts expect 9.63 billion US dollars. Revenue for the first fiscal quarter is estimated at US$2.37 billion to US$2.42 billion, and analysts expect US$2.36 billion; the adjusted earnings per share for the first fiscal quarter are expected to be between US$3.52 and US$3.58, which is also higher than the forecast of US$3.46.

Put down your position and grab the market! The new CEO of Stellantis (STLA.US) launched an “emergency room” rectification operation: abandoning high profits and fervently chasing sales. According to four people familiar with the matter, Antonio Filosa, the new CEO of Stellantis, is planning to adjust the strategy to put car sales growth above profit, and seek to regain market share in North America and Europe through measures such as expanding the low-margin bulk fleet sales business and investing in economical models, and push the world's fourth-largest automobile manufacturer back on track. Filosa officially took office in June of this year, and immediately launched a rectification operation called an “emergency room” by people familiar with the matter to begin cleaning up the mess left by his predecessor Carlos Tavares. Tavares previously pursued a combination strategy of “cost reduction+price increase” to pursue high profit margins. This practice directly caused customer loss. At the end of last year, Tavares was forced to leave his job.

The two parties wrestle for Warner Bros. (WBD.US): Trump forces CNN to split, and the Democratic Party warns of financial infiltration in the Middle East. The dispute over control of Warner Bros. Discovery has ignited war in Hollywood: trade unions denounce a potential unemployment crisis, the cinema industry is a wake-up call for the future of film distribution, and actors express concerns about freedom of speech. Today, the debate over whether the final acquirer is Netflix (NFLX.US) or Paramount Dance (PSKY.US) is dividing America along political lines. Opposing Netflix has become a trend in Republican circles. Paramount is headed by David Ellison, who has close ties to the White House, and its bid for Warner Bros. was supported by President Trump's son-in-law Jared Kushner. On the other hand, some prominent Democrats objected to Paramount's bid, questioning the Middle Eastern background of its $24 billion funding.

Key economic data and event forecasts

21:30 Beijing time: US trade balance for September (100 million dollars) (1204-1211), number of US jobless claims for the week ending December 6 (10,000).

23:00 Beijing time: Final monthly rate of wholesale inventory in the US in September (%).

The next day at 01:00 a.m. Beijing time: The Federal Reserve released data on the financial health of US households in the capital flow report for the third quarter of 2025.

Performance Forecast

Friday morning: Broadcom (AVGO.US), Market Opener (COST.US)

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal