The market was beaten in the face! Wall Street begins questioning a huge arms race, and Apple (AAPL.US) becomes an “anti-AI” safe haven

The Zhitong Finance App notes that earlier this year, Apple (AAPL.US) stock was hit hard because the iPhone manufacturer faced repeated criticism for lacking an artificial intelligence strategy. But as AI trading faces increasing scrutiny, this hesitation has transformed from a weakness to an advantage — and this is evident in the stock market.

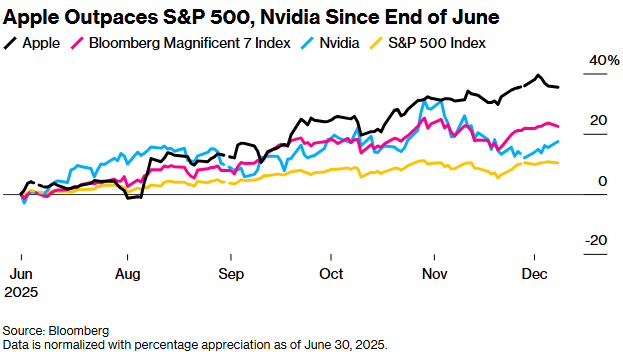

In the first half of 2025, Apple was the second-worst performing stock among the “Big Seven US Stocks”. By the end of June, its stock price had plummeted 18%. But since then, the situation has been reversed. Apple's stock price has soared 35%, while shares of artificial intelligence darlings such as the Meta platform and Microsoft have fallen, dwarfing even Nvidia's performance. Over the same period, the S&P 500 index rose 10%, and the Nasdaq 100 index, which has a high tech share weight, rose 13%.

John Barr, fund manager of Needham Aggressive Growth Fund, which holds Apple shares, said, “It's amazing that when all peers are moving in the opposite direction, they can keep their heads clear and control spending.”

Since the end of June, Apple has outperformed the S&P 500 Index and Nvidia

As a result, Apple's current market capitalization has reached $4.1 trillion, ranks second in weight in the S&P 500, surpassed Microsoft, and is approaching Nvidia. This shift reflects the market's questioning of large tech companies investing hundreds of billions of dollars in AI research and development, as well as Apple's position that the technology will eventually benefit when used for large-scale use once it matures.

Glenview Trust Company Chief Investment Officer Bill Stone holds Apple and sees it as “a bit of an anti-AI position.” He said, “Although they will definitely be incorporating more AI into their phones over time, Apple has avoided an AI arms race and the huge capital expenses that come with it.”

Of course, this rise has brought Apple's stock price to its highest point for a long time. The stock is currently trading at about 33 times the expected earnings for the next 12 months, a level that has only been seen a few times over the past 15 years, and the highest point was 35 times that of September 2020. The stock's average price-earnings ratio during this time was less than 19 times. Apple is now the second-most expensive stock in the “Big Seven” index, second only to Tesla's impressive 203x forward price-earnings ratio.

Craig Moffitt, co-founder of research firm Moffett Nathanson, said: “It's hard to see how the stock can continue to grow in value at this level, making it an attractive entry point.” He added, “The obvious question is, are investors paying too much for Apple's defensiveness? We think so.”

Notably, Warren Buffett's Berkshire Hathaway reduced Apple shares by 15% in the third quarter, while also establishing a position on Alphabet (GOOGL.US), the latest popular AI concept stock. However, in terms of market capitalization, Apple is still the largest holding in Berkshire's stock portfolio.

From a technical perspective, BTIG's chief market technical analyst Jonathan Klinsky wrote in a note to clients last week that based on how far it surpassed the 200-day moving average, Apple's stock price seemed “ready to fall, especially as we look ahead to January.” But in his opinion, “Apple's long-term trend is still definitely bullish.”

As questions about AI grow louder, the logic behind investors' enthusiasm for Apple is easy to understand. As this technology enters the mainstream and becomes profitable, millions of users are likely to access it through Apple products, driving demand for their devices and accelerating the growth of its highly profitable service business.

Furthermore, at a time when Wall Street is uneasy about the huge capital expenses invested in AI research and development, Apple is already in a good position without making all of these expenses.

“This stock is expensive, but Apple's consumer franchise is unshakable,” Moffitt said. He added, “It's understandable that Apple is considered a safe haven at a time when people have real concerns about whether AI is a bubble.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal