Exosens (ENXTPA:EXENS) Valuation After Extending Theon Deal and Locking In Higher Night Vision Demand Through 2030

Exosens (ENXTPA:EXENS) just locked in a longer runway with Theon International by extending their image intensifier supply deal through 2030, turning future options into firm orders and backing ongoing capacity expansion.

See our latest analysis for Exosens.

The deal lands while Exosens trades around €48.9, after a powerful year to date share price return of 154.24 percent and a 1 year total shareholder return of 166.59 percent, suggesting momentum is still firmly building as investors reassess its growth and defense exposure.

If this contract has you thinking about where else demand driven growth could surprise, it might be worth exploring aerospace and defense stocks as a starting point for your next idea.

Yet with Exosens already up more than 150 percent this year and trading only slightly below its analyst target, the key question now is whether the extended Theon deal still leaves upside or if the market has fully priced in its growth.

Most Popular Narrative: 1.5% Undervalued

With the most followed narrative pointing to a fair value just above the latest €48.9 close, the focus shifts squarely to how far earnings can stretch.

Robust ongoing investment in R&D (over 7.6% of sales), with a pipeline of next-generation products (e.g. 5G-ready night vision) scheduled for launch, anchors Exosens' technology leadership, supports higher-margin product mixes, and provides pricing power, all positively impacting future gross and EBITDA margins.

Want to see how sustained double digit growth, rising profitability and a future earnings multiple come together in this valuation story? The key assumptions behind that fair value might surprise you. Discover which revenue trajectory, margin expansion and valuation reset underpin this seemingly modest discount.

Result: Fair Value of €49.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain bottlenecks in capacity expansion or prolonged margin drag from lower-margin acquisitions could quickly challenge this seemingly comfortable upside case.

Find out about the key risks to this Exosens narrative.

Another Angle on Valuation

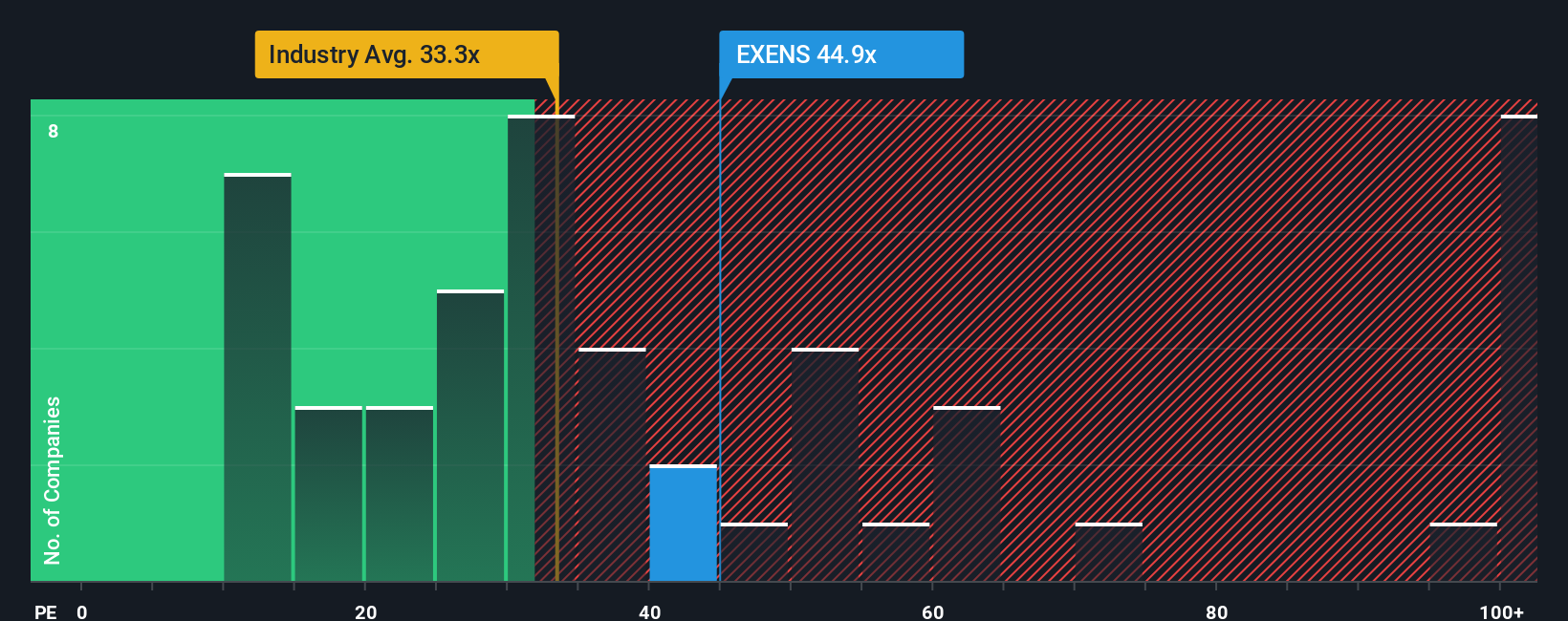

While our model suggests Exosens trades about 19.6 percent below fair value, the earnings multiple tells a different story. The shares are on 44.5 times earnings versus a 25 times fair ratio and 30.9 times for the wider European aerospace and defense group. Is upside already being borrowed from tomorrow’s growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exosens Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Exosens research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single idea. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market catches up.

- Capture early stage growth potential with these 3588 penny stocks with strong financials that already show stronger balance sheets and healthier fundamentals than typical speculative names.

- Position your portfolio for the next wave of intelligent automation by targeting these 27 AI penny stocks reshaping industries with scalable, data driven business models.

- Boost your income stream by focusing on these 15 dividend stocks with yields > 3% that combine solid yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal