TrendForce Jibang Consulting: Memory growth is expected to continue to be strong in the first quarter of 2026

The Zhitong Finance App learned that according to the latest survey by TrendForce Jibang Consulting, due to the fact that memory prices are expected to rise significantly in the first quarter of 2026, global terminal products are facing difficult cost tests. The smartphone and laptop industry will raise product prices and reduce specifications. It is inevitable that sales prospects will be revised again, and resource advantages will be highly concentrated on a few leading brands.

TrendForce Jibang Consulting said that the impact of memory on BOM costs of consumer terminals such as smartphones and PCs is rapidly expanding. Even for the iPhone series, which has relatively excellent profit performance, the share of memory in the BOM cost of the entire machine will increase markedly in the first quarter of 2026, forcing Apple to re-examine the pricing of new models, and not rule out reducing or canceling the price reduction of old models.

For Android brands that focus on the low to medium market, memory, as one of the main marketing highlights, originally accounted for a high share of BOM costs. As the price of such components soars, 2026 will inevitably drive brands to increase the pricing of new models and adjust the price or supply cycle of old models to reduce losses.

TrendForce Jibang Consulting analyzed that rising memory prices will push laptop brands to adjust product portfolios, procurement strategies, and regional sales layouts. Among them, since mobile DRAM is generally directly welded to the motherboard, high-end lightweight laptops are unable to control costs by lowering regulations or replacing modules, and due to design restrictions on changes in specifications, they may become the earliest and largest market segment showing price increase pressure.

As for the consumer laptop market, although demand is sensitive to changes in machine specifications and sales prices, there are still inventories of finished products and low-price memory to support profit performance. It is expected that existing pricing can be maintained in the short term, but the medium to long term will still be reduced or adjusted. It is expected that the PC market will enter a significant price adjustment period in the second quarter of 2026.

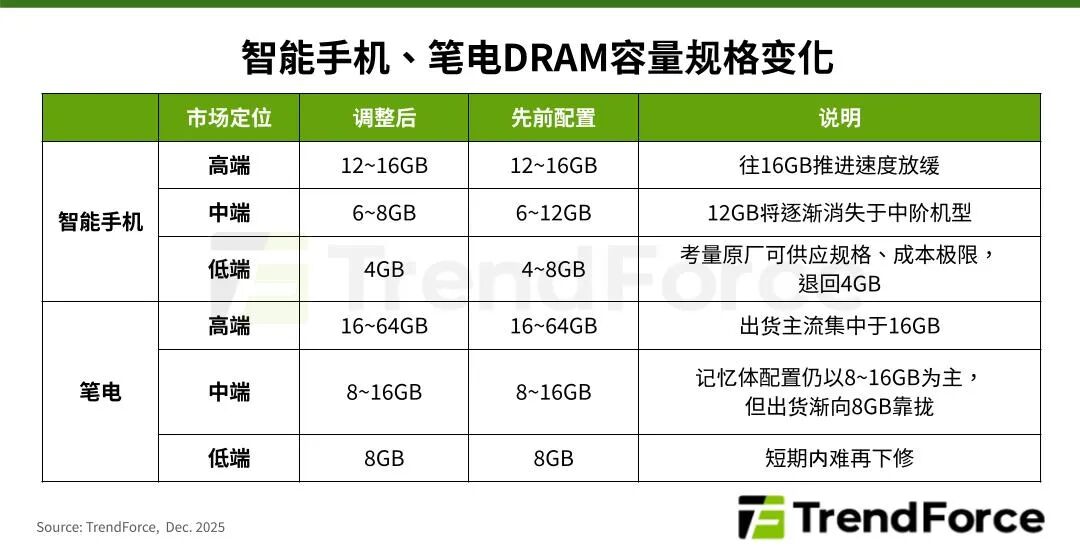

TrendForce Jibang Consulting pointed out that “reducing specifications” or “suspending upgrades” has become a necessary means for smartphone and laptop brands to balance costs. Among them, DRAM revisions, which account for relatively high costs, are more obvious. It is expected that the DRAM capacity specifications for high-end and mid-tier products will be concentrated at the lowest standard in this market, and the rate of increase will slow down. As for the low-end market, it is the price range that has been hit the most. Taking mobile phones as an example, in 2026, the return was mainly 4GB; due to limited processor configurations and operating system requirements, it is difficult to upgrade the DRAM configuration in the short term.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal