Is Bank of Montreal (TSX:BMO) Still Undervalued After Its Recent 28% One-Year Return?

Bank of Montreal (TSX:BMO) has quietly ground out steady gains this year, and with shares now trading around CA$175, many investors are asking whether the recent run still offers reasonable long term value.

See our latest analysis for Bank of Montreal.

At around CA$175.23, BMO’s share price has cooled slightly after a strong year to date, but the roughly 28 percent one year total shareholder return suggests momentum is still broadly constructive rather than fading.

If BMO’s steady climb has you thinking more about financials, it could also be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With BMO trading just below analyst targets yet at a sizable discount to some intrinsic value estimates, the key question now is simple: is this a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative: 40% Undervalued

With Bank of Montreal closing at around CA$175, the most widely followed narrative points to a higher fair value anchored in steady earnings expansion and modest multiple assumptions.

The unified U.S. business structure is expected to enhance organic loan and deposit growth, especially among mass affluent and commercial clients, as well as improve ROE and market share, translating to medium term increases in both revenue and earnings.

Curious how that growth story translates into a higher valuation? The narrative leans on rising revenues, firm profit margins, and a future earnings multiple that quietly rivals sector leaders. Want to see exactly how those moving parts add up to the fair value?

Result: Fair Value of CA$175.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat scenario could be challenged if credit quality deteriorates or if slower Canadian growth forces higher loan loss provisions and weaker operating leverage.

Find out about the key risks to this Bank of Montreal narrative.

Another Lens on Valuation

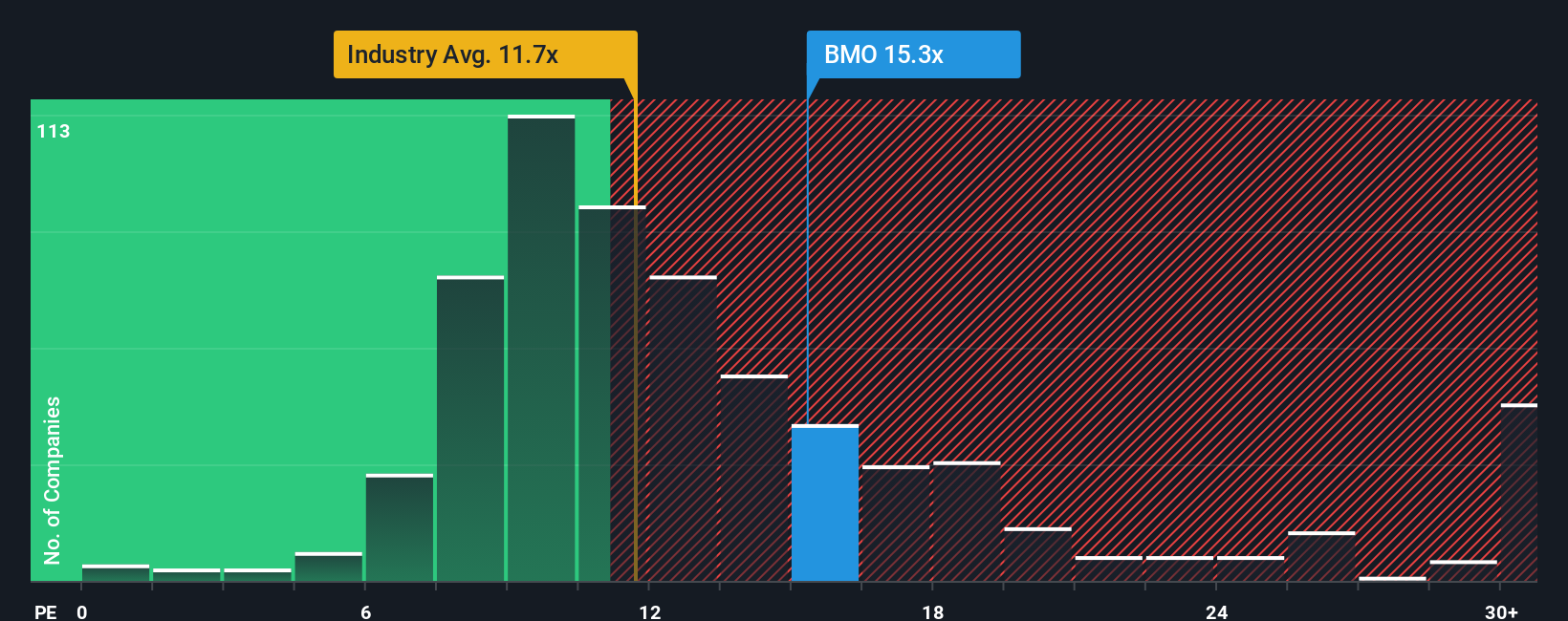

On earnings, the picture is far less generous. BMO trades on a price to earnings ratio of about 15.1 times, slightly above peers at 14.8 times and clearly above its fair ratio of 14.6 times, hinting at limited margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Montreal Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make sure you are not leaving potential opportunities on the table. Use the Simply Wall St Screener to uncover stocks that fit your strategy.

- Harness potential income by targeting these 15 dividend stocks with yields > 3% offering yields that can strengthen your portfolio’s cash flow.

- Position yourself at the forefront of innovation by backing these 26 AI penny stocks that are reshaping industries with transformational technology.

- Explore possible market mispricings by scanning these 900 undervalued stocks based on cash flows where cash flow strength may not yet be fully reflected in share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal