UPS (UPS) Valuation Check as It Restructures Away From Amazon Toward Higher-Margin, Cash-Generative Routes

United Parcel Service (UPS) just laid out a bolder reset of its business, planning to cut Amazon delivery volumes in half by mid 2026 while leaning into higher margin routes and cash generation.

See our latest analysis for United Parcel Service.

That reset comes after a rough stretch for investors, with United Parcel Service’s share price down sharply on a year to date basis, but a 90 day share price return of 17.71 percent hinting that sentiment is stabilising as the restructuring and new partnerships, like same day delivery via Roadie, start to reframe its risk reward profile, even though the three year total shareholder return remains deeply negative.

If UPS’s pivot has you rethinking the logistics space, it might be worth scanning fast growing stocks with high insider ownership to spot other companies where insiders are backing strong growth stories with their own capital.

With three years of weak returns but improving free cash flow and a sizeable intrinsic discount, are investors looking at a mispriced turnaround story here, or is the market already baking in UPS’s next leg of growth?

Most Popular Narrative: 4.7% Overvalued

According to NVF, United Parcel Service’s fair value sits just below the latest 99.64 close, setting up a tight debate over how much upside remains.

We expect United Parcel Service's revenue will grow by 1.75% annually over the next 3 years, just slightly above their current growth rate of 1.73%.

We expect that profit margins will increase to 7.15% from 6.34% over the next 3 years.

Curious how modest revenue growth and steadily rising margins can still support a richer earnings multiple in a mature shipper, not a hyper growth tech name? Want to see which profitability and valuation levers NVF pulls to argue that today’s price is already leaning ahead of the story? The full narrative lays out the step by step path from today’s earnings base to a future valuation that assumes UPS regains ground on its biggest competitors without ever needing breakneck expansion.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor tensions or weaker than expected cost savings from Efficiency Reimagined could derail margin gains and challenge the overvaluation thesis.

Find out about the key risks to this United Parcel Service narrative.

Another View, Multiples Point to Value

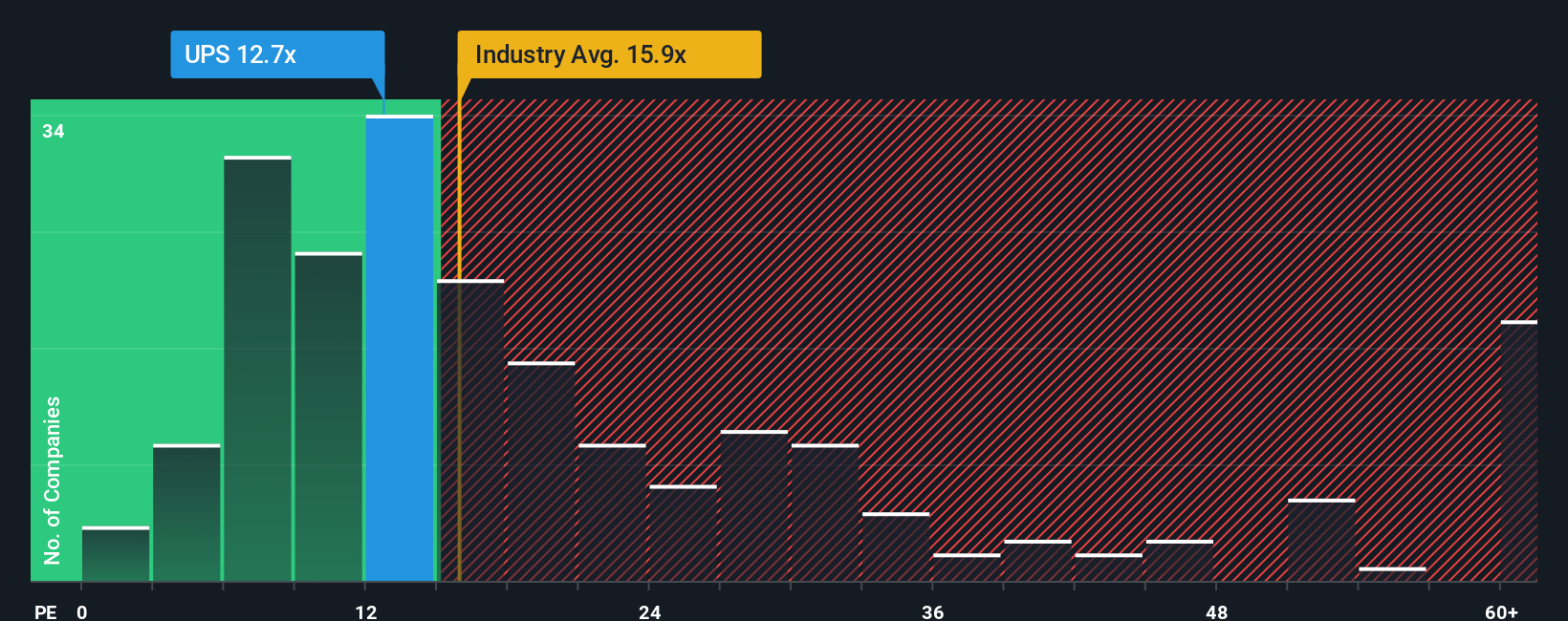

While NVF sees UPS as 4.7 percent overvalued, our valuation using a single earnings multiple tells a different story. UPS trades on 15.4 times earnings, well below peers at 21.2 times and a fair ratio of 19.3 times. This suggests the market may be underpricing a steady, if unspectacular, recovery. Which narrative do you lean toward when the numbers disagree?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Parcel Service Narrative

If these narratives do not quite match your view, or you prefer hands on research, you can build a full perspective in minutes: Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas before you move on?

Do not stop at a single stock. Use the Simply Wall St Screener to quickly uncover other opportunities that could strengthen and balance your portfolio today.

- Capture potential bargain opportunities by targeting companies trading below their estimated cash flow value with these 906 undervalued stocks based on cash flows.

- Ride powerful innovation trends by focusing on businesses harnessing advanced algorithms and automation through these 26 AI penny stocks.

- Boost your income potential by zeroing in on reliable payers using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal