LTC Properties (LTC): Evaluating Valuation After Recent Share Price Drift and Solid Long-Term Returns

LTC Properties (LTC) has been drifting lower over the past month even as its long term total returns and double digit revenue and earnings growth paint a different picture. That disconnect is where this gets interesting.

See our latest analysis for LTC Properties.

At around a 3 percent year to date share price return, LTC’s stock has been treading water recently. This suggests momentum is fading even as its five year total shareholder return above 25 percent reflects steady compounding from income and growth.

If LTC’s recent drift has you rethinking your income ideas, this might be a good moment to explore healthcare stocks as potential alternatives or complements in the same broader space.

So with LTC delivering robust double digit growth yet only modest share price gains, is the market overlooking a quietly compounding healthcare REIT, or has the recent stability simply signaled that future growth is already priced in?

Most Popular Narrative: 7.1% Undervalued

With LTC Properties last closing at $35.14 against a most popular narrative fair value near $37.83, the story leans toward modest upside driven by future growth assumptions rather than a deep discount.

The transformation to a diversified, larger senior housing REIT, while maintaining conservative leverage and strong liquidity, enables LTC to scale efficiently and address increasing healthcare expenditures, supporting more resilient earnings and dividend paying capacity.

Management's disciplined acquisition strategy, which targets assets well suited to meet heightened regulatory and healthcare standards, is aligned with industry trends favoring modern, well maintained facilities, driving future occupancy gains and supporting sustainable FFO growth.

Curious how rapid revenue expansion, shifting profit margins and a future earnings multiple all combine to justify this valuation? The narrative reveals the exact growth runway and earnings power baked into that fair value target.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, analysts also flag acquisition competition and tenant concentration, where thinner yields or operator stress could quickly challenge today’s current growth assumptions.

Find out about the key risks to this LTC Properties narrative.

Another Angle on Valuation

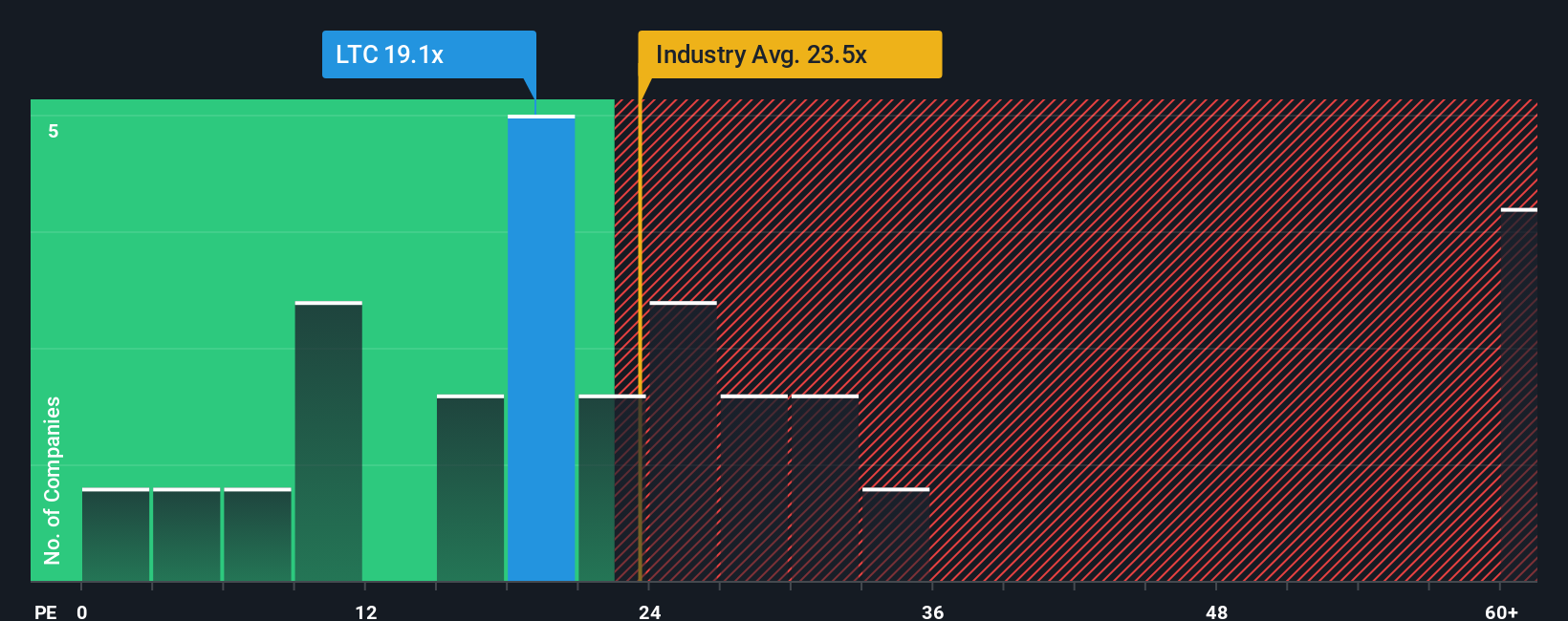

Step away from growth forecasts and the picture shifts. On earnings, LTC trades at about 50.4 times, far richer than US peers near 27 times and above a fair ratio of 41 times, suggesting valuation risk if sentiment cools faster than fundamentals can catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LTC Properties Narrative

If this perspective does not quite match your own view, dig into the numbers yourself and build a personalized storyline in under three minutes with Do it your way.

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall St Screener to uncover fresh opportunities you would not want to overlook.

- Boost your hunt for bargains by scanning these 909 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Capitalize on powerful themes in technology by targeting these 27 AI penny stocks that are positioned to benefit from accelerating demand for artificial intelligence.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with the potential for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal