Dave & Buster’s (PLAY) Margin Squeeze Tests Bullish High-Growth Narrative After Q2 2026 Results

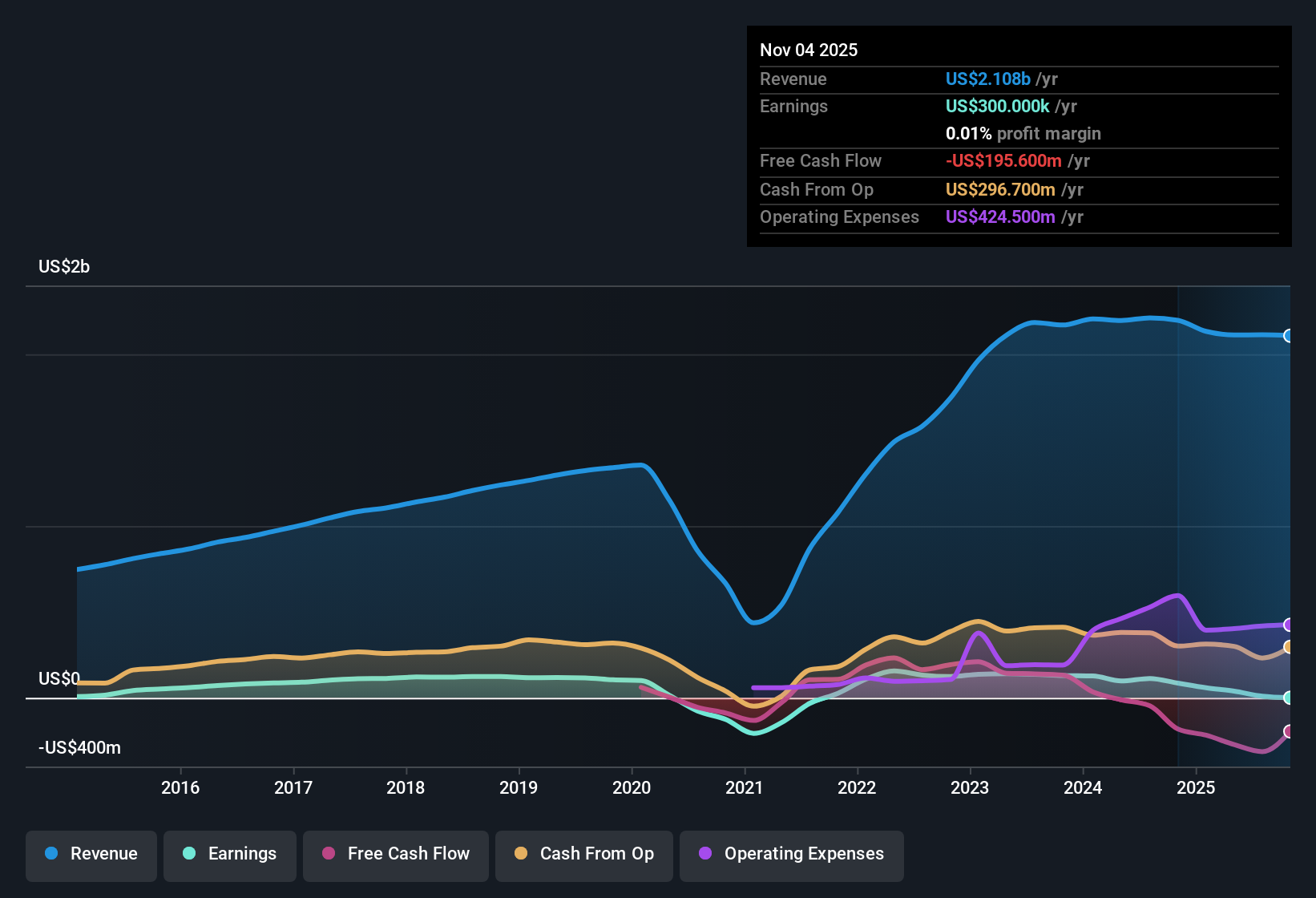

Dave & Buster's Entertainment (PLAY) has just posted another quarter of solid headline numbers, with Q2 2026 revenue of $557.4 million and basic EPS of $0.33, alongside net income of $11.4 million. The company has seen revenue move from $453 million in Q3 2025 to $534.5 million in Q4 2025, then to $567.7 million in Q1 2026 and $557.4 million in Q2 2026, while EPS swung from a loss of $0.84 in Q3 2025 to positive readings of $0.25, $0.63, and $0.33 over the subsequent quarters. With analysts still expecting robust earnings growth ahead, investors will be weighing how the latest results reflect on the sustainability of the company’s margins.

See our full analysis for Dave & Buster's Entertainment.With the numbers on the table, the next step is to see how this earnings profile lines up with the most common narratives around Dave & Buster's and where those stories might need a rethink.

See what the community is saying about Dave & Buster's Entertainment

Margins Squeezed to 0.5 Percent

- Trailing net profit margin sits at just 0.5 percent compared with 5.1 percent a year earlier, and includes a $33.9 million one off loss that dragged the past 12 month figures down.

- Bears highlight that such thin profitability, combined with that $33.9 million charge, leaves little room for error. However, the consensus narrative still expects a back to basics strategy and revamped marketing to improve net margins over time.

- Consensus narrative points to initiatives like TV advertising and promotions such as the Eat and Play Combo as tools to lift customer traffic and help rebuild margins on top of the current 0.5 percent base.

- The same narrative also expects more disciplined store remodels and capital allocation to support free cash flow, which would need to show up as a clear improvement from today’s low margin level.

High P E Versus DCF Fair Value

- The stock trades on a trailing P E of 72.6 times against a peer average of 14.6 times and an industry average of 23.1 times, while the DCF fair value of $6.91 sits well below the current share price of $20.31.

- Critics argue that paying such a rich multiple leaves little margin of safety, even though the consensus narrative expects strategic store development and financial optimizations to enhance shareholder value.

- The consensus view leans on analysts expecting earnings to reach $105.4 million by about 2028, but today’s valuation already prices in a lot of that improvement relative to the $38.6 million base used in the forecast.

- Plans for continued share repurchases are framed as a way to boost EPS, yet those buybacks occur while the market price is far above the $6.91 DCF fair value anchor.

60 Percent Earnings Growth Versus 5 Percent Revenue

- Earnings are forecast to grow about 60 percent per year over the next three years, while revenue is expected to rise a much slower 5.1 percent per year, below the wider US market’s 10.7 percent forecast.

- Consensus narrative leans bullish here, suggesting that a back to basics strategy and innovative games can lift margins enough for earnings to outpace modest sales growth, yet the recent drop in trailing net margin to 0.5 percent shows how much execution work is still needed.

- Supporters point to expectations that profit margins could increase from 1.8 percent today to 4.3 percent in three years, which would help square the gap between 5.1 percent revenue growth and 60 percent earnings growth.

- At the same time, the prior 9.4 percent decline in comparable store sales and weak interest coverage in the last 12 months underline why those bullish margin targets cannot be taken for granted.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dave & Buster's Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that others might be missing? Shape that perspective into a focused narrative in just a few minutes, Do it your way.

A great starting point for your Dave & Buster's Entertainment research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Despite upbeat growth narratives, Dave & Buster's is wrestling with razor thin margins, modest revenue growth, and a valuation that already reflects highly optimistic earnings forecasts.

If paying up for fragile profitability feels risky, use our these 900 undervalued stocks based on cash flows to quickly focus on companies where cash flow and earnings power better support the current share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal