TSX Penny Stocks To Consider In December 2025

As we approach the end of 2025, Canadian markets have shown robust performance with double-digit gains across major indices, supported by a strong labor market and stable economic conditions. In this context, penny stocks — though often considered a relic of past eras — continue to offer intriguing opportunities for investors willing to explore smaller or newer companies. These stocks can provide a unique mix of affordability and growth potential when backed by solid financials, making them worth considering for those seeking under-the-radar investments with promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.34 | CA$252.72M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.27 | CA$137.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.34 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.17 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.24 | CA$164.34M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.12 | CA$201.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Condor Energies (TSX:CDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Energies Inc. is an oil and gas company involved in the production of natural gas in Uzbekistan, Turkey, and Kazakhstan, with a market cap of CA$134 million.

Operations: Condor Energies generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to CA$66.97 million.

Market Cap: CA$134M

Condor Energies Inc., with a market cap of CA$134 million, is navigating the complexities of the oil and gas sector through strategic drilling initiatives in Uzbekistan. Recent developments include the completion of its first horizontal well in the Andakli field, which has shown promising initial production results. Despite being unprofitable, Condor's revenue from its exploration and production segment reached CA$66.97 million. The company maintains a stable cash position exceeding its debt levels but faces challenges with limited cash runway if free cash flow continues to decline. Management remains experienced, guiding ongoing projects to potentially enhance future output.

- Take a closer look at Condor Energies' potential here in our financial health report.

- Review our growth performance report to gain insights into Condor Energies' future.

Kutcho Copper (TSXV:KC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kutcho Copper Corp. is involved in acquiring and exploring resource properties in Canada, with a market cap of CA$25.19 million.

Operations: Kutcho Copper Corp. currently does not report any revenue segments.

Market Cap: CA$25.19M

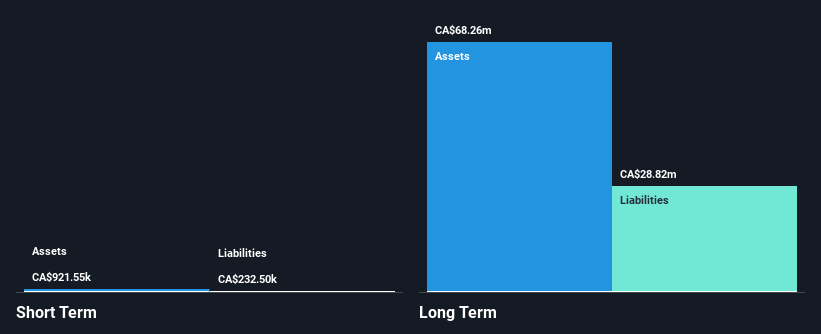

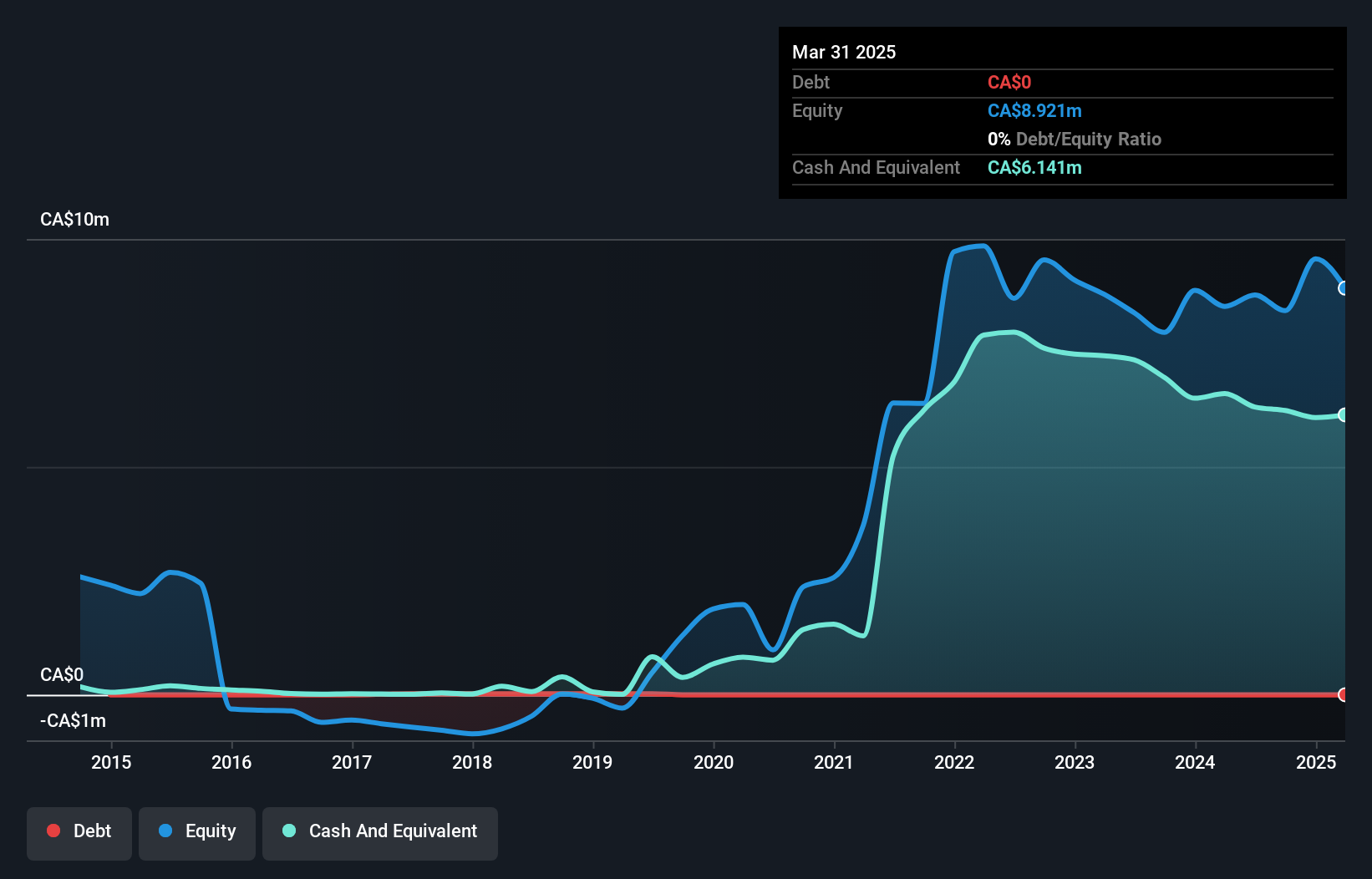

Kutcho Copper Corp., with a market cap of CA$25.19 million, is pre-revenue and focuses on resource exploration in Canada. The company has made progress by reducing its losses at a rate of 20.6% annually over the past five years, though it remains unprofitable with a negative return on equity of -4.64%. Kutcho Copper is debt-free and boasts sufficient cash runway for more than three years based on current free cash flow levels, despite short-term assets not covering long-term liabilities. The management team is seasoned with an average tenure of 13.2 years, providing experienced leadership amidst ongoing challenges.

- Get an in-depth perspective on Kutcho Copper's performance by reading our balance sheet health report here.

- Explore historical data to track Kutcho Copper's performance over time in our past results report.

Laurion Mineral Exploration (TSXV:LME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Laurion Mineral Exploration Inc. focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$79.49 million.

Operations: Laurion Mineral Exploration Inc. currently does not report any revenue segments.

Market Cap: CA$79.49M

Laurion Mineral Exploration Inc., with a market cap of CA$79.49 million, is pre-revenue and engaged in mineral exploration in Canada. Recent drill results at the Ishkoday Project highlight promising high-grade gold veins, reinforcing its potential as a multi-vein gold system. Despite being unprofitable, Laurion has no debt and possesses sufficient cash runway for over a year based on current free cash flow levels. The board of directors is experienced with an average tenure of 6.4 years, providing stability as the company navigates its exploration objectives without significant shareholder dilution over the past year.

- Click here to discover the nuances of Laurion Mineral Exploration with our detailed analytical financial health report.

- Gain insights into Laurion Mineral Exploration's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Click here to access our complete index of 394 TSX Penny Stocks.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal