Global Value Stocks Trading At An Estimated Discount

As global markets navigate a landscape marked by interest rate speculations and mixed economic signals, investors continue to seek opportunities amid the evolving macroeconomic environment. In this context, identifying undervalued stocks that trade at an estimated discount can offer potential value, especially when considering companies with strong fundamentals in sectors poised for resilience or recovery.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stellantis (BIT:STLAM) | €10.17 | €20.10 | 49.4% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.32 | 49.8% |

| Last One MileLtd (TSE:9252) | ¥3440.00 | ¥6859.03 | 49.8% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩28700.00 | ₩57171.84 | 49.8% |

| H.U. Group Holdings (TSE:4544) | ¥3305.00 | ¥6592.59 | 49.9% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €10.90 | €21.62 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.393 | €0.78 | 49.4% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.57 | €5.09 | 49.5% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.26 | CN¥55.81 | 49.4% |

Let's review some notable picks from our screened stocks.

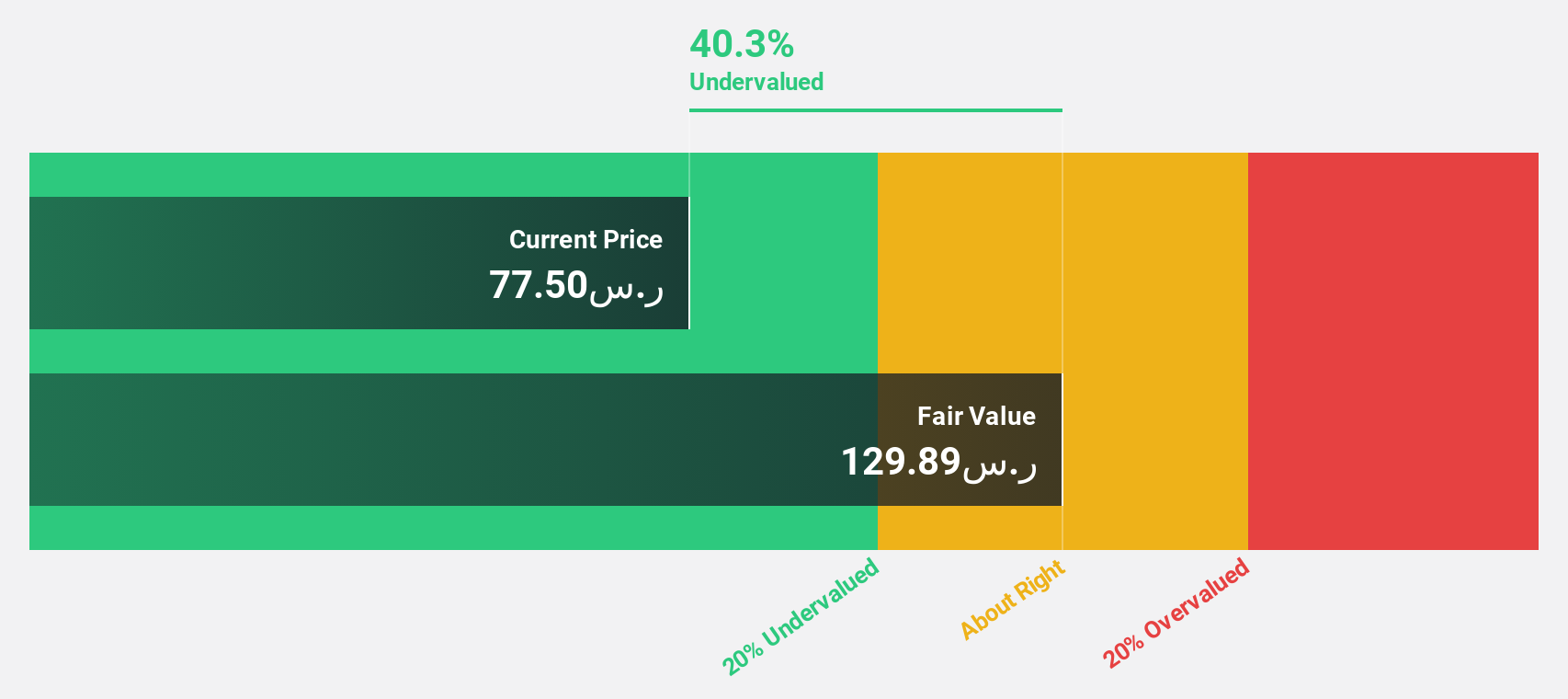

Arabian Drilling (SASE:2381)

Overview: Arabian Drilling Company operates as an onshore and offshore gas and oil rig drilling company in Saudi Arabia, with a market cap of SAR8.38 billion.

Operations: The company's revenue segments include SAR2.41 billion from Land Rigs and SAR1.05 billion from Off-Shore Rigs.

Estimated Discount To Fair Value: 45.6%

Arabian Drilling is trading at SAR 94.15, significantly below its estimated fair value of SAR 173.07, indicating potential undervaluation based on cash flows. Despite a challenging financial year with net losses in Q3 and reduced profit margins, the company anticipates significant earnings growth of over 36% annually. Recent contract renewals with Saudi Aramco, valued over SAR 2 billion, bolster a record backlog of SAR 12.2 billion, enhancing future cash flow prospects.

- Our expertly prepared growth report on Arabian Drilling implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Arabian Drilling with our detailed financial health report.

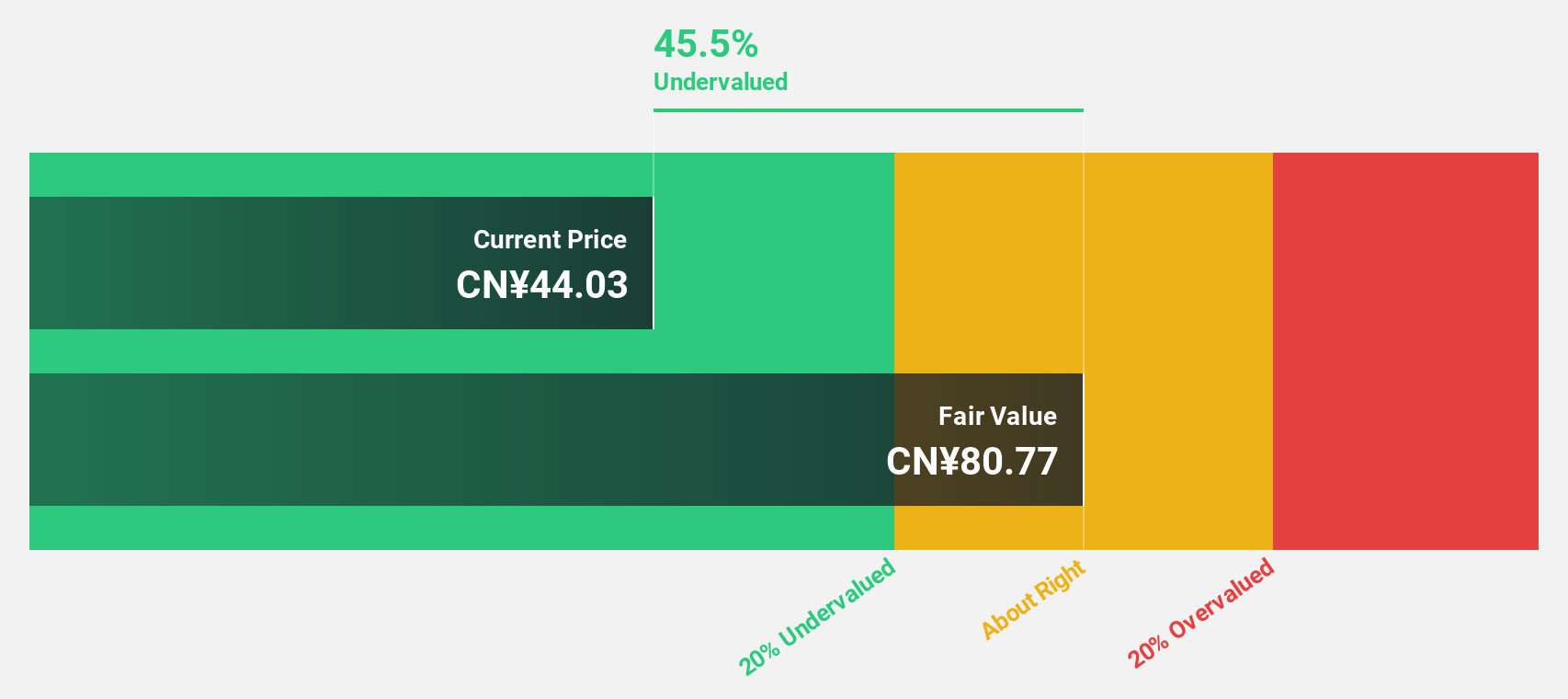

Tianqi Lithium (SZSE:002466)

Overview: Tianqi Lithium Corporation engages in the investment, production, processing, extraction, and sale of lithium and lithium compounds across Australia, Chile, and China with a market cap of CN¥85.16 billion.

Operations: The company's revenue is derived from the investment, production, processing, extraction, and sale of lithium products across Australia, Chile, and China.

Estimated Discount To Fair Value: 48.1%

Tianqi Lithium, trading at CN¥53.1, is significantly undervalued compared to its estimated fair value of CN¥102.33, presenting a potential opportunity based on cash flows. Despite recent volatility and a drop in sales to CN¥7.4 billion for the first nine months of 2025, the company turned profitable with net income of CN¥179.9 million from a previous loss. Revenue growth is expected to outpace the market at 19.4% annually, supporting future cash flow improvement.

- Upon reviewing our latest growth report, Tianqi Lithium's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Tianqi Lithium.

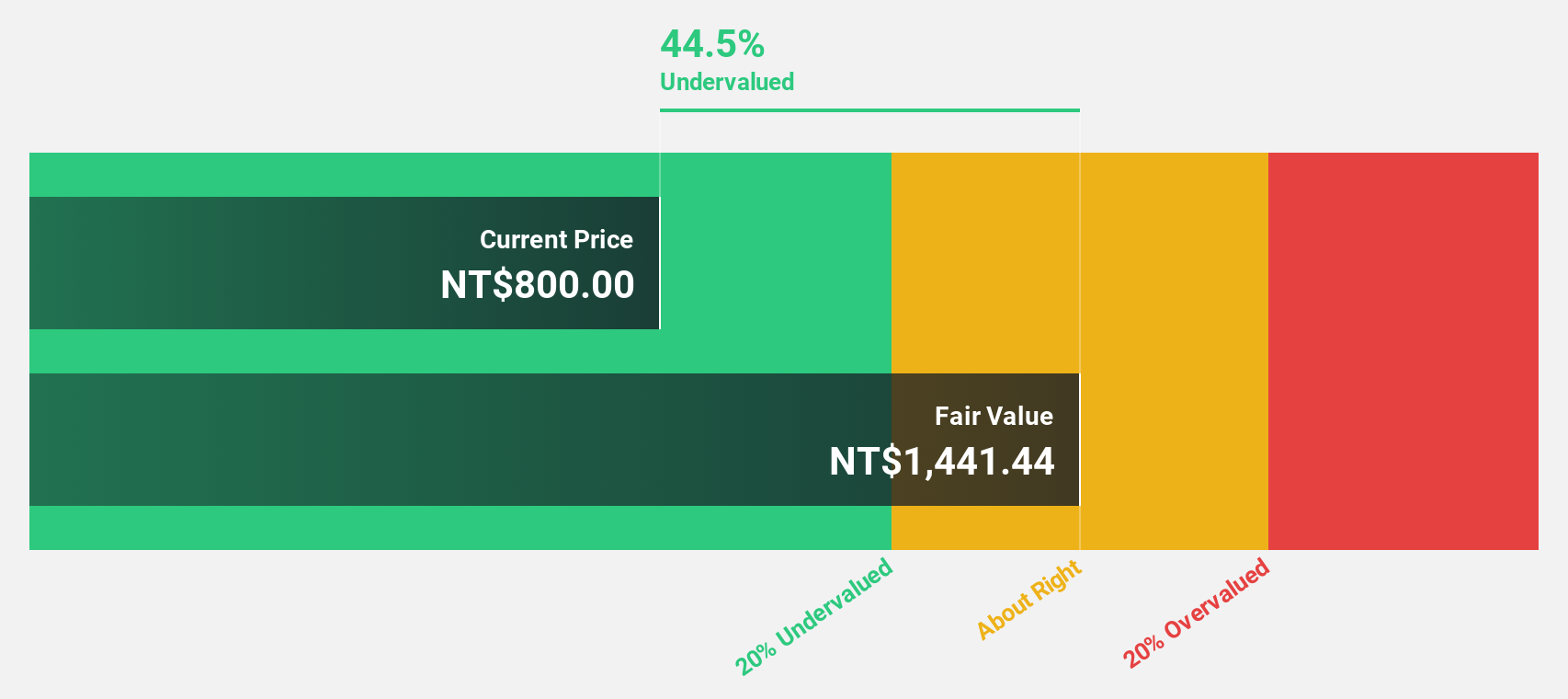

Fositek (TWSE:6805)

Overview: Fositek Corp. designs and manufactures metal stamping products across Asia, the United States, and Europe, with a market cap of NT$105.23 billion.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to NT$11.21 billion.

Estimated Discount To Fair Value: 40.4%

Fositek is trading at NT$1605, significantly below its estimated fair value of NT$2693.04, highlighting potential undervaluation based on cash flows. Recent earnings show robust growth with third-quarter sales rising to TWD 3.57 billion from TWD 1.99 billion year-over-year and net income doubling to TWD 686.96 million. Earnings are forecast to grow significantly at over 51% annually, outpacing the market, though share price volatility remains a concern for investors seeking stability.

- Our comprehensive growth report raises the possibility that Fositek is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Fositek.

Turning Ideas Into Actions

- Gain an insight into the universe of 504 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal