How Investors Are Reacting To TUI (XTRA:TUI1) Record Earnings And €250 Million Airline Cost Cuts

- TUI recently reported the highest annual earnings in its history, supported by a 5% rise in customer bookings to 34.7 million and 4.4% revenue growth, while also planning €250 million of cost cuts in its airlines and markets division after higher expenses and Boeing delivery delays.

- This combination of record profitability, strong travel demand and restructuring signals how TUI is trying to protect margins while addressing operational pressures in its airline-heavy model.

- We’ll now examine how record earnings alongside planned €250 million airline cost savings could influence TUI’s long-term investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TUI Investment Narrative Recap

To own TUI, you need to believe its vertically integrated travel model can turn strong customer demand into sustainable profits despite airline and holiday competition. The latest record earnings, alongside planned €250 million airline cost cuts after Boeing delays, support the near term margin story but do not remove the key risk around volatile travel demand and operational shocks in its Markets + Airline division.

Among recent developments, the reaffirmed guidance for FY2025, with revenue expected to grow 5% to 10% and EBIT 7% to 10%, is most relevant. It frames the record earnings and planned airline savings within a still incremental growth outlook, which matters for how investors weigh the upside from efficiency gains against ongoing restructuring costs and exposure to geopolitical or climate related travel disruptions.

Yet investors should be aware of how concentrated geopolitical and climate risks could suddenly affect TUI’s booking volumes and profitability...

Read the full narrative on TUI (it's free!)

TUI’s narrative projects €26.0 billion in revenue and €877.8 million in earnings by 2028.

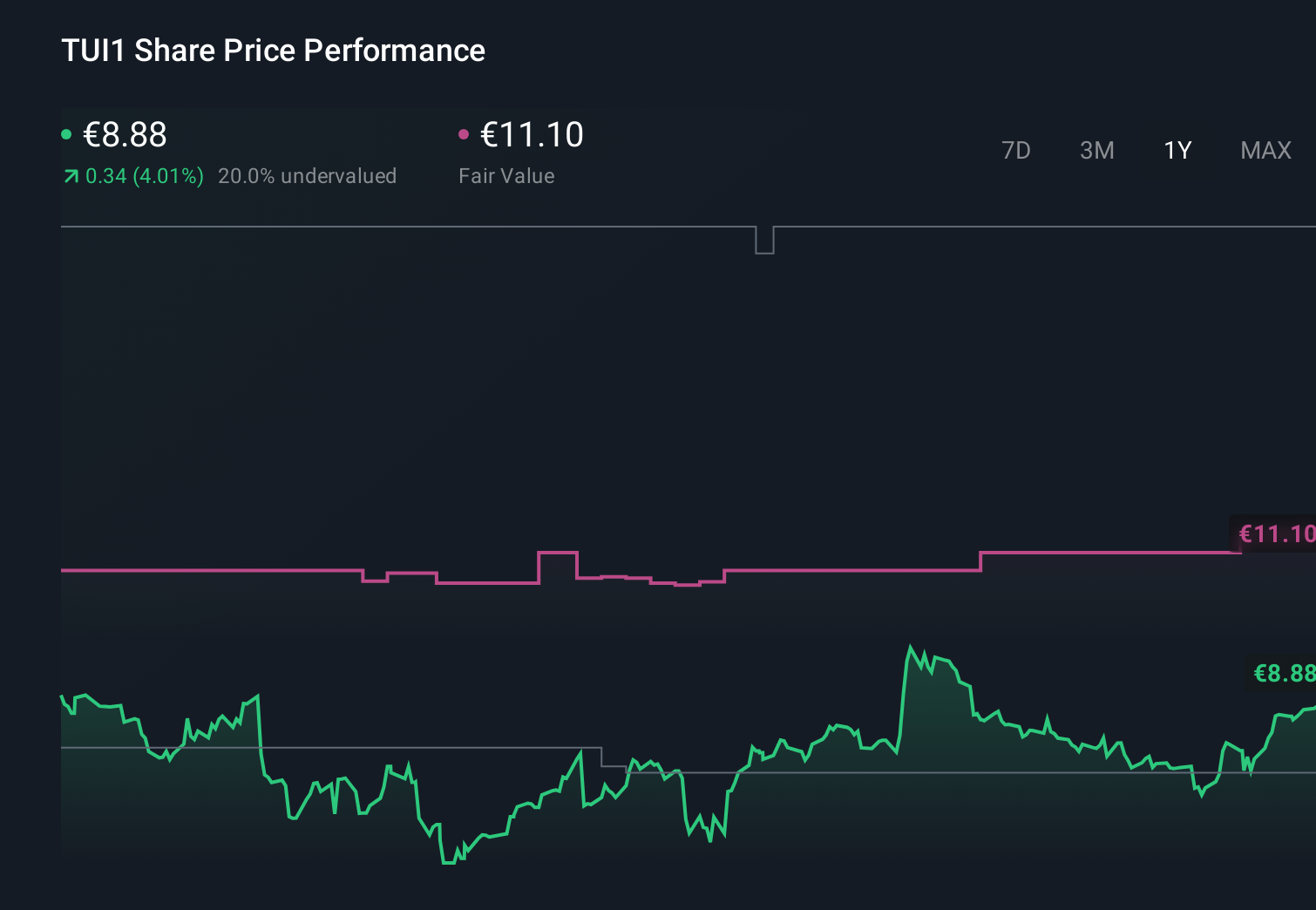

Uncover how TUI's forecasts yield a €11.10 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see TUI’s fair value between €10.64 and about €28.81, underlining how far opinions can stretch. When you set those views against TUI’s reliance on an airline heavy model that is exposed to geopolitical and climate shocks, it becomes clear why reviewing several perspectives on the company’s prospects can be useful.

Explore 9 other fair value estimates on TUI - why the stock might be worth over 3x more than the current price!

Build Your Own TUI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TUI research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free TUI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TUI's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal