Energizer (ENR): Valuation Check After Mixed Q4 2025 Results and Dividend Resilience Concerns

Energizer Holdings (ENR) just released its Q4 2025 results, and the story is a mixed bag, with higher net sales from acquisitions but weaker earnings after impairment charges and debt payoff losses affected the bottom line.

See our latest analysis for Energizer Holdings.

At around $19.43, Energizer Holdings has bounced in the last week with a 1 week share price return of 4.63 percent. However, the 1 year total shareholder return of negative 44.42 percent shows longer term momentum is still firmly under pressure as investors weigh impairments, leverage and the durability of its dividend story.

If this kind of volatility has you looking beyond staples, it could be a good moment to explore fast growing stocks with high insider ownership as a way to spot other compelling ideas on your radar.

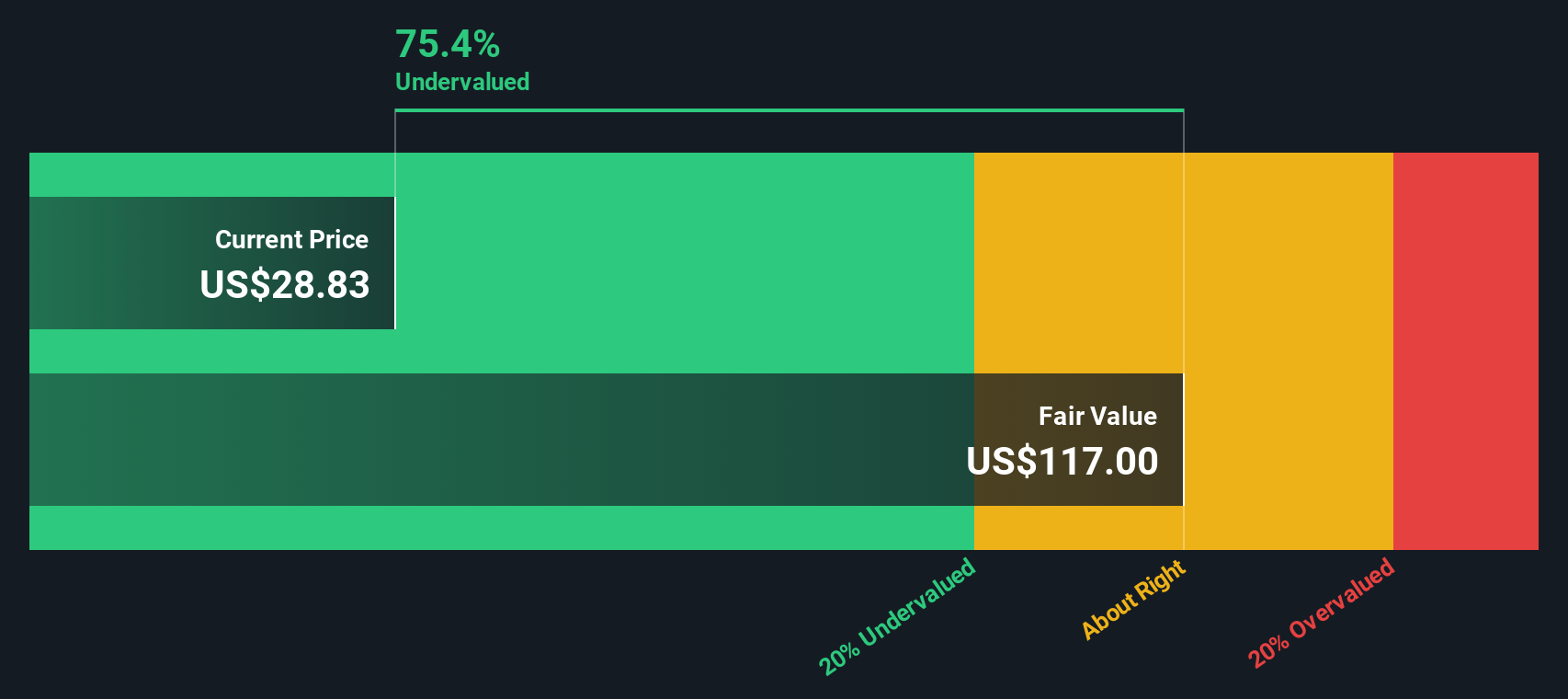

With earnings pressured by impairments but analysts still seeing upside to fair value, is Energizer now trading at an unwarranted discount, or is the market already bracing for weaker growth and dividend risk ahead?

Price-to-Earnings of 5.6x: Is it justified?

On a simple price-to-earnings basis, Energizer Holdings looks deeply out of favor, with its 5.6x multiple implying a steep discount to peers despite the recent share price bounce.

The price-to-earnings ratio compares what investors pay for each dollar of current earnings, and it is especially important for established, cash generative consumer brands like Energizer, where profitability and consistency matter more than hyper growth.

Here, the market is assigning a far lower multiple than both the global Household Products industry average of 17.3x and ENR's fair price-to-earnings ratio of 12.9x. This suggests investors are heavily discounting its earnings power relative to sector norms and the level our fair ratio analysis indicates the stock could move toward over time.

Against global peers on 17.3x earnings and a peer average of 17.5x, Energizer's 5.6x stands out as dramatically cheaper. This reinforces the picture of a stock priced well below both its industry and statistically estimated fair valuation.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 5.6x (UNDERVALUED)

However, sustained share price underperformance and any deterioration in dividend security could quickly overshadow valuation support and further pressure the market narrative.

Find out about the key risks to this Energizer Holdings narrative.

Another View: Our DCF Model Paints a Wilder Picture

While the earnings multiple hints at a bargain, our DCF model goes much further, suggesting fair value near $90.98 versus the current $19.43. That implies Energizer might be trading at roughly a fifth of its estimated worth, but this raises the question of whether this is a genuine mispricing or a sign that cash flow assumptions are too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you would rather challenge these conclusions and rely on your own due diligence, you can build a personalized view from scratch in just minutes. Do it your way.

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next steps by scanning focused stock shortlists that could upgrade your portfolio quality and future return potential.

- Target reliable income streams by reviewing these 12 dividend stocks with yields > 3% that can help anchor your portfolio in choppier markets.

- Capitalize on breakthrough innovation with these 26 AI penny stocks that are reshaping entire industries using intelligent automation and data driven products.

- Position yourself ahead of the crowd by sifting through these 906 undervalued stocks based on cash flows that may offer meaningful upside before the market fully catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal