Assessing PROS Holdings (PRO) Valuation After Its Recent 90-Day Share Price Rebound

PROS Holdings (PRO) has quietly turned into a comeback story, with the stock up nearly 50% over the past 3 months even as its 1 year return still sits slightly negative.

See our latest analysis for PROS Holdings.

That sharp 90 day share price return of roughly 49% has flipped sentiment after a long grind, even though the 1 year total shareholder return of about negative 5% shows this is still an early stage comeback rather than a completed turnaround.

If PROS has you rethinking growth stories in software, it might be worth hunting for other digital winners through high growth tech and AI stocks while momentum is still on your side.

With shares still trading below analyst targets but reflecting strong revenue and profit growth, investors now face a key question: Is PROS Holdings undervalued, or is the market already pricing in its next leg of expansion?

Most Popular Narrative: 9.2% Undervalued

With PROS Holdings closing at 23.25 dollars against a narrative fair value of 25.60 dollars, the storyline leans toward upside while assuming steady execution.

Ongoing investment in domain-specific AI (such as the launch of PROS AI agents and Agentic AI initiatives) enhances competitive differentiation, raises contract values, and lays the groundwork for future outcome-based monetization models, which can potentially improve both revenue and operating leverage.

Want to see how ambitious revenue gains, margin expansion, and a future profit multiple all lock together into one bold valuation roadmap? The narrative spells it out.

Result: Fair Value of $25.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in travel and rising AI competition could stretch sales cycles, pressure pricing power and ultimately derail the margin and growth assumptions behind this valuation.

Find out about the key risks to this PROS Holdings narrative.

Another Lens on Value

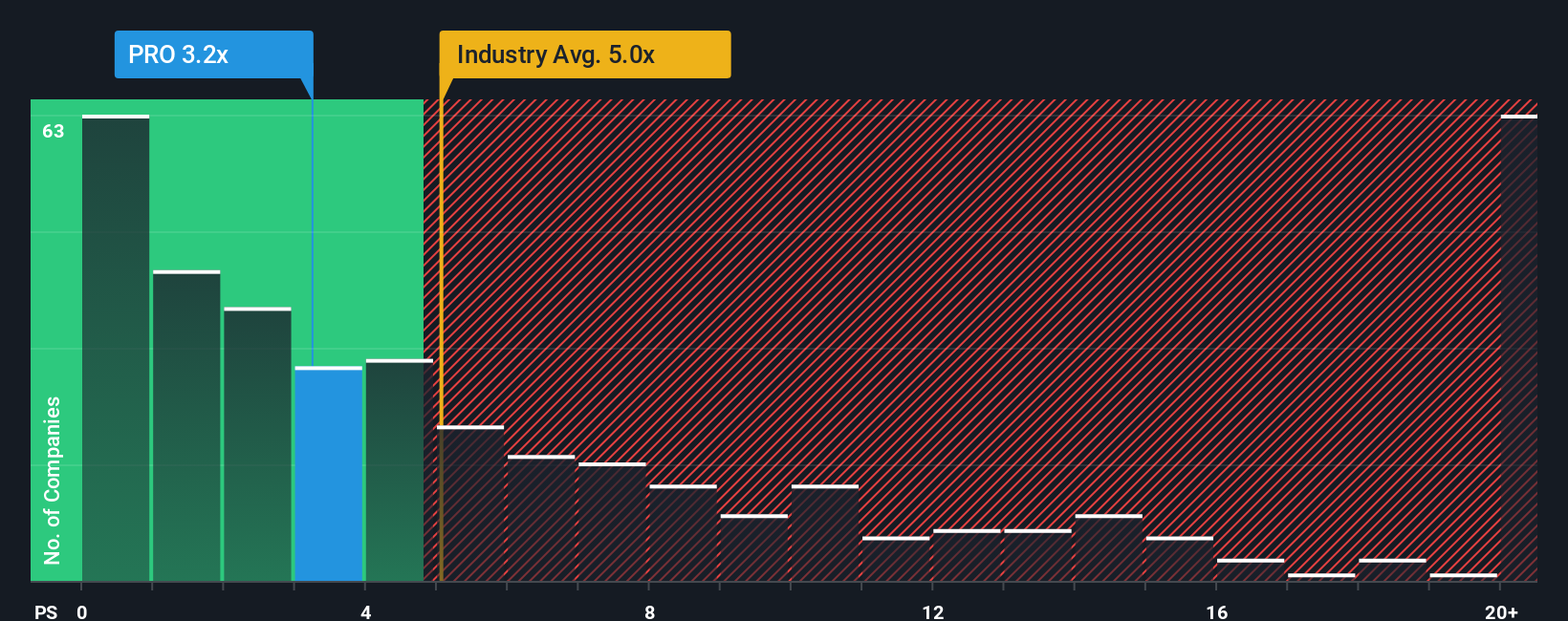

On a simple price to sales yardstick, PROS looks mixed. It trades at 3.2 times sales, cheaper than the US software average of 4.9 times, but slightly richer than peers at 2.5 times and very close to a 3.3 times fair ratio, which hints more at balanced risk than a screaming bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PROS Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in minutes at Do it your way.

A great starting point for your PROS Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead instead of watching opportunities pass by, use the Simply Wall Street Screener to uncover fresh, data backed stock ideas today.

- Capitalize on overlooked potential with these 901 undervalued stocks based on cash flows that may be trading well below what their cash flows suggest they are worth.

- Ride the next wave of innovation by targeting these 27 AI penny stocks shaping the future of automation, analytics, and intelligent software.

- Strengthen your income strategy through these 15 dividend stocks with yields > 3% that combine attractive yields with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal