Gibraltar Industries (ROCK): Rethinking Valuation After Mixed Q3 Results and Agtech Project Delay

Gibraltar Industries (ROCK) heads into its Sidoti Year End Virtual Investor Conference with investors still digesting a mixed Q3. Revenue grew 12% but missed expectations, and a delayed agtech project weighed on the story.

See our latest analysis for Gibraltar Industries.

The mixed quarter and delayed agtech project seem to be weighing on sentiment, with a 30 day share price return of minus 17.57 percent and a 1 year total shareholder return of minus 26.01 percent. This suggests momentum has clearly cooled despite positive three year total shareholder returns.

If this kind of reset has you rethinking where growth could come from next, it may be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar opportunities.

With revenue growth but earnings pressure, a surging backlog yet weak recent returns, and the stock trading well below analyst targets, is Gibraltar now a mispriced value opportunity or is the market correctly discounting its future growth?

Most Popular Narrative: 40.6% Undervalued

With Gibraltar Industries last closing at $50.52 against a narrative fair value of $85, the stage is set for a sharp valuation disconnect debate.

The divestiture of the Renewables segment and renewed focus on core Building Products and Structures businesses are expected to simplify operations, support more effective resource allocation, and position the company to participate in long-term trends in North American infrastructure and urbanization, which in turn may support both revenue growth and margin expansion.

Curious how flat earnings, rising margins, and a significantly higher assumed future profit multiple can still point to substantial upside? The full narrative walks through every step of that math.

Result: Fair Value of $85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained residential softness and execution risks in project based Agtech and Infrastructure work could quickly test the upbeat undervaluation thesis.

Find out about the key risks to this Gibraltar Industries narrative.

Another Angle on Valuation

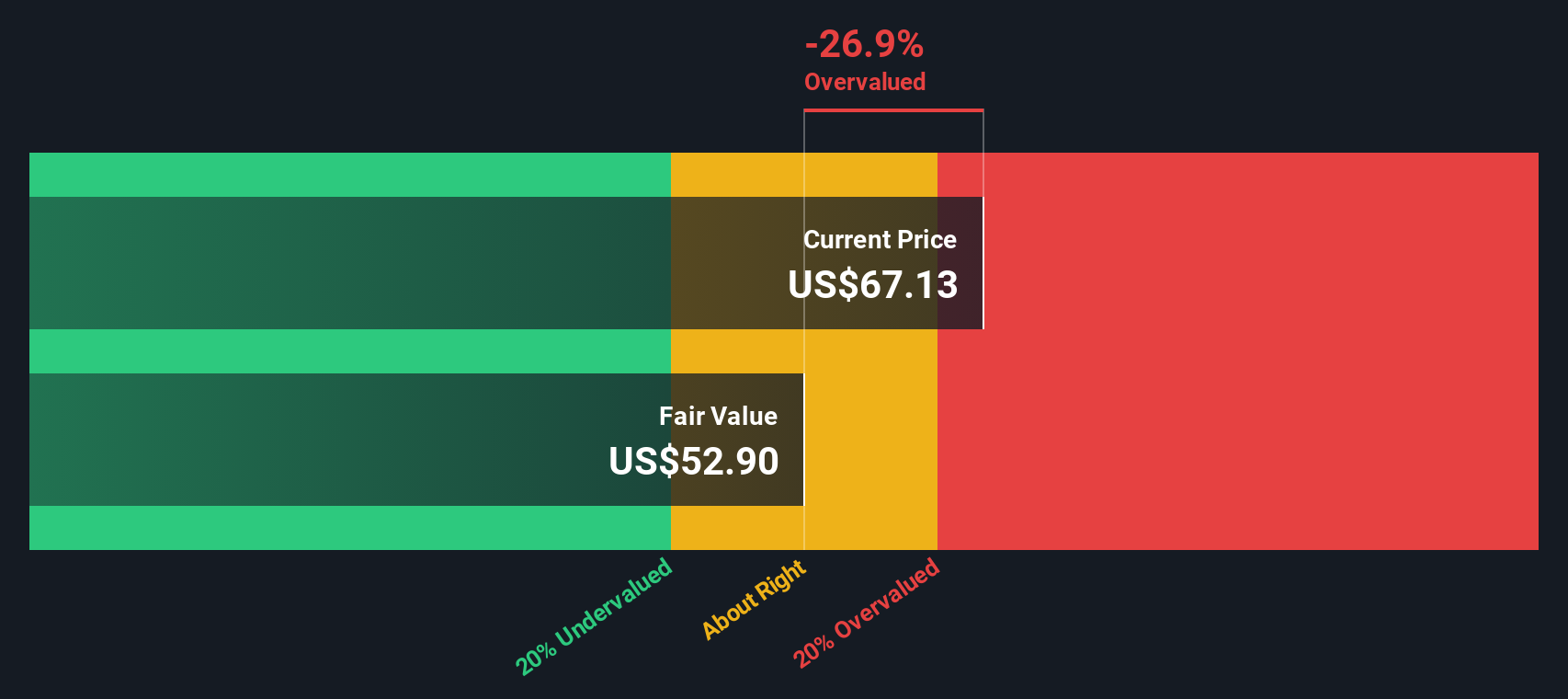

Analysts see upside from today’s price, yet our DCF model paints a harsher picture, implying Gibraltar could be trading above its fair value today. When one method shouts opportunity and another warns of overpayment, which lens do you trust more for the next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gibraltar Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gibraltar Industries Narrative

If you see the story differently or want to dive into the numbers yourself, you can craft a personalized view in just minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Gibraltar Industries.

Ready for your next investing move?

Before you move on, consider using the Simply Wall Street Screener to uncover fresh, data driven ideas that might complement a position in Gibraltar.

- Explore income potential by scanning these 12 dividend stocks with yields > 3% that balance yields with fundamentals and payout histories.

- Review potential market mispricing with these 908 undervalued stocks based on cash flows, where cash flows and conservative assumptions highlight companies trading below certain valuation estimates.

- Assess innovation opportunities through these 26 AI penny stocks, focusing on businesses using artificial intelligence to support revenue growth and competitive positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal