Comfort Systems USA (FIX) Valuation After S&P 500 Inclusion and Strong Share Price Momentum

Comfort Systems USA (FIX) is back in the spotlight after being tapped to join the S&P 500 on December 22, an index upgrade that tends to boost both investor attention and passive fund demand.

See our latest analysis for Comfort Systems USA.

The S&P 500 upgrade caps a breakout year for Comfort Systems USA, with a 138 percent year to date share price return and a 117 percent one year total shareholder return, signaling strong, still building momentum after record quarterly results.

If this kind of run has you wondering what else might be setting up for the next leg higher, now is a good time to explore fast growing stocks with high insider ownership.

With shares at all time highs and analysts scrambling to lift targets, investors now face a tougher question: is Comfort Systems USA still trading below its true earning power, or is the market already pricing in years of future growth?

Most Popular Narrative Narrative: 10% Undervalued

With Comfort Systems USA last closing at $1,021.36 against a narrative fair value of $1,132.80, the story leans toward upside grounded in long term earnings power.

Ongoing modular construction expansion, with modular revenue now 18% of total and more capacity coming online, is capitalizing on industry movement toward integrated and efficient building solutions supporting higher revenue growth and gross margin expansion.

Curious how sustained double digit growth, rising margins, and a lower future earnings multiple can still support a premium valuation narrative for an industrial contractor? The full story reveals the exact growth runway, profitability shift, and valuation reset that have to line up almost perfectly for this fair value to hold.

Result: Fair Value of $1,132.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to technology-led projects and persistent skilled labor shortages could quickly pressure margins and challenge the current upside narrative.

Find out about the key risks to this Comfort Systems USA narrative.

Another Lens on Valuation

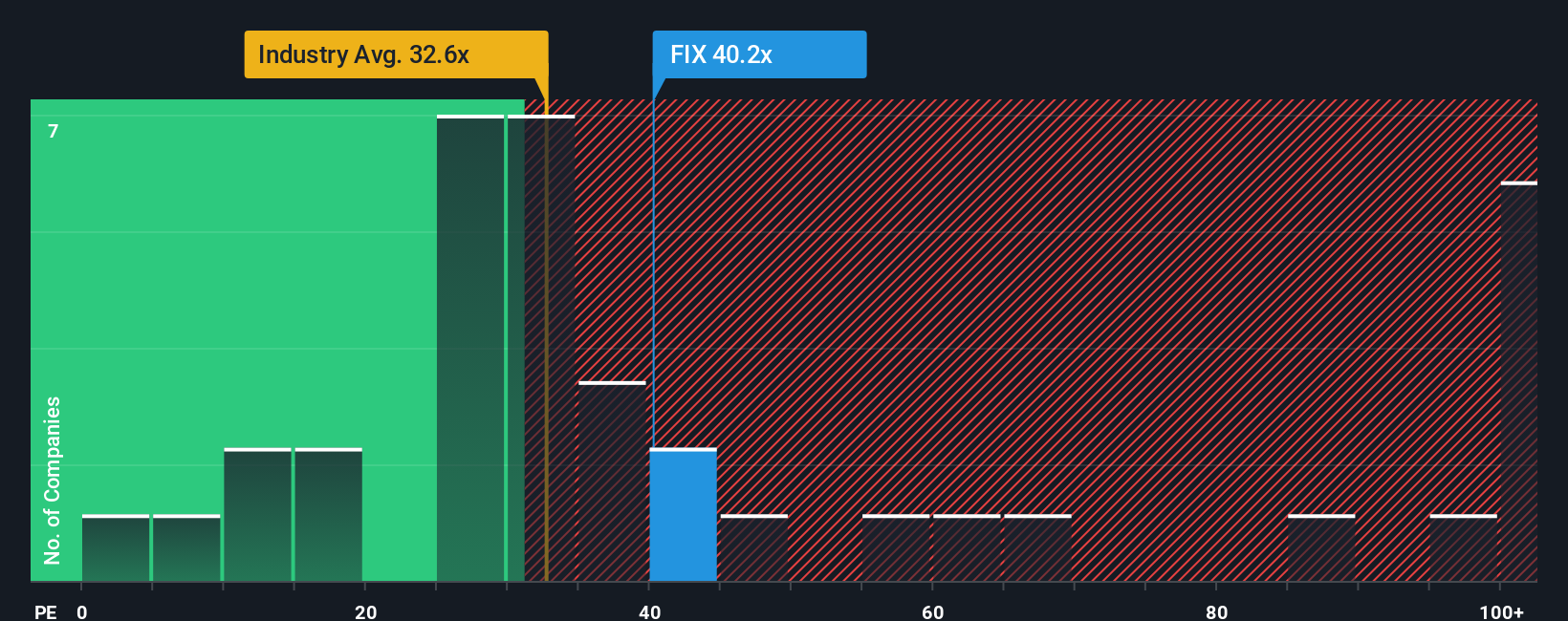

On simple earnings terms, Comfort Systems USA looks punchy, trading on about 42.9 times earnings versus 33.4 times for the US Construction industry and 63.2 times for close peers. Its fair ratio is 43.7 times, suggesting the market may edge higher, but it leaves little room for slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Comfort Systems USA Narrative

If you are not fully aligned with this view, or would rather dig into the numbers yourself, you can build a personalized thesis in just minutes: Do it your way.

A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You are already ahead of the crowd by analyzing Comfort Systems USA, but you may miss additional opportunities if you ignore other high potential ideas next.

- Explore misunderstood bargains by running through these 906 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow driven pricing.

- Consider the next wave of innovation by reviewing these 26 AI penny stocks positioned at the intersection of automation, data, and scalable software models.

- Identify potentially steadier income streams by filtering for these 12 dividend stocks with yields > 3% that combine regular payouts with sustainable balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal