Does Ventas Still Offer Value After Its Strong 2025 Run and DCF Implied Upside?

- Wondering if Ventas is still a smart buy after its big run, or if you might be late to the party? In this piece, we break down whether the current price makes sense or is quietly offering value.

- Ventas has pulled back about 3.4% over the last 7 days, but is still up 2.0% over 30 days and 34.1% year to date, building on 1 year, 3 year, and 5 year gains of 33.3%, 86.5%, and 79.7% respectively.

- Recently, the stock has been in focus as investors reassess healthcare real estate plays amid shifting interest rate expectations and ongoing demand for senior housing and medical facilities. Sector wide news about aging demographics and capital flowing back into high quality REITs has increased attention on names like Ventas as potential long term compounders.

- Right now, Ventas scores a 3/6 valuation score, suggesting it screens as undervalued on half of our key checks. Next, we will look at what different valuation approaches say about that number and outline a more complete way to judge value that we will return to at the end.

Approach 1: Ventas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what Ventas is worth today by projecting its adjusted funds from operations into the future and discounting those cash flows back to the present using a required return.

Ventas generated about $1.31 billion in free cash flow over the last twelve months, and analysts expect this to rise steadily over time. Based on current estimates and Simply Wall St extrapolations, free cash flow is projected to reach roughly $2.11 billion by 2029, with further growth taking it to about $2.95 billion by 2035. These future cash flows (in dollars) are discounted under a two stage Free Cash Flow to Equity model to reflect risk and the time value of money.

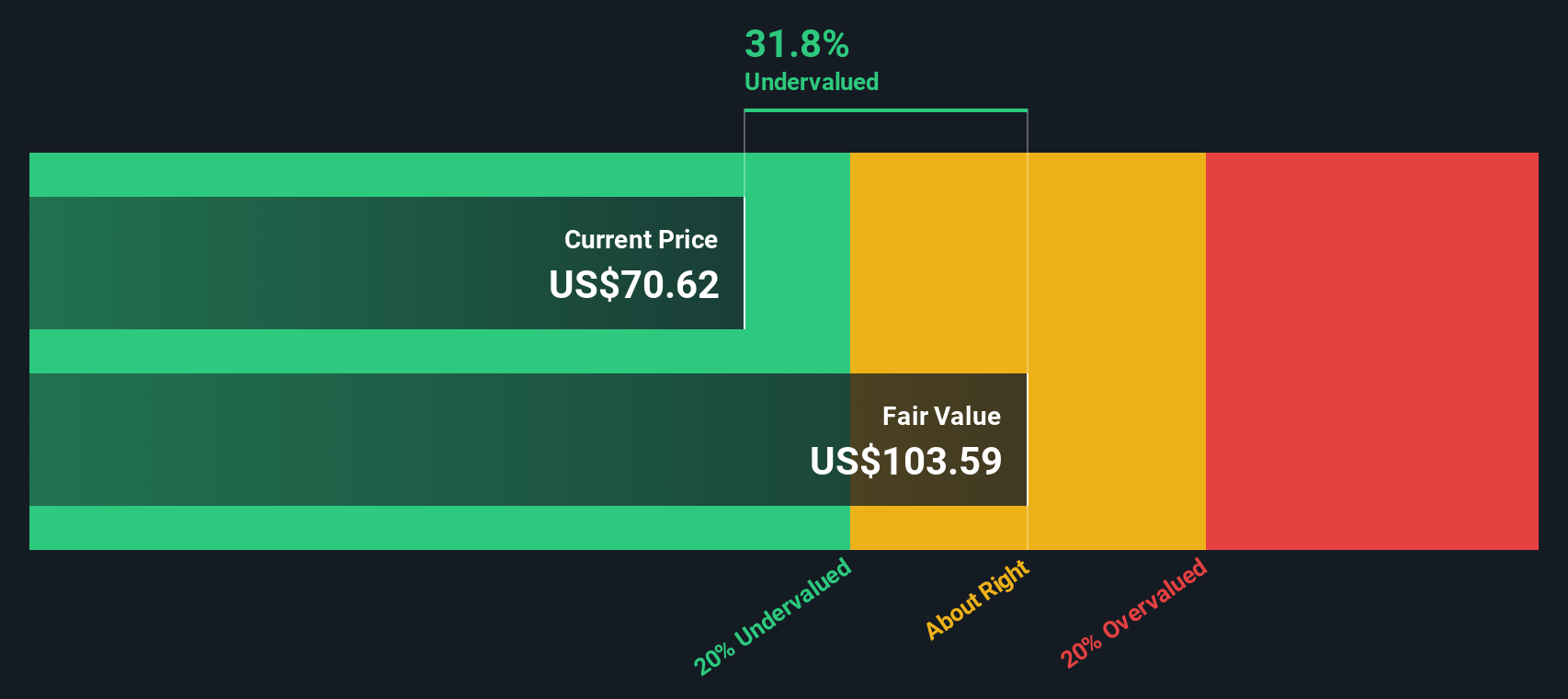

On this basis, the intrinsic value for Ventas is estimated at $107.05 per share. Compared with the current share price, the DCF implies the stock trades at about a 27.4% discount, which indicates potential undervaluation if these cash flow assumptions occur as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ventas is undervalued by 27.4%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

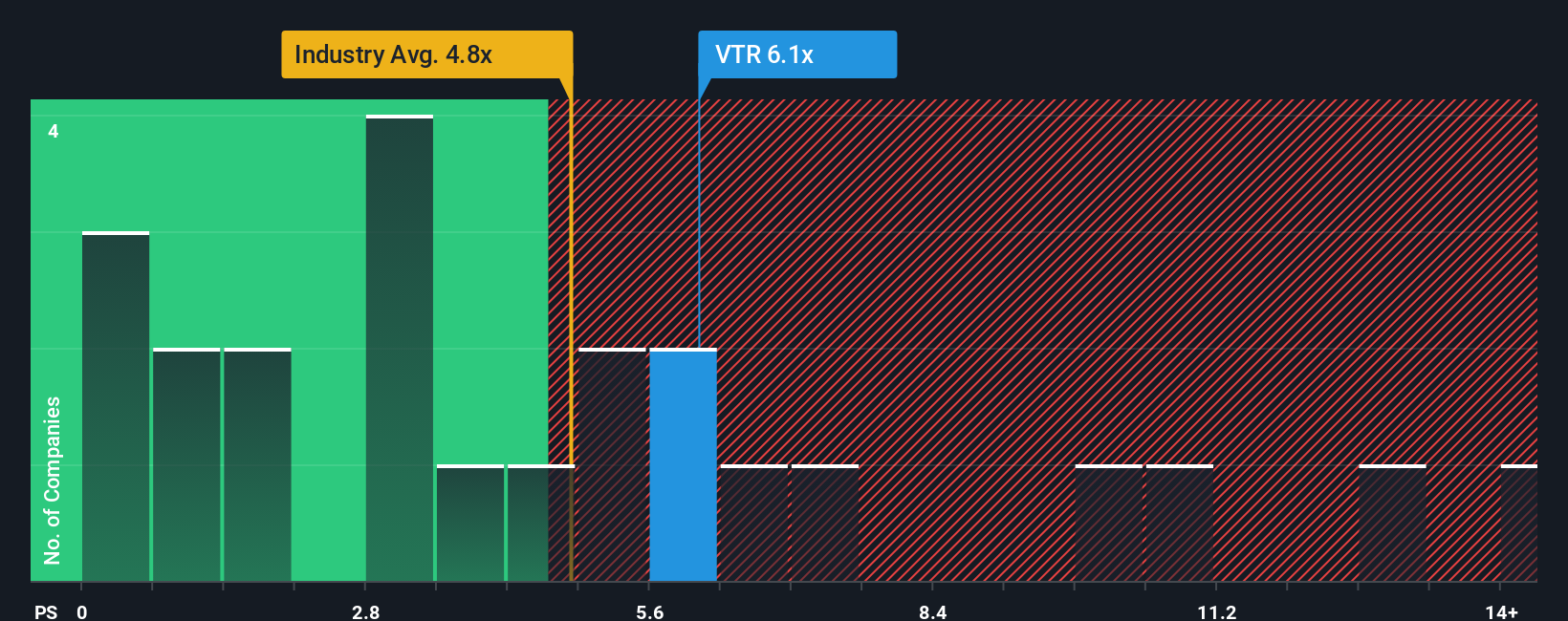

Approach 2: Ventas Price vs Sales

For a real estate investment trust like Ventas, the price to sales multiple is a useful way to gauge value because revenue tends to be more stable and less noisy than earnings, which can swing with depreciation, interest costs, and one off items.

In general, investors are willing to pay a higher price to sales multiple when they expect stronger growth and see lower risk, while slower growth or higher uncertainty usually justifies a lower, more conservative multiple. Ventas currently trades on a price to sales ratio of 6.59x, which is slightly above the Health Care REITs industry average of 6.44x but below the 7.52x average for its closest peers. Simply Wall St also calculates a Fair Ratio of 5.81x, a proprietary estimate of what a reasonable multiple should be once factors like growth prospects, profitability, industry dynamics, company size, and risk profile are all blended together. This tailored yardstick is more informative than blunt peer or sector comparisons because it adjusts for what actually makes Ventas different. Since the current 6.59x multiple sits meaningfully above the 5.81x Fair Ratio, the shares look somewhat expensive on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ventas Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St's Community page that lets you attach your own story to the numbers by setting assumptions for Ventas future revenue, earnings, and margins. This turns that story into a financial forecast and then into a Fair Value you can compare with today’s share price to decide whether to buy, hold, or sell. Narratives are dynamic, updating automatically as new news, earnings, or guidance arrives, so your view of Ventas does not stay static while the world changes. For example, one investor might build a bullish Ventas Narrative around accelerating revenue growth of about 13.9%, expanding profit margins near 6.9%, and a higher Fair Value of roughly $82.95 per share. Another, more cautious investor could plug in slower growth and lower margins that produce a meaningfully lower Fair Value, and Narratives makes both perspectives visible and comparable in one place.

Do you think there's more to the story for Ventas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal