Global Dividend Stocks: 3 Top Picks For Your Portfolio

As global markets navigate the anticipation of interest rate decisions and mixed economic signals, investors are eyeing potential opportunities in dividend stocks to enhance portfolio stability amid these dynamic conditions. In this environment, a good dividend stock is characterized by consistent payouts and financial resilience, offering a reliable income stream even as market uncertainties persist.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.79% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1313 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fibra MtyP.I. de (BMV:FMTY 14)

Simply Wall St Dividend Rating: ★★★★★★

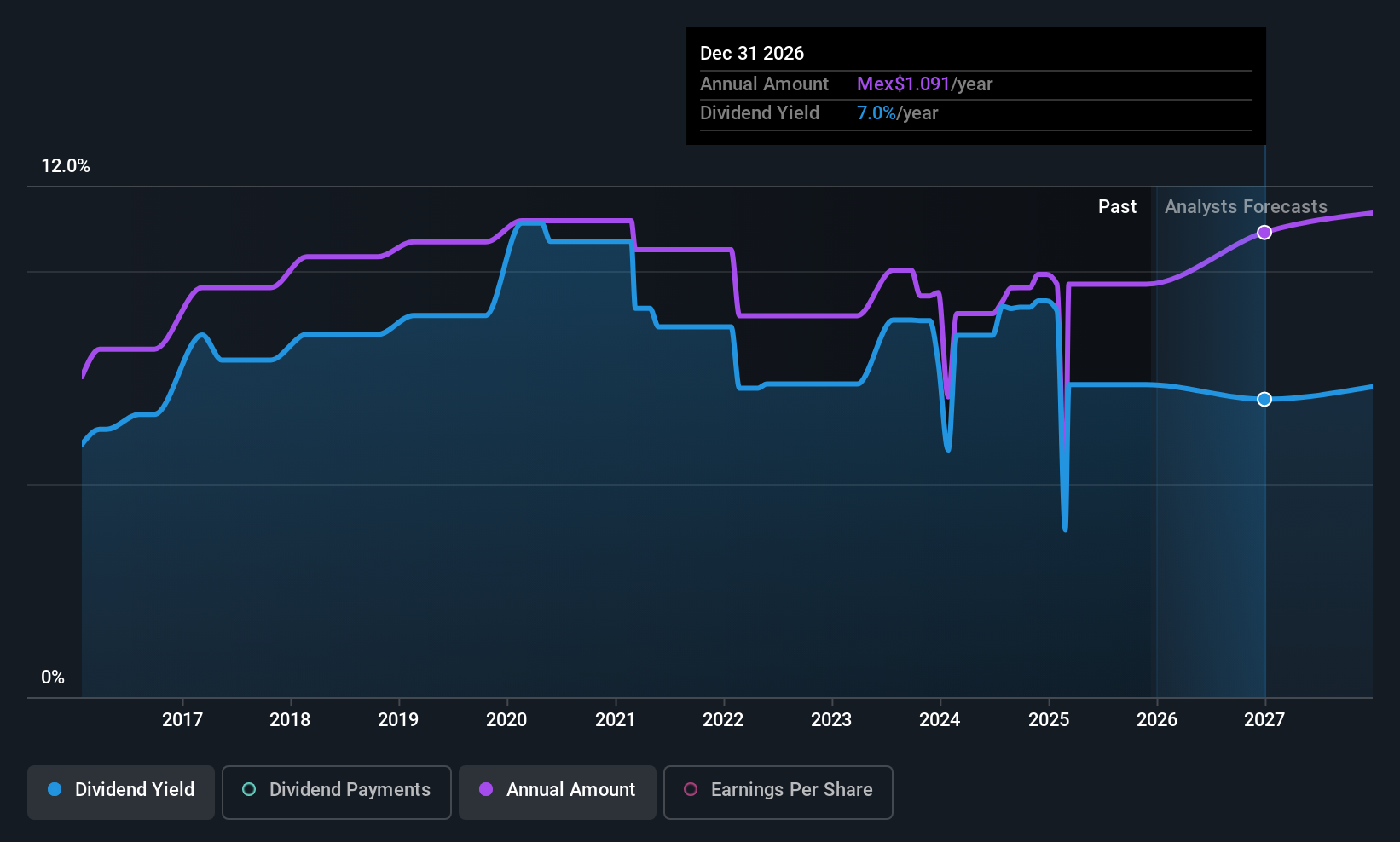

Overview: Fibra Mty is a Mexican real estate investment trust that began operations in December 2014, with a market cap of MX$38.05 billion.

Operations: Fibra Mty generates revenue from its real estate portfolio primarily through three segments: Offices (MX$785.58 million), Commercial (MX$37.99 million), and Industrial (MX$2.48 billion).

Dividend Yield: 6.2%

Fibra Mty offers a stable dividend yield of 6.21%, positioning it in the top 25% of Mexican dividend payers. Over the past decade, its dividends have been reliable and growing with minimal volatility, supported by a payout ratio of 93.4% and cash payout ratio of 88.5%. Despite recent financial challenges, including a net loss for Q3 2025, Fibra Mty continues to maintain regular and special cash dividends, reflecting its commitment to shareholders.

- Unlock comprehensive insights into our analysis of Fibra MtyP.I. de stock in this dividend report.

- In light of our recent valuation report, it seems possible that Fibra MtyP.I. de is trading beyond its estimated value.

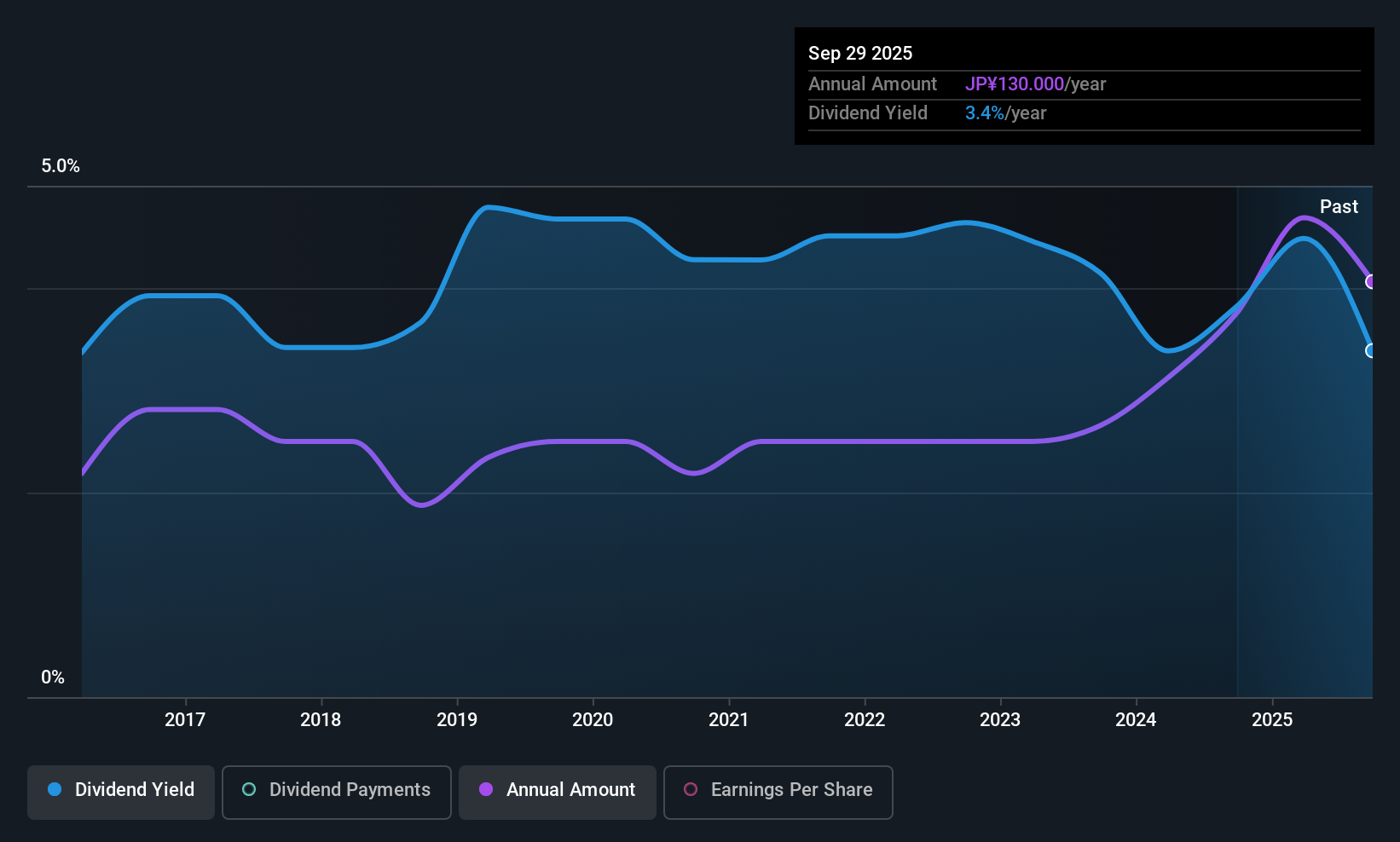

Togami Electric Mfg (TSE:6643)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Togami Electric Mfg. Co., Ltd. manufactures and sells industrial power distribution equipment in Japan, with a market cap of ¥18.69 billion.

Operations: Togami Electric Mfg. Co., Ltd.'s revenue is primarily derived from its Industrial Power Distribution Equipment segment, which accounts for ¥23.81 billion, followed by the Plastic Molding Business at ¥3.99 billion and Metal Processing at ¥2.52 billion.

Dividend Yield: 3.1%

Togami Electric Mfg. maintains a sustainable dividend payout with a low earnings payout ratio of 31.6% and a cash payout ratio of 52.2%, ensuring coverage by both earnings and cash flows. However, its dividend history is marked by volatility over the past decade, making it less reliable despite recent growth in payments. The company's recent share buyback, totaling ¥399.97 million for 101,100 shares, may signal confidence in its financial stability amidst these challenges.

- Navigate through the intricacies of Togami Electric Mfg with our comprehensive dividend report here.

- According our valuation report, there's an indication that Togami Electric Mfg's share price might be on the expensive side.

Nihon DenkeiLtd (TSE:9908)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nihon Denkei Co., Ltd. is engaged in the trading of electronic measuring instruments both in Japan and internationally, with a market cap of ¥24.50 billion.

Operations: Nihon Denkei Ltd. generates revenue from electronic measuring instruments with ¥19.47 billion coming from China and ¥104.57 billion from Japan.

Dividend Yield: 4.1%

Nihon Denkei Ltd. offers a robust dividend profile with a low payout ratio of 34.3%, indicating dividends are well covered by earnings, yet its high cash payout ratio of 794.8% suggests poor coverage by free cash flows. Despite this, the company boasts stable and reliable dividends over the past decade, with consistent growth in payments. Its dividend yield of 4.09% ranks among the top 25% in Japan's market, although sustainability concerns persist due to cash flow issues.

- Take a closer look at Nihon DenkeiLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Nihon DenkeiLtd shares in the market.

Taking Advantage

- Discover the full array of 1313 Top Global Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal